Rhode Island Partnership Return Form

What is the Rhode Island Partnership Return

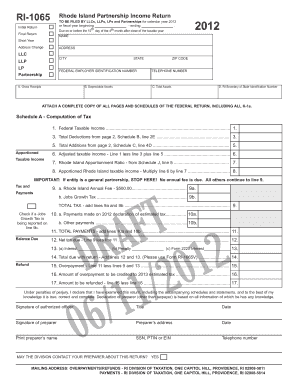

The Rhode Island Partnership Return, also known as the RI Form 1065, is a tax document used by partnerships operating within the state. This form reports the income, deductions, and credits of the partnership, allowing it to pass through its income to its partners. Each partner then reports their share of the partnership's income on their individual tax returns. Understanding this form is crucial for compliance with state tax regulations and ensuring accurate reporting of partnership income.

Steps to complete the Rhode Island Partnership Return

Completing the Rhode Island Partnership Return involves several key steps. First, gather all necessary financial documents, including income statements and expense records. Next, accurately fill out the RI Form 1065, ensuring that all income and deductions are reported correctly. Pay special attention to the allocation of income among partners, as this must reflect the partnership agreement. After completing the form, review it for accuracy before submitting it to the Rhode Island Division of Taxation.

Filing Deadlines / Important Dates

Filing deadlines for the Rhode Island Partnership Return are essential to avoid penalties. Typically, the return is due on the fifteenth day of the fourth month following the close of the partnership's tax year. For partnerships operating on a calendar year, this means the due date is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to stay informed about any changes in deadlines due to legislative updates or other factors.

Required Documents

To successfully complete the Rhode Island Partnership Return, certain documents are required. These include:

- Financial statements, such as profit and loss statements

- Records of all income received by the partnership

- Documentation of all deductible expenses

- Partnership agreement outlining the distribution of income among partners

- Previous year’s tax returns, if applicable

Having these documents readily available will streamline the process of filling out the form and ensure compliance with state regulations.

Legal use of the Rhode Island Partnership Return

The Rhode Island Partnership Return serves a legal purpose by ensuring that partnerships report their income accurately to the state. This form must be completed in accordance with Rhode Island tax laws, and any discrepancies can lead to audits or penalties. It is crucial for partnerships to maintain accurate records and adhere to the legal requirements associated with filing the RI Form 1065 to avoid potential legal issues.

Form Submission Methods (Online / Mail / In-Person)

Partnerships can submit the Rhode Island Partnership Return through various methods. The form can be filed online using the Rhode Island Division of Taxation's e-filing system, which offers a convenient and efficient way to submit tax returns. Alternatively, partnerships may choose to mail their completed forms to the appropriate tax office. In-person submissions are also accepted but may require an appointment. Each method has its own advantages, and partnerships should choose the one that best suits their needs.

Quick guide on how to complete rhode island partnership return

Complete Rhode Island Partnership Return effortlessly on any device

Online document management has become increasingly popular with businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents quickly without delays. Manage Rhode Island Partnership Return on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Rhode Island Partnership Return without stress

- Obtain Rhode Island Partnership Return and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Recheck all the information and then click the Done button to save your changes.

- Choose your preferred method to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Rhode Island Partnership Return and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rhode island partnership return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Rhode Island 1065 instructions?

Rhode Island 1065 instructions provide detailed guidelines for partnerships operating in the state to file their tax returns. These instructions outline the necessary forms, documentation, and the steps needed to ensure compliance with state law. Understanding these instructions is essential for accurate and timely filing.

-

Why should I use airSlate SignNow for filing Rhode Island 1065 instructions?

Using airSlate SignNow allows you to streamline the document signing process required for your Rhode Island 1065 instructions. Our platform offers an easy-to-use interface combined with secure eSigning capabilities, ensuring that you can gather signatures quickly and efficiently. This helps you meet tax deadlines without hassle.

-

How can I access the Rhode Island 1065 instructions online?

You can access the Rhode Island 1065 instructions online through the official state tax department website or by using resources provided by airSlate SignNow. We offer valuable tools and integrations to help you easily locate and utilize the relevant forms and instructions for your filing.

-

What features does airSlate SignNow offer for Rhode Island 1065 filing?

airSlate SignNow offers several features that cater to Rhode Island 1065 filing, including document templates and eSigning. You can easily customize your documents, collaborate in real-time, and securely send them for signatures, all of which can save you valuable time during your tax season.

-

Can airSlate SignNow integrate with my accounting software for Rhode Island 1065 filing?

Yes, airSlate SignNow supports integrations with various accounting software that can help streamline your Rhode Island 1065 filing process. This means you can import data directly into your tax documents, reducing errors and time spent on manual data entry. Check our integration list for compatibility.

-

Is airSlate SignNow suitable for small businesses filing Rhode Island 1065 instructions?

Absolutely! airSlate SignNow is a cost-effective solution tailored for businesses of all sizes, including small businesses. The platform’s user-friendly design and flexible pricing options make it an ideal choice for those looking to manage their Rhode Island 1065 instructions efficiently and affordably.

-

How secure is my information with airSlate SignNow when handling Rhode Island 1065 instructions?

Security is a top priority at airSlate SignNow. We implement advanced encryption and comply with industry standards to protect your information while you work on your Rhode Island 1065 instructions. You can trust that your sensitive data and documents are safe with our robust security measures.

Get more for Rhode Island Partnership Return

- Adult sepsis form

- Phlebotomy skills competency checklist collin form

- Driver education brochure tantasquaorg form

- Winair forms token value list air commercial real estate

- Letter of interest form beacon health strategies

- Conciliation court information sheet yavapai county courts website

- Partnership return form 1065pdf city of lapeer ci lapeer mi

- Confidential assessment form formulaire dvaluation confidentielle

Find out other Rhode Island Partnership Return

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History