Form 3903 Moving Expenses Irs

What is the Form 3903 Moving Expenses IRS

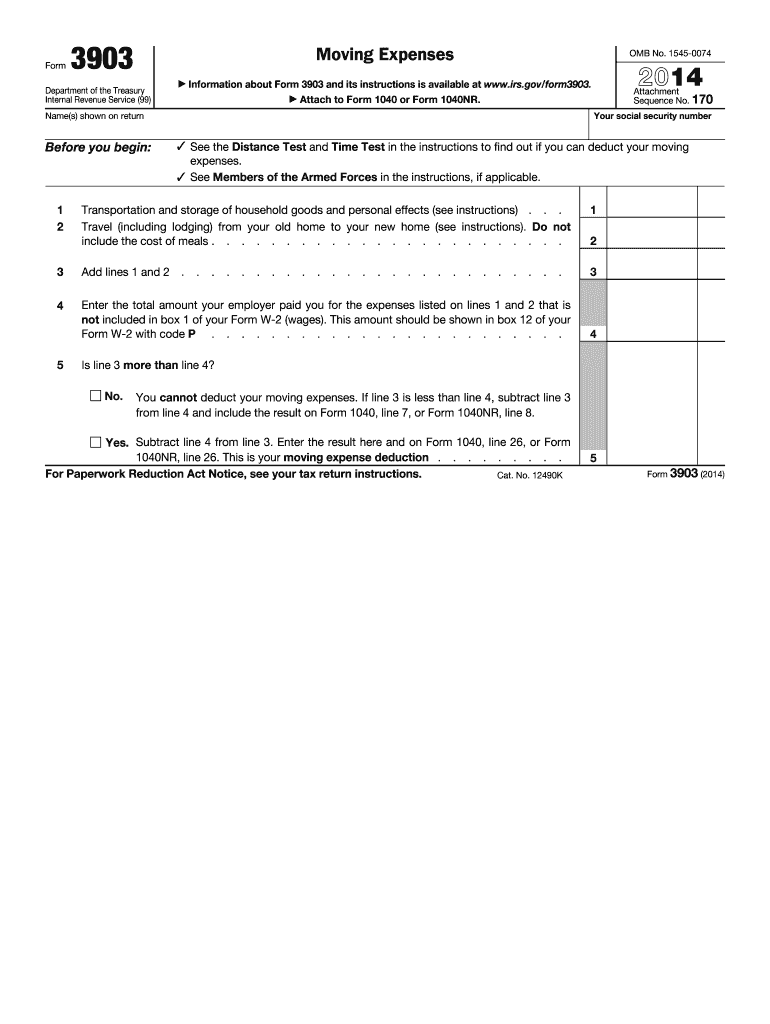

The Form 3903 Moving Expenses IRS is a tax form used by individuals to report and claim deductions for moving expenses incurred during a relocation for work-related reasons. This form is particularly relevant for employees who move due to a job change or for self-employed individuals who relocate for business purposes. The IRS allows certain moving expenses to be deducted, helping taxpayers reduce their taxable income.

How to use the Form 3903 Moving Expenses IRS

To effectively use the Form 3903 Moving Expenses IRS, individuals must first determine their eligibility for moving expense deductions. Eligible expenses may include costs related to moving household goods, travel expenses for the taxpayer and their family, and storage fees. After confirming eligibility, taxpayers should fill out the form accurately, detailing all relevant expenses and ensuring that all required information is provided. This form is then submitted with the individual’s tax return for the applicable tax year.

Steps to complete the Form 3903 Moving Expenses IRS

Completing the Form 3903 Moving Expenses IRS involves several key steps:

- Gather Documentation: Collect receipts and records of all moving-related expenses.

- Determine Eligibility: Ensure that the move meets IRS criteria for deductibility.

- Fill Out the Form: Provide personal information, details of the move, and itemized expenses on the form.

- Review for Accuracy: Double-check all entries to avoid errors that could delay processing.

- Submit with Tax Return: Include the completed form with your federal tax return, ensuring it is filed by the deadline.

Key elements of the Form 3903 Moving Expenses IRS

The Form 3903 Moving Expenses IRS consists of several key elements that taxpayers must complete:

- Personal Information: Name, address, and Social Security number.

- Moving Details: Dates of the move and the address of the previous and new residences.

- Expense Categories: Itemized sections for different types of moving expenses, including transportation and storage costs.

- Signature: The form must be signed and dated to validate the information provided.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 3903 Moving Expenses IRS. Taxpayers should familiarize themselves with the criteria for qualifying moving expenses, including the distance test and time test. The IRS also outlines the types of expenses that can be claimed, such as transportation and lodging costs during the move. Adhering to these guidelines ensures compliance and maximizes the potential tax benefits associated with moving expenses.

Eligibility Criteria

To qualify for deductions using the Form 3903 Moving Expenses IRS, taxpayers must meet certain eligibility criteria. Generally, the move must be closely related to the start of a new job or business location. Additionally, the distance between the old and new home must be at least fifty miles farther from the old job location than the previous home was. Furthermore, the taxpayer must work full-time for at least thirty-nine weeks during the twelve months following the move.

Quick guide on how to complete form 3903 moving expenses irs

Prepare Form 3903 Moving Expenses Irs effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents quickly and efficiently. Manage Form 3903 Moving Expenses Irs on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form 3903 Moving Expenses Irs with ease

- Locate Form 3903 Moving Expenses Irs and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method of sharing your form, whether via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 3903 Moving Expenses Irs and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3903 moving expenses irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 3903 Moving Expenses Irs and why is it important?

Form 3903 Moving Expenses Irs is essential for taxpayers who are eligible to deduct moving expenses related to a job change. This form helps in claiming deductions accurately and can save money on your tax return. Understanding how to fill out this form correctly can signNowly impact your overall financial situation.

-

How can airSlate SignNow assist in handling Form 3903 Moving Expenses Irs?

airSlate SignNow provides a streamlined solution for electronically signing, sharing, and storing documents, including Form 3903 Moving Expenses Irs. Its easy-to-use interface ensures you can complete these forms quickly, enhancing efficiency in your tax preparation process. By using SignNow, you can securely manage all your important documents from one platform.

-

What features does airSlate SignNow offer for managing documents related to Form 3903 Moving Expenses Irs?

airSlate SignNow includes features like secure eSignature, templates for standard forms, and cloud storage. These features simplify the process of preparing and submitting Form 3903 Moving Expenses Irs, making paperwork hassle-free. Additionally, you can track the status of your documents in real time, ensuring nothing falls through the cracks.

-

How much does it cost to use airSlate SignNow for Form 3903 Moving Expenses Irs?

airSlate SignNow offers flexible pricing plans that cater to various needs, making it a cost-effective choice for managing Form 3903 Moving Expenses Irs. You can choose from monthly or annual subscriptions, ensuring you only pay for what you need. With a free trial available, you can explore the service before committing financially.

-

Is airSlate SignNow compliant with IRS regulations for Form 3903 Moving Expenses Irs?

Yes, airSlate SignNow is fully compliant with IRS regulations, ensuring that electronic signatures for Form 3903 Moving Expenses Irs are legally valid. This compliance helps users rest assured that their submitted documents will be accepted by the IRS. You can confidently handle all your tax needs, including switching to digital formats, without worrying about legality.

-

Can I integrate airSlate SignNow with other platforms for managing Form 3903 Moving Expenses Irs?

Absolutely! airSlate SignNow seamlessly integrates with various business applications such as Google Drive, Dropbox, and CRM systems. This integration allows you to manage Form 3903 Moving Expenses Irs alongside other essential documents and workflows, streamlining your productivity. You can access everything you need in one place, enhancing your tax preparation process.

-

What are the benefits of using airSlate SignNow for filing Form 3903 Moving Expenses Irs?

Using airSlate SignNow to file Form 3903 Moving Expenses Irs simplifies the process with automated workflows and easy document sharing. You can save time and minimize errors, ensuring that your tax filings are correct. The platform also offers enhanced security features to protect your sensitive financial information.

Get more for Form 3903 Moving Expenses Irs

- Governor quinn signs consumer protection bill illinois department insurance illinois form

- Biometric interoperability biometrics form

- Storm water application for more than 2 acres disturbed d 3306 cicacenter form

- Developing educational software within application software infitt form

- Medical chronology template form

- Us navy fleet bands form

- Fy24 sample incident reporting form fa1 monitoring review

- 20230819 speakers bureau presentation request formampnbspampnbspampnbspampnbspampnbspampnbspampnbspampnbsp 20230819 speakers

Find out other Form 3903 Moving Expenses Irs

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now