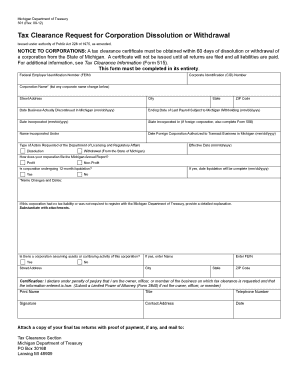

Michigan Tax Clearance Certificate Form

What is the Michigan Tax Clearance Certificate

The Michigan Tax Clearance Certificate is an official document issued by the Michigan Department of Treasury. It verifies that a taxpayer has settled all outstanding tax obligations with the state. This certificate is often required for various business transactions, including the sale of a business, obtaining certain licenses, or securing loans. It serves as proof that the taxpayer is in good standing and has complied with state tax laws, making it a crucial document for individuals and businesses alike.

How to obtain the Michigan Tax Clearance Certificate

To obtain the Michigan Tax Clearance Certificate, taxpayers must follow a specific process. First, they need to ensure that all tax returns are filed and that any outstanding taxes, penalties, or interest are paid. Once these requirements are met, taxpayers can request the certificate by submitting a completed request form to the Michigan Department of Treasury. This can typically be done online, by mail, or in person, depending on the taxpayer's preference. The processing time may vary, so it's advisable to request the certificate well in advance of any deadlines.

Steps to complete the Michigan Tax Clearance Certificate

Completing the Michigan Tax Clearance Certificate involves several key steps:

- Ensure all tax obligations are current, including filing all necessary returns.

- Pay any outstanding taxes, penalties, or interest to the Michigan Department of Treasury.

- Obtain the request form for the Tax Clearance Certificate from the Michigan Department of Treasury's website or office.

- Fill out the request form accurately, providing all required information.

- Submit the completed form along with any necessary documentation, either online, by mail, or in person.

Key elements of the Michigan Tax Clearance Certificate

The Michigan Tax Clearance Certificate includes several important elements that validate its authenticity and purpose. Key components typically include:

- The taxpayer's name and address.

- The certificate's issuance date.

- A statement confirming the taxpayer's compliance with state tax obligations.

- Contact information for the Michigan Department of Treasury.

- Any specific conditions or limitations related to the use of the certificate.

Legal use of the Michigan Tax Clearance Certificate

The Michigan Tax Clearance Certificate is legally binding and serves as an essential document in various business and legal contexts. It is often required when applying for business licenses, permits, or financing. Additionally, it may be requested during the sale or transfer of ownership of a business to ensure that all tax liabilities have been addressed. Failure to provide this certificate when required can result in delays or complications in business transactions.

Required Documents

When requesting the Michigan Tax Clearance Certificate, taxpayers may need to provide specific documents to verify their tax compliance. Commonly required documents include:

- Completed tax returns for the relevant years.

- Proof of payment for any outstanding taxes, penalties, or interest.

- Identification documents, such as a driver's license or business registration papers.

Quick guide on how to complete michigan tax clearance certificate

Effortlessly Prepare Michigan Tax Clearance Certificate on Any Device

Managing documents online has become increasingly favored by both organizations and individuals. It offers a superb environmentally friendly alternative to conventional printed and signed paperwork, as you can easily find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without holdups. Manage Michigan Tax Clearance Certificate on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to Modify and Electronically Sign Michigan Tax Clearance Certificate with Ease

- Find Michigan Tax Clearance Certificate and click on Get Form to begin.

- Use the tools available to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Edit and electronically sign Michigan Tax Clearance Certificate and assure outstanding communication at any phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan tax clearance certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax clearance certificate in Michigan?

A tax clearance certificate in Michigan is an official document that confirms an individual or business has paid all their taxes and has no outstanding debts with the Michigan Department of Treasury. This certificate is often required when applying for loans, permits, or licenses within the state.

-

How can I obtain a tax clearance certificate in Michigan?

To obtain a tax clearance certificate in Michigan, you must submit a request to the Michigan Department of Treasury, ensuring all tax obligations are met. Using airSlate SignNow can streamline the process by allowing you to eSign and send necessary forms and documents quickly.

-

What are the costs associated with acquiring a tax clearance certificate in Michigan?

Generally, obtaining a tax clearance certificate in Michigan may involve minimal fees, primarily associated with any outstanding tax payments or penalties. Utilizing airSlate SignNow can save you time and potential costs as it offers affordable eSigning solutions for tax-related documentation.

-

How does a tax clearance certificate benefit businesses in Michigan?

A tax clearance certificate benefits businesses in Michigan by demonstrating compliance with state tax laws, which is crucial for building credibility with banks and licensing authorities. This can enhance your business's reputation and open doors to new opportunities.

-

Can I use airSlate SignNow to manage documents related to my tax clearance certificate in Michigan?

Yes, airSlate SignNow allows you to easily manage, eSign, and send documents related to your tax clearance certificate in Michigan. This efficient process minimizes paperwork and helps ensure that you meet all submission deadlines.

-

Are there integrations available with airSlate SignNow for managing tax-related documents?

Absolutely! airSlate SignNow provides integrations with various platforms including cloud storage services, customer relationship management systems, and project management tools, enabling seamless management of tax-related documents like the tax clearance certificate in Michigan.

-

How long does it take to receive a tax clearance certificate in Michigan?

The processing time for a tax clearance certificate in Michigan can vary, typically taking several days to a few weeks. By using airSlate SignNow, you can expedite document submissions, helping to speed up the overall process.

Get more for Michigan Tax Clearance Certificate

- Application for scholarship doa nc form

- Access to defense finance and accounting services data sources dodcio defense form

- Surat pengesahan pelajar uitm form

- Biggin scott tenancy application form

- Index of narrative complexity story coding form index of narrative ctspeechhearing

- Dhcs 1051 california department of public health state of cdph ca form

- Intake form in social work

- Amendmentwithdrawalcancellation of fictitious name pa gov form

Find out other Michigan Tax Clearance Certificate

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien