Ohio Taxation Form

What is the Ohio Taxation

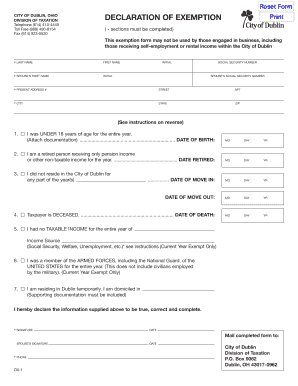

The Ohio taxation form is a crucial document used by residents and businesses to report their income and calculate the amount of state tax owed. It encompasses various forms related to individual taxation, including the declaration form Ohio, which is specifically designed for individuals to declare their income and claim any applicable exemptions. Understanding this form is essential for compliance with state tax laws and ensuring accurate tax reporting.

Steps to Complete the Ohio Taxation

Completing the Ohio taxation form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, such as W-2s, 1099s, and any other income statements. Next, follow these steps:

- Identify the correct form based on your income type and filing status.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring that you include any taxable income.

- Claim applicable deductions and exemptions, such as the Ohio declaration exemption.

- Calculate your total tax liability using the provided tax tables or software.

- Review your completed form for accuracy before submission.

Legal Use of the Ohio Taxation

The Ohio taxation form must be completed and submitted in accordance with state laws to be considered legally binding. Electronic signatures are acceptable, provided that the signing process meets the requirements set forth by the ESIGN Act and UETA. Utilizing a reliable eSignature platform can enhance the legal standing of your completed form, ensuring that it is recognized by state authorities.

Required Documents

To successfully complete the Ohio taxation form, you will need to gather several important documents. These include:

- W-2 forms from employers, detailing annual wages.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental income or dividends.

- Documentation for any deductions or credits you plan to claim.

Having these documents ready will streamline the process and help ensure that your form is accurate and complete.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is essential for compliance with Ohio tax laws. Typically, the deadline for filing individual income tax returns is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to check for any updates or changes to deadlines each tax year to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Ohio taxation form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Ohio Department of Taxation website, which allows for quick processing.

- Mailing the completed form to the appropriate tax office, ensuring it is postmarked by the filing deadline.

- In-person submission at designated tax offices, which may offer assistance for complex cases.

Choosing the right submission method can help ensure timely processing of your tax return.

Quick guide on how to complete ohio taxation

Complete Ohio Taxation effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, alter, and electronically sign your documents swiftly without delays. Handle Ohio Taxation on any device using airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

The easiest way to modify and electronically sign Ohio Taxation with minimal effort

- Find Ohio Taxation and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that task.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Ohio Taxation and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio taxation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio taxation form?

The Ohio taxation form is an official document required by the state of Ohio for various tax-related purposes. It helps individuals and businesses report their tax obligations accurately. Using airSlate SignNow, you can easily manage and eSign your Ohio taxation form online.

-

How can airSlate SignNow help me with my Ohio taxation form?

airSlate SignNow provides an intuitive platform for preparing, signing, and sending your Ohio taxation form. Our solution streamlines the eSigning process, allowing you to complete your tax forms efficiently without the hassle of paper documents. Experience the convenience of digital signatures with airSlate SignNow.

-

Are there any costs associated with using airSlate SignNow for my Ohio taxation form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, starting from a free trial for basic functionalities. Our pricing is competitive, ensuring you get a cost-effective solution for managing your Ohio taxation form and other documents. Visit our pricing page for detailed information.

-

Is airSlate SignNow compliant with Ohio taxation regulations?

Absolutely! airSlate SignNow is designed to comply with legal requirements for electronic signatures in Ohio. Your Ohio taxation form signed through our platform meets all the state regulations, ensuring that your tax submissions are valid and secure.

-

Can I integrate airSlate SignNow with other software for my Ohio taxation form?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow. Whether you use accounting software or other document management systems, you can easily integrate them to manage your Ohio taxation form more effectively. Check out our integrations page for more details.

-

What features does airSlate SignNow offer for handling Ohio taxation forms?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and automated workflows specifically for managing your Ohio taxation form. You can also track the status of your documents and get real-time notifications when they are signed. This makes the tax filing process simpler and more efficient.

-

How do I get started with airSlate SignNow for my Ohio taxation form?

Getting started with airSlate SignNow is easy! Simply sign up for an account, and you can begin creating and signing your Ohio taxation form immediately. Our user-friendly interface ensures you can navigate the platform effortlessly, whether you are tech-savvy or not.

Get more for Ohio Taxation

Find out other Ohio Taxation

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors