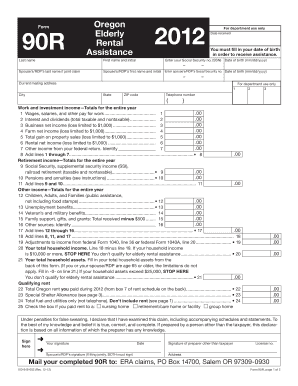

Tax Form 90r

What is the Tax Form 90r

The Tax Form 90r is a specific document used for reporting certain tax-related information. This form is typically associated with various tax obligations, including income reporting and deductions. Understanding the purpose of the Tax Form 90r is essential for compliance with U.S. tax laws. It is crucial for taxpayers to accurately complete this form to avoid potential penalties and ensure that their tax filings are correct.

How to use the Tax Form 90r

Using the Tax Form 90r involves several key steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements and prior tax returns. Next, carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors before signing and dating it. Finally, submit the form according to the guidelines provided by the IRS, either electronically or by mail.

Steps to complete the Tax Form 90r

Completing the Tax Form 90r requires a systematic approach. Begin by downloading the form from the IRS website or obtaining a physical copy. Next, enter your personal information, including your name, address, and Social Security number. Follow this by inputting your income details, deductions, and any other relevant information. Once all sections are filled out, double-check for accuracy, sign the form, and retain a copy for your records. Finally, submit the completed form by the specified deadline.

Legal use of the Tax Form 90r

The legal use of the Tax Form 90r is governed by IRS regulations. It is essential that the form is filled out truthfully and accurately, as providing false information can lead to severe penalties. The form must be signed by the taxpayer or an authorized representative to be considered valid. Additionally, electronic submissions must comply with eSignature laws to ensure their legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Form 90r can vary depending on the specific tax year and the taxpayer's circumstances. Generally, the form must be submitted by April fifteenth for individual taxpayers. However, extensions may be available under certain conditions. It is important to stay informed about any changes to deadlines, as late submissions can result in penalties and interest on unpaid taxes.

Required Documents

To successfully complete the Tax Form 90r, several supporting documents are typically required. These may include W-2 forms, 1099 forms, and any documentation related to deductions or credits claimed. Having these documents ready will streamline the process and help ensure that all information reported on the form is accurate and complete.

Examples of using the Tax Form 90r

Examples of using the Tax Form 90r can provide clarity on its application. For instance, a self-employed individual may use the form to report income from freelance work, while a retired person might utilize it to declare pension income. Each scenario highlights the form's versatility in capturing various income sources and tax obligations, ensuring compliance with federal regulations.

Quick guide on how to complete tax form 90r

Effortlessly prepare Tax Form 90r on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the features you require to create, modify, and electronically sign your paperwork swiftly and without delays. Manage Tax Form 90r on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Tax Form 90r with ease

- Find Tax Form 90r and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight key sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), an invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Modify and electronically sign Tax Form 90r and ensure excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax form 90r

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Tax Form 90r and how can airSlate SignNow help me with it?

Tax Form 90r is a document that reports certain tax information for businesses. airSlate SignNow simplifies the process of sending, signing, and managing this form electronically, allowing you to complete your tax obligations efficiently and securely.

-

Is airSlate SignNow a cost-effective solution for managing Tax Form 90r?

Yes, airSlate SignNow offers competitive pricing plans that make it a cost-effective solution for businesses needing to handle Tax Form 90r. With a range of features at an affordable price, you can streamline your document flow without breaking the bank.

-

What features does airSlate SignNow provide for handling Tax Form 90r?

airSlate SignNow includes features such as customizable templates, electronic signatures, document tracking, and secure cloud storage specifically designed for managing forms like Tax Form 90r. These features enhance the efficiency and security of your document management process.

-

Can I integrate airSlate SignNow with other software to streamline Tax Form 90r processing?

Absolutely! airSlate SignNow supports integrations with many popular software solutions such as CRMs and accounting platforms, which can help automate your workflow for Tax Form 90r. This integration ensures that you can easily manage your tax documents alongside your other business operations.

-

What are the benefits of using airSlate SignNow for Tax Form 90r?

Using airSlate SignNow for Tax Form 90r provides several benefits, including reduced paperwork, faster processing times, and enhanced security for your sensitive information. These advantages help businesses stay compliant while also improving overall efficiency.

-

How secure is my information when using airSlate SignNow for Tax Form 90r?

airSlate SignNow ensures the highest level of security for your information, including data encryption and secure storage. When processing Tax Form 90r, you can be confident that your sensitive data is well protected against unauthorized access.

-

Can I track the status of Tax Form 90r with airSlate SignNow?

Yes, airSlate SignNow includes document tracking features that allow you to monitor the status of Tax Form 90r in real-time. You'll receive notifications at each step of the signing process, ensuring you are always informed about your document's progress.

Get more for Tax Form 90r

- St petersburg city council consent agenda meeting of stpete form

- Chemistry and toxicology of perchlorate form

- Wheaton illinois espace wheaton form

- Louisiana roommate agreement template pdf word form

- Roommate agreement sample in word and pdf formats

- Drywall contract template 787751402 form

- Dropship contract template form

- Drywall drywall bid proposal contract template form

Find out other Tax Form 90r

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document