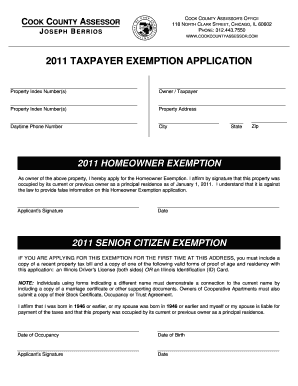

Taxpayer Exemption Application Form

What is the Taxpayer Exemption Application Form

The Taxpayer Exemption Application Form is a crucial document that allows individuals or businesses to apply for exemptions from certain taxes. These exemptions can vary based on state laws and specific circumstances, such as non-profit status or eligibility for specific tax benefits. Understanding the purpose of this form is essential, as it can significantly impact tax liabilities and financial obligations.

Steps to complete the Taxpayer Exemption Application Form

Completing the Taxpayer Exemption Application Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal details, tax identification numbers, and supporting documentation that validates your exemption claim. Next, carefully fill out the form, ensuring that all sections are completed and that the information provided is accurate. Once completed, review the form for any errors or omissions. Finally, submit the form according to the specified guidelines, whether online, by mail, or in person.

Legal use of the Taxpayer Exemption Application Form

The legal use of the Taxpayer Exemption Application Form is governed by federal and state regulations. It is essential to follow these regulations to ensure that the form is considered valid and legally binding. The form must be filled out truthfully and submitted in accordance with the applicable laws. Any misrepresentation or failure to comply with the legal requirements can result in penalties or denial of the exemption.

Eligibility Criteria

Eligibility for submitting the Taxpayer Exemption Application Form varies based on several factors, including the type of exemption being sought and the applicant's status. Common criteria include being a non-profit organization, educational institution, or a business meeting specific qualifications. It is important to review the eligibility requirements specific to your state and the type of exemption to ensure compliance before applying.

Required Documents

When submitting the Taxpayer Exemption Application Form, certain documents are typically required to support your application. These may include proof of non-profit status, financial statements, or any other documentation that substantiates your claim for exemption. Having these documents ready can streamline the application process and improve the chances of approval.

Form Submission Methods

The Taxpayer Exemption Application Form can usually be submitted through various methods, including online submissions, mailing a physical copy, or delivering it in person to the appropriate tax authority. Each method may have specific guidelines and requirements, so it is essential to choose the most suitable option based on your circumstances and preferences.

Filing Deadlines / Important Dates

Filing deadlines for the Taxpayer Exemption Application Form can vary depending on state regulations and the type of exemption being requested. It is crucial to be aware of these deadlines to ensure timely submission and avoid potential penalties. Keeping track of important dates related to the application process can help you stay organized and compliant with tax obligations.

Quick guide on how to complete taxpayer exemption application form

Effortlessly Prepare Taxpayer Exemption Application Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the correct form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and electronically sign your documents quickly and efficiently. Manage Taxpayer Exemption Application Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

Steps to Modify and Electronically Sign Taxpayer Exemption Application Form with Ease

- Find Taxpayer Exemption Application Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and possesses the same legal validity as a traditional signature in ink.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, hassle of searching for forms, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign Taxpayer Exemption Application Form and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxpayer exemption application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Taxpayer Exemption Application Form?

The Taxpayer Exemption Application Form is a document that allows individuals or organizations to apply for tax exemption benefits. This form is essential for ensuring that eligible taxpayers can officially claim their exemption status and save on taxes. It is critical to complete the form accurately to avoid any delays in processing.

-

How can I fill out the Taxpayer Exemption Application Form using airSlate SignNow?

Using airSlate SignNow, you can easily fill out the Taxpayer Exemption Application Form online. Our platform provides a user-friendly interface where you can add your information, sign, and manage the document electronically. This simplifies the process and helps you avoid the hassle of printing and mailing paper forms.

-

Is airSlate SignNow cost-effective for managing the Taxpayer Exemption Application Form?

Yes, airSlate SignNow offers a cost-effective solution for managing the Taxpayer Exemption Application Form. By using our service, businesses can save time and reduce costs associated with manual paperwork. We offer competitive pricing plans tailored to meet the needs of various organizations.

-

What features does airSlate SignNow provide for the Taxpayer Exemption Application Form?

airSlate SignNow offers features such as electronic signing, document templates, and secure cloud storage specifically designed for managing the Taxpayer Exemption Application Form. These features streamline workflows, ensuring that the application process is both efficient and legally compliant. Additionally, real-time tracking allows users to monitor the document status easily.

-

Can I track the progress of my Taxpayer Exemption Application Form with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the progress of your Taxpayer Exemption Application Form in real-time. You will receive notifications about when the document is viewed, signed, or completed, providing greater transparency and control over the application process.

-

Does airSlate SignNow integrate with other software for managing the Taxpayer Exemption Application Form?

Yes, airSlate SignNow integrates seamlessly with a variety of software tools, enhancing the management of the Taxpayer Exemption Application Form. You can connect with popular applications such as CRM systems, cloud storage services, and other productivity tools, allowing for a streamlined workflow and better data management.

-

What are the benefits of using airSlate SignNow for the Taxpayer Exemption Application Form?

Using airSlate SignNow for the Taxpayer Exemption Application Form offers numerous benefits, including enhanced efficiency, increased accuracy, and reduced paper usage. Our platform ensures that you can manage your applications quickly and securely while also providing easy access to important documents whenever needed.

Get more for Taxpayer Exemption Application Form

Find out other Taxpayer Exemption Application Form

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile