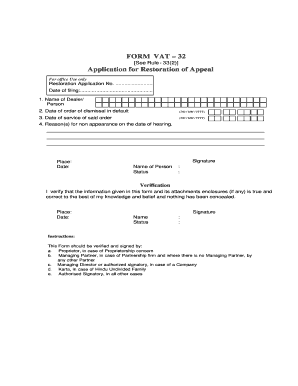

Restoration of Appeal under Mvat Act Form

What is the restoration of appeal under MVAT Act?

The restoration of appeal under the MVAT Act refers to a legal process that allows taxpayers to reinstate an appeal that may have been dismissed or rejected due to various reasons, such as failure to appear or meet deadlines. This process is crucial for ensuring that taxpayers have the opportunity to contest decisions made by tax authorities regarding value-added tax assessments. The MVAT Act, applicable in certain states, provides a framework for taxpayers to seek restoration of their appeals, ensuring fairness and transparency in tax administration.

Steps to complete the restoration of appeal under MVAT Act

Completing the restoration of appeal under the MVAT Act involves several key steps:

- Gather necessary documentation, including the original appeal and any correspondence with tax authorities.

- Prepare a formal application for restoration, clearly stating the reasons for the initial dismissal and justifying the request for reinstatement.

- Submit the application to the appropriate tax authority, adhering to any specific submission guidelines outlined in the MVAT Act.

- Ensure that the application is filed within the stipulated time frame to avoid further complications.

- Follow up with the tax authority to confirm receipt and inquire about the status of the application.

Required documents for the restoration of appeal under MVAT Act

When applying for the restoration of appeal under the MVAT Act, certain documents are typically required to support your application. These may include:

- Copy of the original appeal that was dismissed.

- Proof of any communication with the tax authorities regarding the appeal.

- Any relevant financial documents that may support your case.

- Identification documents to verify your identity as the taxpayer.

Eligibility criteria for the restoration of appeal under MVAT Act

To be eligible for the restoration of appeal under the MVAT Act, taxpayers must meet specific criteria, which may include:

- Having a valid reason for the initial dismissal of the appeal, such as unforeseen circumstances or lack of notice.

- Filing the restoration application within the time limits set by the MVAT Act.

- Providing sufficient evidence to support the claim for restoration.

Legal use of the restoration of appeal under MVAT Act

The legal use of the restoration of appeal under the MVAT Act is grounded in the principles of fairness and justice. Taxpayers have the right to contest decisions made by tax authorities, and the restoration process ensures that they can do so even after an initial dismissal. This legal framework is designed to protect taxpayer rights and promote accountability within the tax system.

Form submission methods for the restoration of appeal under MVAT Act

Submitting the restoration of appeal under the MVAT Act can typically be done through various methods, including:

- Online submission via the official tax authority website, where forms can be filled out and submitted electronically.

- Mailing a physical copy of the application to the designated tax office.

- In-person submission at local tax authority offices, where taxpayers can receive immediate assistance and confirmation of receipt.

Quick guide on how to complete restoration of appeal under mvat act

Complete Restoration Of Appeal Under Mvat Act effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without interruptions. Manage Restoration Of Appeal Under Mvat Act on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to alter and eSign Restoration Of Appeal Under Mvat Act without hassle

- Obtain Restoration Of Appeal Under Mvat Act and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Restoration Of Appeal Under Mvat Act to ensure smooth communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the restoration of appeal under mvat act

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the restoration of appeal under MVAT Act?

The restoration of appeal under MVAT Act refers to the process of reinstating an appeal that was previously dismissed or rejected. This process allows taxpayers to present their case again for review, ensuring that they have a fair chance to contest decisions made by tax authorities.

-

How can I initiate the restoration of appeal under MVAT Act?

To initiate the restoration of appeal under MVAT Act, you typically need to file an application with the appropriate tax authority along with supporting documents. It's essential to adhere to specific guidelines and timelines to ensure that your appeal is considered.

-

What are the benefits of using airSlate SignNow for the restoration of appeal under MVAT Act?

Using airSlate SignNow for the restoration of appeal under MVAT Act allows for efficient document handling and secure electronic signatures. This streamlines the process, making it faster and easier to manage the necessary paperwork without the delays associated with traditional methods.

-

Is there a fee for submitting the restoration of appeal under MVAT Act?

Yes, there may be a fee associated with submitting the restoration of appeal under MVAT Act, depending on the specific regulations in your state. It's advisable to check with your local tax office for the exact amount and payment options available.

-

Can airSlate SignNow assist with the documentation needed for the restoration of appeal under MVAT Act?

Absolutely! airSlate SignNow can help you prepare, manage, and securely sign all necessary documents required for the restoration of appeal under MVAT Act. Our platform ensures that all your paperwork is organized and easily accessible throughout the process.

-

Which features of airSlate SignNow are most useful for the restoration of appeal under MVAT Act?

Key features of airSlate SignNow that are beneficial for the restoration of appeal under MVAT Act include customizable templates, automated workflows, and real-time tracking of document status. These tools help streamline your appeal process from submission to approval.

-

Does airSlate SignNow integrate with any accounting software for better management during the restoration of appeal under MVAT Act?

Yes, airSlate SignNow offers integrations with popular accounting software, making it easier to manage your financial documents while working on the restoration of appeal under MVAT Act. This integration helps maintain accurate records and improves overall efficiency.

Get more for Restoration Of Appeal Under Mvat Act

- Connecticut commercial contractor package form

- Ct assist form

- Connecticut connecticut property management package form

- Georgia commercial contractor package form

- Georgia married couple 481375722 form

- Iowa mutual wills package with last wills and testaments for married couple with adult children form

- Montana mutual wills package with last wills and testaments for married couple with minor children form

- North dakota mutual wills package with last wills and testaments for married couple with adult children form

Find out other Restoration Of Appeal Under Mvat Act

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer