City of Akron Income Tax 2008-2026

What is the City of Akron Income Tax?

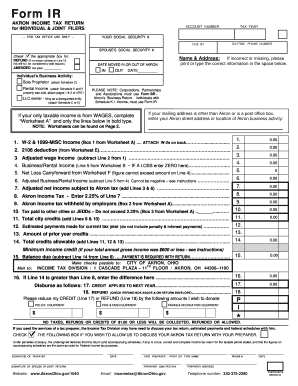

The City of Akron income tax is a municipal tax imposed on individuals and businesses earning income within Akron, Ohio. This tax is essential for funding local services, including public safety, infrastructure, and community programs. The income tax rate is set by the city and may vary based on the type of income earned. Understanding this tax is crucial for residents and businesses to ensure compliance and proper financial planning.

How to Complete the City of Akron Income Tax Form

Completing the city of Akron income tax form involves several key steps. First, gather all necessary financial documents, including W-2s and 1099s, which detail your income for the year. Next, access the official city of Akron income tax form, which can be found in a printable format or completed online. Carefully fill out the form, ensuring all income sources are reported accurately. After completing the form, review it for any errors before submitting it to avoid delays or penalties.

Required Documents for Filing

When filing the city of Akron income tax, certain documents are essential to ensure a smooth process. These typically include:

- W-2 forms from employers, detailing wages and taxes withheld

- 1099 forms for any freelance or contract work

- Proof of any deductions or credits you plan to claim

- Previous year’s tax return for reference

Having these documents ready will facilitate accurate completion of the tax form and help in avoiding any compliance issues.

Form Submission Methods

The city of Akron provides multiple methods for submitting the income tax form. Taxpayers can choose to file online through the city’s official tax portal, which offers a convenient and efficient way to submit forms. Alternatively, individuals may opt to mail their completed forms to the designated tax office or submit them in person. Each submission method has its own processing times, so it is advisable to choose the one that best fits your needs.

Penalties for Non-Compliance

Failing to comply with the city of Akron income tax regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is important to file your tax return on time and pay any owed taxes to avoid these repercussions. Understanding the consequences of non-compliance can motivate taxpayers to prioritize their tax obligations.

Filing Deadlines and Important Dates

Filing deadlines for the city of Akron income tax are crucial for taxpayers to keep in mind. Typically, the deadline for submitting your income tax return is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Staying informed about these dates helps ensure timely filing and payment, reducing the risk of penalties.

Quick guide on how to complete city of akron income tax

Complete City Of Akron Income Tax effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to access the necessary form and securely retain it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage City Of Akron Income Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign City Of Akron Income Tax seamlessly

- Obtain City Of Akron Income Tax and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal authority as a conventional ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, whether via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign City Of Akron Income Tax to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of akron income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Akron tax form, and why is it important?

The city of Akron tax form is essential for residents and businesses to report their income and calculate local taxes owed. It's important for compliance with local tax laws, ensuring that you avoid potential penalties or fines while contributing to community services.

-

How can I easily eSign the city of Akron tax form using airSlate SignNow?

With airSlate SignNow, you can upload your city of Akron tax form, add your signature electronically, and send it securely. The platform simplifies the signing process, making it easy to manage your documents without the need for printing or mailing.

-

What are the costs associated with using airSlate SignNow for the city of Akron tax form?

airSlate SignNow offers a variety of pricing plans that cater to different needs, including a free trial. The cost-effective solution allows you to handle the city of Akron tax form and other documents within your budget, ensuring you maximize value without overspending.

-

Can I use airSlate SignNow to send the city of Akron tax form to multiple recipients?

Yes, airSlate SignNow allows you to send the city of Akron tax form to multiple recipients at once. This feature is particularly useful for businesses that need to gather signatures from various stakeholders efficiently, streamlining the overall process.

-

Is airSlate SignNow secure for handling the city of Akron tax form?

Absolutely! airSlate SignNow employs industry-leading security measures to protect your city of Akron tax form and other sensitive documents. With encryption and secure servers, you can confidently eSign and send your forms without worrying about data bsignNowes.

-

What features does airSlate SignNow offer for managing the city of Akron tax form?

airSlate SignNow provides a range of features like document templates, real-time tracking, and customizable workflows specifically designed for the city of Akron tax form. These tools enhance efficiency, allowing you to manage your tax forms effectively with ease.

-

Does airSlate SignNow integrate with other software for the city of Akron tax form?

Yes, airSlate SignNow seamlessly integrates with various software solutions, improving your workflow for the city of Akron tax form. Integrations with popular platforms enable you to access and manage your forms within your existing systems, saving time and enhancing productivity.

Get more for City Of Akron Income Tax

- Uk application form pdf

- Dobson high school request for high school transcript print form mpsaz

- Ccc transcript request form

- Per capita adult change of address form

- Note and mobile home security agreement minnesota housing mnhousing form

- Family reunion registration form

- Htf 4 draw request request for payment sc state housing form

- Crane checklist form

Find out other City Of Akron Income Tax

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed