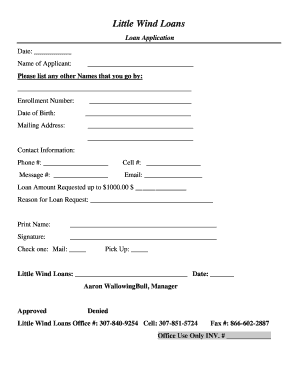

Little Wind Loans Form

What is the Little Wind Loans

The Little Wind Loans refer to a specific type of financial assistance designed to help individuals or businesses manage short-term financial needs. These loans typically have a streamlined application process and are intended for quick access to funds. They may be used for various purposes, including personal expenses, business operations, or unexpected emergencies. Understanding the terms and conditions associated with these loans is essential for making informed financial decisions.

How to Obtain the Little Wind Loans

To obtain Little Wind Loans, applicants generally follow a straightforward process. Initially, individuals need to identify a lender that offers these loans. Once a lender is chosen, applicants must complete an application form, providing necessary personal and financial information. This may include details about income, credit history, and the purpose of the loan. After submission, the lender reviews the application, and if approved, funds are typically disbursed quickly, often within a few days.

Steps to Complete the Little Wind Loans

Completing the Little Wind Loans involves several key steps:

- Research lenders: Identify reputable lenders that offer Little Wind Loans.

- Gather documentation: Prepare necessary documents, such as proof of income and identification.

- Fill out the application: Complete the application form accurately, ensuring all required information is included.

- Submit the application: Send the application to the chosen lender, either online or in person.

- Review loan terms: Carefully read the loan agreement, paying attention to interest rates and repayment terms.

- Receive funds: If approved, funds will be disbursed as per the lender's policy.

Legal Use of the Little Wind Loans

Legal use of Little Wind Loans is crucial to ensure compliance with applicable regulations. Borrowers should use funds for the intended purpose as stated in the loan agreement. Misuse of loan funds can lead to legal consequences, including penalties or loan default. It is advisable to maintain clear records of how the loan funds are utilized to protect against any potential disputes with the lender.

Key Elements of the Little Wind Loans

Understanding the key elements of Little Wind Loans can help borrowers make informed decisions. These elements typically include:

- Loan amount: The total sum of money that can be borrowed.

- Interest rate: The cost of borrowing, expressed as a percentage of the loan amount.

- Repayment terms: The schedule and conditions under which the loan must be repaid.

- Fees: Any additional charges associated with the loan, such as origination fees.

- Eligibility criteria: Requirements that borrowers must meet to qualify for the loan.

Required Documents

When applying for Little Wind Loans, certain documents are typically required to verify identity and financial status. Commonly requested documents include:

- Proof of identity: Such as a government-issued ID or driver's license.

- Proof of income: Recent pay stubs, tax returns, or bank statements.

- Credit history: Some lenders may request a credit report to assess creditworthiness.

- Loan purpose documentation: Information supporting the intended use of the loan funds.

Quick guide on how to complete little wind loans 266596196

Complete Little Wind Loans effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Manage Little Wind Loans on any platform using airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to alter and eSign Little Wind Loans without hassle

- Obtain Little Wind Loans and click on Get Form to initiate.

- Utilize the tools we provide to finish your form.

- Emphasize important sections of your documents or redact sensitive information with specialized tools provided by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting multiple copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and eSign Little Wind Loans to ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the little wind loans 266596196

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are little wind loans and how can they help my business?

Little wind loans are designed to provide flexible funding options for small businesses. They help you manage cash flow, invest in essential projects, and cover unexpected expenses. With little wind loans, you can access the financial support you need to sustain and grow your business.

-

What features do little wind loans offer?

Little wind loans come with a variety of features tailored for small business needs. Key features include quick approval times, competitive interest rates, and flexible repayment terms. They are designed to be straightforward and accessible, ensuring you can secure the funds you need without excessive barriers.

-

How do little wind loans compare to traditional bank loans?

Little wind loans typically offer more flexible terms than traditional bank loans, making them more accessible for small businesses. The approval process for little wind loans is usually faster and less stringent, allowing you to receive funding quickly. This is particularly beneficial for businesses needing quick financial relief or support.

-

What are the benefits of using little wind loans?

Using little wind loans provides immediate financial relief, enabling you to tackle urgent business needs. The loans can enhance your cash flow management and support your growth initiatives without the long-term commitment of larger loans. Overall, little wind loans can give you the financial agility needed to adapt to changing market conditions.

-

How can I apply for little wind loans?

Applying for little wind loans is a straightforward process that can often be completed online. Most lenders require basic business information and financial documents, which can make the application quick and efficient. Once submitted, you can expect a fast response, allowing you to plan your next steps promptly.

-

Are little wind loans suitable for all types of businesses?

Yes, little wind loans are generally suitable for a wide range of businesses, including startups and established companies. Whether you are seeking funding for expansion, equipment purchase, or operational expenses, little wind loans can accommodate diverse business needs. However, it's important to assess your specific financial situation when considering this option.

-

What integrations does airSlate SignNow support for managing little wind loans?

airSlate SignNow integrates with various financial platforms that can simplify the management of little wind loans. These integrations allow you to streamline document workflows, improve time management, and maintain accurate records of your loan transactions. By utilizing these tools, you can enhance your operational efficiency and focus on growing your business.

Get more for Little Wind Loans

- Special administrator form

- Letters colorado form

- Acceptance of appointment colorado form

- Bond personal representative form

- Notice of appointment of guardian and or conservator and notice of right to request termination modification revised 1 01 form

- Inventory colorado form

- Colorado probate court form

- Notice disallowance form

Find out other Little Wind Loans

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast