AP 178, Texas Application for International Fuel Tax Agreement IFTA Form

What is the AP 178, Texas Application For International Fuel Tax Agreement IFTA

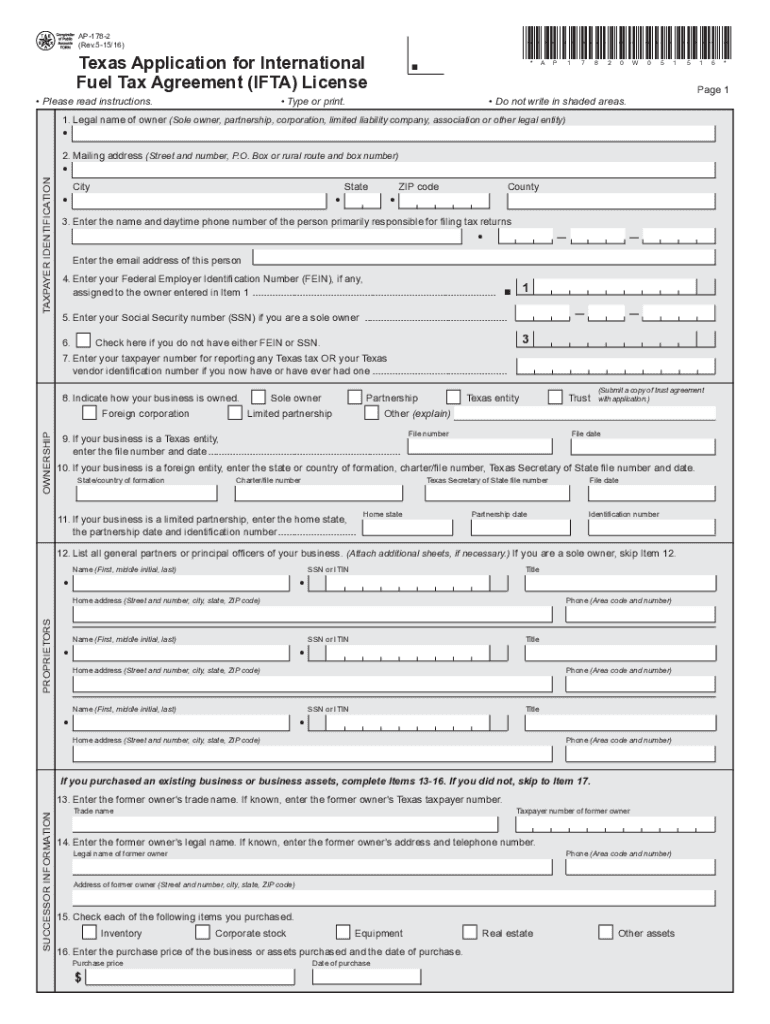

The AP 178 is a crucial form used in Texas for the International Fuel Tax Agreement (IFTA). This application enables motor carriers to report and pay fuel taxes across multiple jurisdictions. IFTA simplifies the fuel tax reporting process for interstate commercial vehicle operators by allowing them to file a single quarterly fuel tax return instead of separate returns for each state. The AP 178 serves as the official application for obtaining an IFTA license, which is essential for compliance with fuel tax regulations in the United States and Canada.

Steps to complete the AP 178, Texas Application For International Fuel Tax Agreement IFTA

Completing the AP 178 involves several key steps to ensure accurate submission. Here is a structured approach:

- Gather necessary information, including your business details, vehicle information, and fuel usage data.

- Fill out the AP 178 form, ensuring all sections are completed accurately. Pay special attention to the vehicle identification numbers and the type of fuel used.

- Review the form for any errors or omissions, as inaccuracies can lead to delays in processing.

- Submit the completed form to the Texas Comptroller of Public Accounts, either online, by mail, or in person, depending on your preference.

Key elements of the AP 178, Texas Application For International Fuel Tax Agreement IFTA

The AP 178 includes several important elements that applicants must understand:

- Business Information: This section requires the legal name, address, and contact information of the business.

- Vehicle Information: Details about each vehicle, including the type of fuel used and vehicle identification numbers, are essential.

- Tax Compliance: Applicants must affirm their compliance with state and federal fuel tax regulations.

- Signature: A signature is required to validate the application, confirming that the information provided is accurate.

Legal use of the AP 178, Texas Application For International Fuel Tax Agreement IFTA

The legal use of the AP 178 is governed by the regulations set forth in the International Fuel Tax Agreement. This form must be completed and submitted accurately to ensure compliance with tax obligations. Failure to submit the AP 178 can result in penalties, including fines and the inability to operate legally across state lines. It is important for businesses to maintain records of their fuel purchases and vehicle operations to support the information provided in the application.

Form Submission Methods for the AP 178, Texas Application For International Fuel Tax Agreement IFTA

The AP 178 can be submitted through various methods, providing flexibility for applicants:

- Online: Many businesses prefer to submit the form electronically through the Texas Comptroller's website, which offers a streamlined process.

- By Mail: Applicants can print the completed form and send it via postal service to the appropriate office.

- In-Person: For those who prefer direct interaction, submitting the form in person at a local office is also an option.

Eligibility Criteria for the AP 178, Texas Application For International Fuel Tax Agreement IFTA

To be eligible to complete the AP 178, applicants must meet certain criteria. These include being a registered motor carrier operating qualified vehicles that travel in multiple jurisdictions. Additionally, applicants must comply with all applicable state and federal fuel tax regulations. It is essential to ensure that all vehicles are properly licensed and that the business is in good standing with tax authorities.

Quick guide on how to complete ap 178 texas application for international fuel tax agreement ifta

Prepare AP 178, Texas Application For International Fuel Tax Agreement IFTA effortlessly on any gadget

Digital document management has become widely embraced by companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly without delays. Manage AP 178, Texas Application For International Fuel Tax Agreement IFTA on any gadget using airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The easiest method to alter and eSign AP 178, Texas Application For International Fuel Tax Agreement IFTA without hassle

- Locate AP 178, Texas Application For International Fuel Tax Agreement IFTA and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Alter and eSign AP 178, Texas Application For International Fuel Tax Agreement IFTA to ensure excellent communication at any point of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ap 178 texas application for international fuel tax agreement ifta

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AP 178 feature in airSlate SignNow?

The AP 178 feature in airSlate SignNow allows users to streamline their document signing process, making it easier to manage and track electronic signatures. This functionality is designed to enhance workflow efficiency, particularly for businesses that rely on quick document turnaround times.

-

How much does airSlate SignNow cost for using the AP 178 feature?

AirSlate SignNow offers flexible pricing plans that include the AP 178 functionality. Depending on your business needs, you can choose a plan that fits your budget while getting access to this powerful feature to improve document handling.

-

What are the key benefits of using airSlate SignNow with AP 178?

Using airSlate SignNow with the AP 178 feature provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. By leveraging this solution, businesses can ensure faster processing of documents while maintaining compliance and security.

-

Can AP 178 integrate with other software applications?

Yes, airSlate SignNow with AP 178 supports integration with various software applications, enhancing your existing workflows. This feature allows for seamless sharing of documents between platforms, ultimately boosting productivity and ensuring a cohesive digital experience.

-

Is the AP 178 feature user-friendly for non-technical users?

Absolutely! The AP 178 feature in airSlate SignNow is designed to be intuitive and user-friendly. This ensures that even non-technical users can easily navigate the platform, making it accessible for everyone in your organization.

-

What types of documents can I send using AP 178?

With the AP 178 feature in airSlate SignNow, you can send a wide variety of documents, including contracts, agreements, and forms. This versatility allows businesses to handle all types of documentation with ease and efficiency.

-

How secure is the AP 178 feature in airSlate SignNow?

The AP 178 feature in airSlate SignNow prioritizes security by implementing industry-standard encryption protocols and compliance measures. This ensures that all documents are safeguarded during transmission and storage, providing peace of mind for businesses dealing with sensitive information.

Get more for AP 178, Texas Application For International Fuel Tax Agreement IFTA

- Broadridge nobo request form

- Consumer finance class actions fcra and facta strafford form

- Asf project restart american securitization forum form

- New mexico board of nursing 2012 form

- Empire win loss statement form

- P a forestry application form

- Environmental materials reporting form that you can type in

- Azusa pacific university trustees scholarship form

Find out other AP 178, Texas Application For International Fuel Tax Agreement IFTA

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now