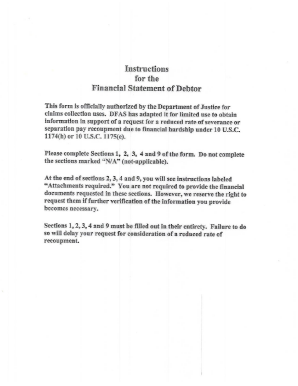

Instructions for the Financial Statement of Debtor Dfas Form

What is the Instructions For The Financial Statement Of Debtor Dfas

The Instructions for the Financial Statement of Debtor DFAS is a crucial document used by individuals and businesses to report their financial status to the Defense Finance and Accounting Service (DFAS). This form is essential for debtors who need to disclose their financial information accurately, ensuring compliance with legal obligations. The form typically includes sections for listing assets, liabilities, income, and expenses, providing a comprehensive overview of the debtor's financial situation.

Steps to complete the Instructions For The Financial Statement Of Debtor Dfas

Completing the Instructions for the Financial Statement of Debtor DFAS involves several key steps:

- Gather Financial Information: Collect all necessary documents, including bank statements, pay stubs, tax returns, and any other relevant financial records.

- Fill Out the Form: Carefully enter your financial details in the designated sections, ensuring accuracy and completeness.

- Review Your Entries: Double-check all information for any errors or omissions to avoid potential issues during processing.

- Sign and Date: Ensure that you sign and date the form, as this validates your submission.

Legal use of the Instructions For The Financial Statement Of Debtor Dfas

The legal use of the Instructions for the Financial Statement of Debtor DFAS is paramount for ensuring that the information provided is accepted by relevant authorities. This form must be completed in accordance with federal regulations, as it serves as a formal declaration of financial status. Accurate and honest reporting is essential to avoid legal repercussions, including penalties for misrepresentation or fraud.

Required Documents

To successfully complete the Instructions for the Financial Statement of Debtor DFAS, several documents are typically required:

- Recent bank statements

- Pay stubs or proof of income

- Tax returns for the previous year

- Documentation of any outstanding debts

- Records of monthly expenses

Form Submission Methods (Online / Mail / In-Person)

Submitting the Instructions for the Financial Statement of Debtor DFAS can be done through various methods, depending on individual preferences and requirements:

- Online Submission: Many users opt to submit the form electronically through secure online portals, which can expedite processing times.

- Mail Submission: Alternatively, the completed form can be printed and mailed to the appropriate DFAS office.

- In-Person Submission: In some cases, individuals may choose to deliver the form directly to a DFAS office for immediate processing.

Who Issues the Form

The Instructions for the Financial Statement of Debtor DFAS is issued by the Defense Finance and Accounting Service, which is responsible for managing the financial operations of the Department of Defense. This agency ensures that all financial reporting is conducted in compliance with federal regulations and provides guidance on the completion of the form.

Quick guide on how to complete instructions for the financial statement of debtor dfas

Effortlessly Complete Instructions For The Financial Statement Of Debtor Dfas on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle Instructions For The Financial Statement Of Debtor Dfas on any device using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

How to Adjust and Electronically Sign Instructions For The Financial Statement Of Debtor Dfas With Ease

- Find Instructions For The Financial Statement Of Debtor Dfas and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to preserve your modifications.

- Choose how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Instructions For The Financial Statement Of Debtor Dfas and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for the financial statement of debtor dfas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For The Financial Statement Of Debtor Dfas?

The Instructions For The Financial Statement Of Debtor Dfas provide a detailed guide on how to accurately prepare and submit financial statements. This documentation is essential to ensure compliance with legal and financial reporting requirements.

-

How can airSlate SignNow assist in preparing the Instructions For The Financial Statement Of Debtor Dfas?

airSlate SignNow offers a user-friendly platform that allows you to create, send, and electronically sign documents, including financial statements. With our templates, you can efficiently complete the Instructions For The Financial Statement Of Debtor Dfas without any hassle.

-

Is airSlate SignNow cost-effective for managing the Instructions For The Financial Statement Of Debtor Dfas?

Yes, airSlate SignNow is a cost-effective solution for managing your document needs. Our pricing plans accommodate various budgets, ensuring you can efficiently handle the Instructions For The Financial Statement Of Debtor Dfas without overspending.

-

What features does airSlate SignNow provide for handling financial documents?

airSlate SignNow includes features such as secure eSigning, document templates, and real-time tracking, specifically designed for managing financial documents. This ensures that your Instructions For The Financial Statement Of Debtor Dfas are completed accurately and promptly.

-

Can I integrate airSlate SignNow with other software tools for my financial documentation?

Absolutely! airSlate SignNow offers integrations with various software tools, enhancing your workflow for the Instructions For The Financial Statement Of Debtor Dfas. You can connect with popular applications such as Google Drive, Dropbox, and CRM systems to streamline your processes.

-

What benefits does airSlate SignNow provide for efficient document management?

By using airSlate SignNow, you gain access to advanced features like automation and collaborative editing that simplify document management. This is particularly beneficial when working on the Instructions For The Financial Statement Of Debtor Dfas, as it reduces errors and speeds up completion times.

-

Is training available for using airSlate SignNow for financial documents?

Yes, airSlate SignNow offers comprehensive training resources to help you understand how to manage your financial documents effectively. This includes guidance on the Instructions For The Financial Statement Of Debtor Dfas, ensuring you utilize our platform to its fullest potential.

Get more for Instructions For The Financial Statement Of Debtor Dfas

- Form ds 11 fillable bing

- Ramsey county mn juvenile justice redesign final report co ramsey mn form

- Fencing scoresheet form

- Application for health approval fraser health authority form

- Norton ks prison visitation application 2013 2019 form

- Pennsylvania rev 467 form

- Change report form final department of public health and social dphss guam

- Nhjb 2065 f form

Find out other Instructions For The Financial Statement Of Debtor Dfas

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will