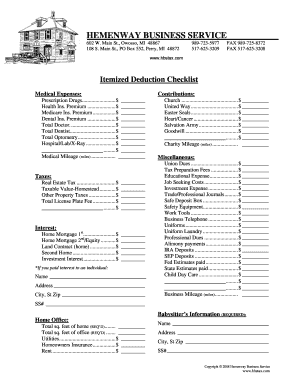

Itemized Deduction Checklist Hbstax Com Form

Understanding the Itemized Deductions List

The itemized deductions list is a crucial component for taxpayers who choose to detail their eligible expenses instead of taking the standard deduction. This list includes various categories of expenses that can reduce taxable income, allowing individuals to potentially save on their tax bills. Common items on the list include medical expenses, mortgage interest, charitable contributions, and certain unreimbursed business expenses. Familiarizing oneself with these categories can lead to more effective tax planning and preparation.

Steps to Complete the Itemized Deductions List

Completing the itemized deductions list involves several steps to ensure accuracy and compliance with IRS requirements. Begin by gathering all relevant financial documents, including receipts and statements that support your deductions. Next, categorize your expenses according to the IRS guidelines. It is essential to maintain organized records to substantiate each item on your list. Once you have compiled your deductions, you can transfer the information to the appropriate tax forms, such as Schedule A of Form 1040. Review your entries carefully to avoid errors that could lead to penalties.

IRS Guidelines for Itemized Deductions

The IRS provides specific guidelines regarding what qualifies as an itemized deduction. Understanding these guidelines is essential for taxpayers to maximize their deductions legally. For instance, medical expenses must exceed a certain percentage of adjusted gross income to be deductible. Additionally, there are limits on the amount of state and local taxes that can be deducted. Familiarize yourself with these rules to ensure compliance and to optimize your tax return. Consulting IRS publications or a tax professional can provide further clarity on these guidelines.

Required Documents for Itemized Deductions

To complete the itemized deductions list accurately, certain documents are necessary. These may include:

- Receipts for medical expenses, including prescriptions and treatments

- Form 1098 for mortgage interest paid

- Documentation of charitable contributions, such as receipts or bank statements

- Records of property taxes paid

- Statements for unreimbursed business expenses, if applicable

Having these documents on hand will facilitate the completion of your itemized deductions list and help ensure that you claim all eligible deductions.

Examples of Common Itemized Deductions

Understanding common itemized deductions can help taxpayers identify potential savings. Some typical examples include:

- Medical and dental expenses that exceed a specified percentage of adjusted gross income

- Home mortgage interest payments

- State and local income taxes or sales taxes

- Charitable donations to qualified organizations

- Certain unreimbursed business expenses for employees

These examples highlight the variety of deductions available, emphasizing the importance of maintaining accurate records to support each claim.

Filing Deadlines for Itemized Deductions

Filing deadlines are critical for taxpayers who wish to claim itemized deductions. Typically, individual tax returns are due on April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to file your return as early as possible to avoid any last-minute issues and to ensure that all deductions are accurately reported. Taxpayers can also apply for an extension if they need additional time, but it is essential to pay any taxes owed by the original deadline to avoid penalties.

Digital vs. Paper Version of Itemized Deductions List

Taxpayers have the option to complete their itemized deductions list using either digital or paper methods. Digital forms offer advantages such as ease of use, automatic calculations, and the ability to save and edit information easily. Additionally, electronic submissions can expedite processing times. On the other hand, some individuals may prefer paper forms for their simplicity or familiarity. Regardless of the method chosen, it is important to ensure that all information is accurate and complies with IRS regulations.

Quick guide on how to complete itemized deduction checklist hbstax com

Easily Prepare Itemized Deduction Checklist Hbstax com on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Handle Itemized Deduction Checklist Hbstax com on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

The Simplest Way to Modify and eSign Itemized Deduction Checklist Hbstax com Effortlessly

- Locate Itemized Deduction Checklist Hbstax com and click Get Form to begin.

- Make use of the available tools to complete your document.

- Emphasize important sections of your documents or redact sensitive information using features provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sharing your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you select. Edit and eSign Itemized Deduction Checklist Hbstax com to maintain effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the itemized deduction checklist hbstax com

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an itemized deductions list?

An itemized deductions list is a comprehensive record of eligible expenses that can be deducted from your taxable income, potentially reducing your overall tax burden. By detailing specific categories such as medical expenses, mortgage interest, and charitable donations, this list helps you identify how much you can deduct. Understanding your itemized deductions list is essential for maximizing your tax benefits.

-

How can airSlate SignNow help with my itemized deductions list?

airSlate SignNow streamlines the process of managing your itemized deductions list by providing a secure platform to eSign and send necessary documents. This easy-to-use solution simplifies document management, ensuring you have all the required receipts and forms organized. With airSlate SignNow, you can focus on your deductions without the stress of document handling.

-

Is airSlate SignNow cost-effective for managing tax documents?

Yes, airSlate SignNow is a cost-effective solution for managing all your tax-related documents, including your itemized deductions list. With tiered pricing plans, businesses of all sizes can find an option that fits their budget. This affordability, combined with features tailored for document signing and management, makes it an ideal choice for tax season.

-

Can I integrate airSlate SignNow with my accounting software?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, making it easier to keep your itemized deductions list current. By syncing your documents and data across platforms, you can ensure that all necessary expenses are captured effectively, ultimately simplifying your tax preparation process.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow provides a robust set of features for document management, including customizable templates, eSignature capabilities, and secure cloud storage. These features allow you to create and manage your itemized deductions list efficiently while ensuring compliance with legal requirements. This comprehensive approach to document management enhances productivity and accuracy in your tax filings.

-

How does eSigning benefit my itemized deductions list?

eSigning your itemized deductions list or related documents can speed up the approval process with financial institutions or tax preparers. By using airSlate SignNow’s eSigning feature, you can ensure that all your documents are signed quickly and securely. This eliminates the hassle of printing, scanning, and mailing, making your tax preparation processes more efficient.

-

What security measures does airSlate SignNow have for my tax documents?

Security is a top priority at airSlate SignNow, especially for sensitive tax documents like your itemized deductions list. The platform employs advanced encryption and secure storage protocols to ensure your information is protected against unauthorized access. You can rest assured that your important tax documents are safe while using airSlate SignNow.

Get more for Itemized Deduction Checklist Hbstax com

- Review and practice for the earth science sol 2010 2019 form

- Comrec checklist college of medicine medcol form

- Military housing office marine corps air station beaufort beaufort marines form

- Yexus lub neej pdf form

- Lejekontrakt typeformular u 1991

- Supply and demand super teacher worksheets deaccessproject form

- Pediatric symptom checklist 17 psc 17 wyomingpal form

- Machtiging motorrijtuigenbelasting automatisch betalen form

Find out other Itemized Deduction Checklist Hbstax com

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy