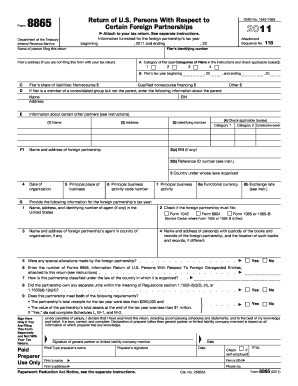

8865 Form

What is the 8865 Form

The 8865 form, officially known as the Return of U.S. Persons With Respect to Certain Foreign Partnerships, is a tax document required by the Internal Revenue Service (IRS). It is primarily used by U.S. persons who own an interest in a foreign partnership. The form helps the IRS track foreign income and ensures compliance with U.S. tax laws. Failure to file this form can lead to significant penalties, making it crucial for eligible taxpayers to understand its purpose and requirements.

How to use the 8865 Form

Using the 8865 form involves several steps to ensure accurate reporting of foreign partnership interests. Taxpayers must first determine if they meet the criteria for filing, which typically includes ownership of at least a ten percent interest in the partnership. Once eligibility is confirmed, individuals should gather necessary financial information about the partnership, including income, deductions, and distributions. The form must be completed accurately and submitted alongside the taxpayer's annual income tax return.

Steps to complete the 8865 Form

Completing the 8865 form requires careful attention to detail. Here are the essential steps:

- Identify your filing category based on your ownership interest in the foreign partnership.

- Gather all relevant financial information regarding the partnership.

- Fill out the form, ensuring that all sections are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form by the due date, typically along with your annual tax return.

Legal use of the 8865 Form

The 8865 form is legally binding when filed correctly and on time. It serves as a declaration of a taxpayer's interest in a foreign partnership and must comply with IRS regulations. Electronic filing is permitted, provided that the necessary legal requirements for eSignatures are met. This includes using a compliant platform that ensures the integrity and security of the submitted data, making the eDocument legally enforceable.

Filing Deadlines / Important Dates

Understanding the deadlines for filing the 8865 form is crucial to avoid penalties. The form is typically due on the same date as the taxpayer's income tax return, including extensions. For most individuals, this means the deadline is April 15. If additional time is needed, taxpayers can apply for an extension, which generally provides an additional six months to file. However, any taxes owed must still be paid by the original due date to avoid interest and penalties.

Required Documents

To complete the 8865 form, taxpayers need several key documents. These typically include:

- Financial statements of the foreign partnership.

- Records of income, deductions, and distributions related to the partnership.

- Information about any foreign taxes paid or accrued.

- Personal identification details, including Social Security numbers.

Penalties for Non-Compliance

Failure to file the 8865 form can result in significant penalties. The IRS imposes a penalty of $10,000 for each form not filed timely. If the failure to file continues for more than 90 days after the IRS issues a notice, additional penalties may apply. Moreover, taxpayers may face increased scrutiny in future filings, making compliance with this form essential for maintaining good standing with the IRS.

Quick guide on how to complete 8865 form

Complete 8865 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed paperwork, since you can acquire the correct form and securely store it online. airSlate SignNow provides all the features you require to create, modify, and eSign your documents swiftly without delays. Manage 8865 Form on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related operation today.

The easiest way to modify and eSign 8865 Form effortlessly

- Obtain 8865 Form and click Get Form to begin.

- Utilize the features we offer to complete your form.

- Emphasize signNow sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or downloading it to your computer.

Forget about lost or misplaced paperwork, tedious form hunting, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign 8865 Form and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8865 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8865 and why is it important?

Form 8865 is used by U.S. taxpayers to report their interests in foreign partnerships. Properly submitting Form 8865 is crucial for compliance with IRS regulations to avoid penalties and ensure accurate tax reporting.

-

How can airSlate SignNow help me with Form 8865?

With airSlate SignNow, you can easily prepare, send, and eSign Form 8865 digitally. Our platform streamlines the documentation process, enabling you to focus on compliance and accurate reporting without the hassle of paperwork.

-

What features does airSlate SignNow offer for managing Form 8865?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document storage specifically for Form 8865. These tools help ensure that your documents are always ready, organized, and compliant with IRS requirements.

-

Is airSlate SignNow compatible with other accounting software for Form 8865?

Yes, airSlate SignNow seamlessly integrates with popular accounting software to simplify the process of managing Form 8865. This integration allows for easy import and export of data, ensuring accuracy in reporting.

-

What are the pricing plans available for airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to various business needs, ensuring that preparing Form 8865 is both affordable and efficient. You can choose from monthly or annual subscriptions tailored to fit your company's size and usage.

-

Can I track the progress of my Form 8865 submissions with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your Form 8865 submissions in real-time. This transparency ensures that you are always informed about the progress and any required actions.

-

How does airSlate SignNow ensure the security of my Form 8865 documents?

airSlate SignNow prioritizes data security with advanced encryption and secure cloud storage for your Form 8865 documents. Our platform is designed to protect your sensitive information while ensuring compliance with industry standards.

Get more for 8865 Form

- 10 0433 print form south texas veterans health care system southtexas va

- Appointment letter of dc industry form

- Vcs deduction form

- 10 0430 form

- Va form 21 0960c 9 multiple sclerosis ms disability benefits questionnaire vba va

- Oaan 7003 form

- Bp a0192 release of information consent jun federal bureau of bop

- Long care application form

Find out other 8865 Form

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer