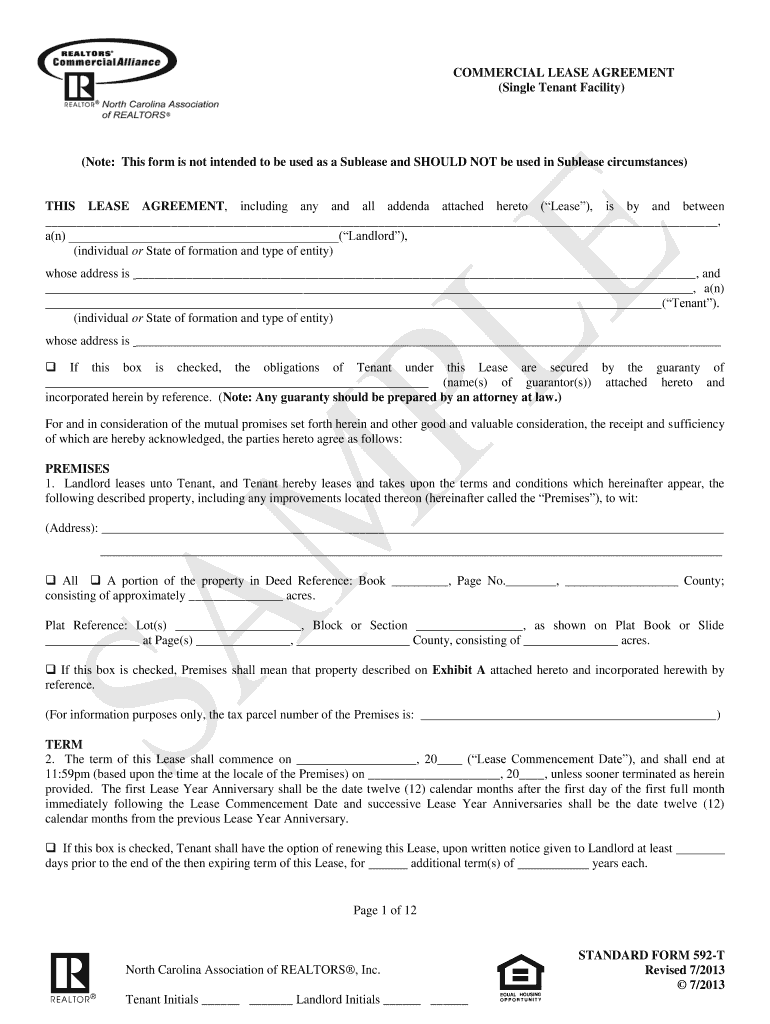

Standard Form 592 T

What is the Standard Form 592 T

The Standard Form 592 T is a document used primarily for reporting withholding on payments made to non-residents and certain types of business entities. It is essential for ensuring compliance with tax regulations in the United States, particularly for businesses engaging with foreign entities or individuals. This form helps to document the amount withheld and ensures that the appropriate taxes are remitted to the IRS. Understanding the purpose and requirements of the 592 form is crucial for businesses to avoid penalties and maintain accurate financial records.

How to use the Standard Form 592 T

Using the Standard Form 592 T involves several steps to ensure accurate completion and submission. First, gather all necessary information regarding the payments made to non-residents, including their identification details and the amounts paid. Next, fill out the form by entering the required information, such as the payer's details, recipient's information, and the total amount withheld. After completing the form, review it for accuracy before submitting it to the IRS. It is advisable to keep a copy for your records to reference in case of any inquiries or audits.

Steps to complete the Standard Form 592 T

Completing the Standard Form 592 T requires careful attention to detail. Follow these steps:

- Collect all relevant information about the payments made to non-residents.

- Fill in the payer's name, address, and taxpayer identification number (TIN).

- Provide the recipient's name, address, and TIN.

- Detail the amounts paid and the corresponding withholding tax.

- Review the form for any errors or omissions.

- Submit the completed form to the IRS by the specified deadline.

Legal use of the Standard Form 592 T

The legal use of the Standard Form 592 T is vital for compliance with U.S. tax laws. This form serves as a formal record of tax withholding on payments to non-residents, ensuring that businesses fulfill their tax obligations. Failure to properly complete and submit this form can lead to penalties and interest charges. It is important for businesses to understand the legal implications associated with the 592 form, as it helps protect them from potential audits and ensures transparency in their financial dealings.

Key elements of the Standard Form 592 T

The Standard Form 592 T includes several key elements that must be accurately reported. These elements consist of:

- Payer information: Name, address, and TIN of the business making the payment.

- Recipient information: Name, address, and TIN of the non-resident receiving the payment.

- Payment details: The total amount paid and the amount withheld for tax purposes.

- Certification: A declaration confirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Standard Form 592 T are crucial for compliance. Typically, the form must be submitted to the IRS by specific dates, depending on the type of payment and the recipient's residency status. It is important to stay informed about these deadlines to avoid penalties. Generally, the form is due by the end of the month following the payment period. Keeping a calendar of important dates can help businesses manage their filing responsibilities effectively.

Quick guide on how to complete 592 t commercial lease agreement single tenant facility ncrealtors

Prepare Standard Form 592 T effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-conscious substitute for traditional printed and signed files, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Standard Form 592 T on any device with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to adjust and eSign Standard Form 592 T with ease

- Locate Standard Form 592 T and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of your files or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your edits.

- Select how you'd like to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Standard Form 592 T and ensure outstanding communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 592 t commercial lease agreement single tenant facility ncrealtors

How to generate an electronic signature for your 592 T Commercial Lease Agreement Single Tenant Facility Ncrealtors online

How to create an eSignature for the 592 T Commercial Lease Agreement Single Tenant Facility Ncrealtors in Chrome

How to make an electronic signature for signing the 592 T Commercial Lease Agreement Single Tenant Facility Ncrealtors in Gmail

How to make an eSignature for the 592 T Commercial Lease Agreement Single Tenant Facility Ncrealtors straight from your mobile device

How to create an electronic signature for the 592 T Commercial Lease Agreement Single Tenant Facility Ncrealtors on iOS

How to create an eSignature for the 592 T Commercial Lease Agreement Single Tenant Facility Ncrealtors on Android

People also ask

-

What is an acop form sample and how can it be used?

An acop form sample is a template that helps you create compliant documentation for various business processes. It can be tailored to meet specific organizational needs, making it a versatile tool for improving efficiency in document handling.

-

How can airSlate SignNow help with acop form samples?

airSlate SignNow provides a platform where you can easily create, send, and eSign acop form samples. The user-friendly interface simplifies the process, allowing you to manage your documents seamlessly and securely.

-

What are the pricing options for using airSlate SignNow to manage acop form samples?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose a plan that fits your needs, allowing you to efficiently manage your acop form samples without incurring high costs.

-

Are there any features specifically for acop form samples in airSlate SignNow?

Yes, airSlate SignNow includes several features designed for handling acop form samples, such as customizable templates, secure eSignature options, and automated workflows. These tools help streamline your document processing and ensure compliance.

-

Can I integrate airSlate SignNow with other software for managing acop form samples?

Absolutely! airSlate SignNow integrates with various popular applications, allowing you to manage your acop form samples alongside other business functions. This ensures a smooth workflow and enhances productivity across your organization.

-

What benefits can I expect from using airSlate SignNow for acop form samples?

Using airSlate SignNow for your acop form samples brings numerous benefits such as increased efficiency, reduced turnaround time, and higher compliance rates. The platform also enhances team collaboration by simplifying the document management process.

-

Is there customer support available for issues related to acop form samples?

Yes, airSlate SignNow offers dedicated customer support to assist you with any issues related to acop form samples. Their knowledgeable team is available to help you navigate the platform and maximize its features.

Get more for Standard Form 592 T

Find out other Standard Form 592 T

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy