Realtor Tax Deduction Worksheet Form

What is the Realtor Tax Deduction Worksheet

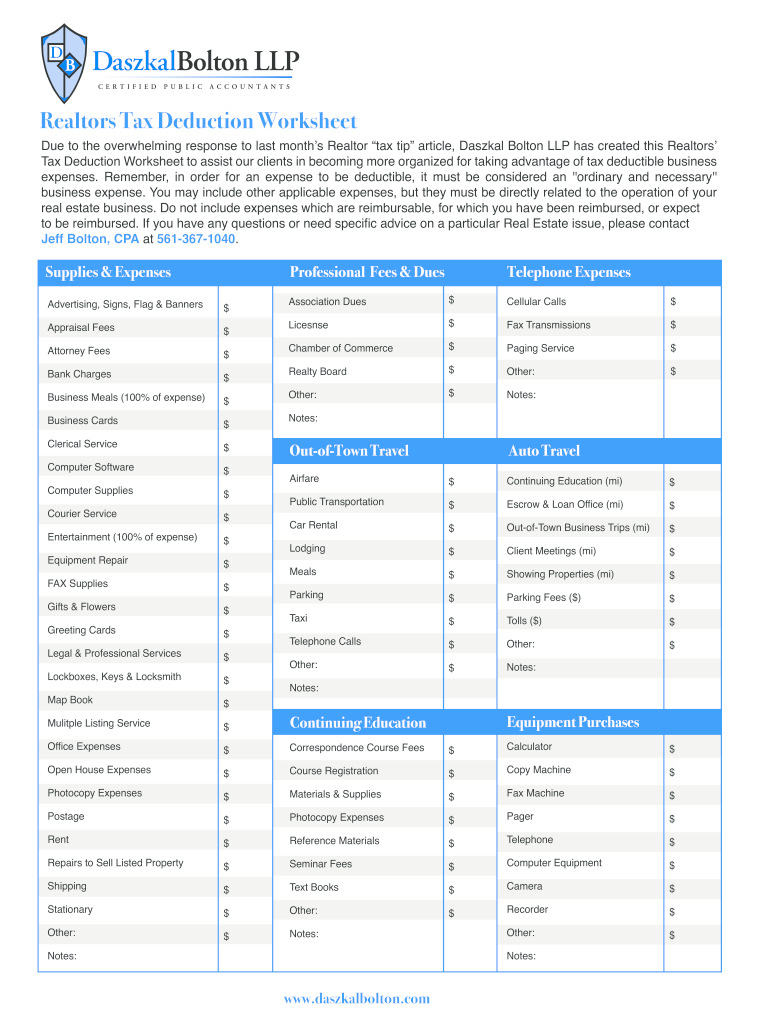

The Realtor Tax Deduction Worksheet is a specialized form designed to help real estate agents track and calculate their deductible expenses. This worksheet is essential for agents who want to maximize their tax deductions and ensure compliance with IRS regulations. It typically includes categories for various expenses, such as marketing costs, vehicle expenses, and office supplies, allowing agents to itemize their deductions efficiently. By using this worksheet, real estate professionals can streamline their tax preparation process and potentially lower their taxable income.

How to use the Realtor Tax Deduction Worksheet

Using the Realtor Tax Deduction Worksheet involves several straightforward steps. First, gather all relevant receipts and documentation related to your business expenses. Next, categorize these expenses according to the sections provided in the worksheet. Common categories include advertising, professional fees, and travel expenses. As you fill out the worksheet, ensure that you accurately input the amounts for each category. This meticulous approach will help you maintain organized records and simplify the tax filing process.

Steps to complete the Realtor Tax Deduction Worksheet

Completing the Realtor Tax Deduction Worksheet requires careful attention to detail. Start by listing your income from real estate transactions. Then, proceed to document your expenses in the designated sections. For each expense, include the date, description, and amount. It is crucial to keep receipts and supporting documents for verification purposes. After filling out the worksheet, review all entries for accuracy before finalizing it for submission with your tax return.

IRS Guidelines

The IRS provides specific guidelines regarding tax deductions for real estate agents. Understanding these guidelines is essential for accurately completing the Realtor Tax Deduction Worksheet. The IRS allows deductions for ordinary and necessary expenses incurred in the course of business. This includes costs related to maintaining a home office, marketing properties, and professional development. Familiarizing yourself with these regulations ensures that you claim all eligible deductions while remaining compliant with tax laws.

Required Documents

To complete the Realtor Tax Deduction Worksheet effectively, certain documents are necessary. Keep a record of all receipts for expenses you plan to deduct. Additionally, gather any relevant financial statements, such as bank statements or invoices. If you have claimed vehicle expenses, maintain a mileage log detailing business-related travel. Having these documents organized will facilitate the completion of the worksheet and support your claims during tax filing.

Form Submission Methods (Online / Mail / In-Person)

Once the Realtor Tax Deduction Worksheet is completed, you can submit it through various methods. The most common approach is to include it with your tax return when filing online. If you prefer to file by mail, ensure that you send it to the appropriate IRS address based on your location. In-person submission is also an option if you visit a local IRS office. Each method has its own timeline and requirements, so it is important to choose the one that best suits your needs.

Penalties for Non-Compliance

Failing to comply with IRS guidelines when using the Realtor Tax Deduction Worksheet can result in significant penalties. If deductions are claimed without proper documentation or if inaccurate information is provided, the IRS may impose fines or additional taxes owed. Furthermore, repeated non-compliance can lead to audits or further scrutiny of your tax filings. Understanding the importance of accurate reporting and maintaining thorough records is essential for avoiding these potential consequences.

Quick guide on how to complete realtor tax deduction worksheet form

The simplest method to locate and endorse Realtor Tax Deduction Worksheet

On the scale of an entire organization, ineffective workflows related to document authorization can waste signNow working hours. Signing documents such as Realtor Tax Deduction Worksheet is a fundamental aspect of operations in any enterprise, which is why the effectiveness of each agreement’s lifecycle has a considerable impact on the overall efficiency of the company. With airSlate SignNow, finalizing your Realtor Tax Deduction Worksheet is as straightforward and quick as possible. This platform offers you the latest version of nearly any document. Even better, you can sign it instantly without needing to install additional applications on your computer or printing hard copies.

Steps to obtain and sign your Realtor Tax Deduction Worksheet

- Explore our catalog by category or utilize the search bar to find the document you require.

- Examine the form preview by clicking Learn more to ensure it’s the correct one.

- Hit Get form to begin editing right away.

- Fill out your form and incorporate any necessary details using the toolbar.

- Once completed, click the Sign tool to endorse your Realtor Tax Deduction Worksheet.

- Choose the signature method that works best for you: Draw, Generate initials, or add a picture of your handwritten signature.

- Click Done to finish editing and move on to document-sharing options if necessary.

With airSlate SignNow, you possess all the tools required to manage your documents efficiently. You can locate, fill out, edit, and even send your Realtor Tax Deduction Worksheet all in one tab without any complications. Streamline your processes by using a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

What is the right way to fill out Two-Earners Worksheet tax form?

Wages, in this context, are what you expect to appear in box 1 of your W-2.The IRS recommends that the additional withholding be applied to the higher-paid spouse and that the lesser-paid spouse should simply claim zero withholding allowances, as this is usually more accurate (due to the way that withholding is actually calculated by payroll programs, you may wind up with less withheld than you want if you split it).

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

Create this form in 5 minutes!

How to create an eSignature for the realtor tax deduction worksheet form

How to create an electronic signature for your Realtor Tax Deduction Worksheet Form online

How to make an eSignature for the Realtor Tax Deduction Worksheet Form in Chrome

How to create an eSignature for putting it on the Realtor Tax Deduction Worksheet Form in Gmail

How to make an eSignature for the Realtor Tax Deduction Worksheet Form straight from your smart phone

How to create an electronic signature for the Realtor Tax Deduction Worksheet Form on iOS devices

How to create an eSignature for the Realtor Tax Deduction Worksheet Form on Android

People also ask

-

What is a real estate agent tax deductions worksheet excel?

A real estate agent tax deductions worksheet excel is a specialized tool designed to help agents track and categorize their tax-deductible expenses throughout the year. Using this worksheet can simplify the tax filing process and ensure agents maximize their deductions. With airSlate SignNow, agents can easily integrate this worksheet into their workflow for seamless access.

-

How can a real estate agent tax deductions worksheet excel benefit me?

Utilizing a real estate agent tax deductions worksheet excel can signNowly streamline your tax preparation. It allows you to document all relevant expenses in one place, ensuring you don't miss out on potential deductions. Moreover, it helps you keep your finances organized, making tax season less stressful.

-

Does airSlate SignNow offer a template for a real estate agent tax deductions worksheet excel?

Yes, airSlate SignNow provides customizable templates for a real estate agent tax deductions worksheet excel. These templates can be tailored to fit your unique needs, allowing you to easily input and track your expenses. Our user-friendly platform ensures a hassle-free experience while you prepare your taxes.

-

What features are included with the real estate agent tax deductions worksheet excel?

The real estate agent tax deductions worksheet excel includes features such as categorized expense tracking, automated calculations, and easy data entry. Additionally, users can add notes or comments for each item for clarification. This comprehensive setup helps ensure that no deduction goes overlooked.

-

Is the real estate agent tax deductions worksheet excel easy to use?

Absolutely! The real estate agent tax deductions worksheet excel is designed for ease of use, even for those less familiar with Excel. The intuitive layout and guides provided by airSlate SignNow make it simple to navigate. This ensures you can quickly input your expenses without any technical headaches.

-

Can I integrate the real estate agent tax deductions worksheet excel with other software?

Yes, one of the advantages of using the airSlate SignNow platform is its integration capabilities. You can easily connect your real estate agent tax deductions worksheet excel with various accounting software like QuickBooks or TurboTax. This enables you to sync your financial data seamlessly, enhancing your overall efficiency.

-

What are the pricing options for using the real estate agent tax deductions worksheet excel?

airSlate SignNow offers flexible pricing plans that cater to different user needs, including access to the real estate agent tax deductions worksheet excel. You can choose a plan that best fits your budget and requirements, ensuring that you have the necessary tools for your tax preparation without breaking the bank.

Get more for Realtor Tax Deduction Worksheet

- Label the cross section of a leaf form

- Secretary of state considation for refund fom form

- Reframing the authentic photography mobile technologies and inter disciplinary form

- Cms exhibit 286 form

- Inverse functions worksheet with answers pdf form

- Pw2help ford com form

- Pcrdp punjab form

- Application for permit driver license or non driver id card use to apply for a learner permit driver license or non driver id form

Find out other Realtor Tax Deduction Worksheet

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter