WH 1606A the South Carolina Department of Revenue Form

What is the WH-1606A The South Carolina Department Of Revenue

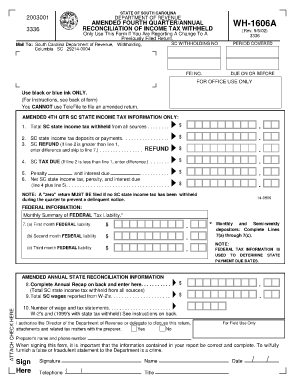

The WH-1606A is a form issued by the South Carolina Department of Revenue, primarily used for withholding tax purposes. This form is essential for employers who need to report and remit state income taxes withheld from employees' wages. It serves as a declaration of the amount withheld and ensures compliance with state tax regulations. Understanding the purpose of the WH-1606A helps employers maintain accurate records and fulfill their tax obligations effectively.

How to use the WH-1606A The South Carolina Department Of Revenue

Using the WH-1606A involves several steps, starting with gathering the necessary employee information, such as names, Social Security numbers, and the total amount of state income tax withheld. Employers must accurately complete the form, ensuring all details are correct to avoid penalties. Once filled out, the WH-1606A should be submitted according to the guidelines provided by the South Carolina Department of Revenue, either electronically or via mail.

Steps to complete the WH-1606A The South Carolina Department Of Revenue

Completing the WH-1606A requires careful attention to detail. Here are the steps to follow:

- Gather all relevant employee information, including names and Social Security numbers.

- Calculate the total amount of state income tax withheld for each employee.

- Fill out the form accurately, ensuring all fields are completed.

- Review the information for any errors or omissions.

- Submit the completed WH-1606A to the South Carolina Department of Revenue by the specified deadline.

Legal use of the WH-1606A The South Carolina Department Of Revenue

The WH-1606A is legally binding when completed and submitted in accordance with South Carolina tax laws. It is crucial for employers to understand the legal implications of this form, as inaccuracies or failure to submit can result in penalties. The form must be signed by an authorized representative of the business, affirming that the information provided is true and accurate, thus ensuring compliance with state regulations.

Required Documents

To complete the WH-1606A, employers should have several documents on hand, including:

- Employee payroll records that show the amounts withheld.

- Tax identification numbers for the business and employees.

- Previous tax filings to ensure consistency in reporting.

Form Submission Methods (Online / Mail / In-Person)

The WH-1606A can be submitted through various methods to accommodate different preferences. Employers may choose to file electronically via the South Carolina Department of Revenue's online portal, which is often the fastest option. Alternatively, forms can be mailed to the appropriate address or submitted in person at designated locations. It's important to check the latest submission guidelines to ensure compliance with state requirements.

Quick guide on how to complete wh 1606a the south carolina department of revenue

Complete WH 1606A The South Carolina Department Of Revenue effortlessly on any device

Online document management has become increasingly favored by organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can acquire the appropriate form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, adjust, and electronically sign your documents promptly without any holdups. Manage WH 1606A The South Carolina Department Of Revenue on any device with airSlate SignNow Android or iOS applications and simplify any document-centric procedure today.

The simplest method to modify and electronically sign WH 1606A The South Carolina Department Of Revenue with ease

- Locate WH 1606A The South Carolina Department Of Revenue and then click Get Form to begin.

- Use the tools provided to complete your document.

- Highlight relevant sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your updates.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign WH 1606A The South Carolina Department Of Revenue and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wh 1606a the south carolina department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the WH 1606A The South Carolina Department Of Revenue?

The WH 1606A The South Carolina Department Of Revenue is a tax form used by businesses in South Carolina to report withholding tax from employee wages. Understanding this form is crucial for compliance with state tax regulations and avoiding penalties.

-

How does airSlate SignNow help with the WH 1606A The South Carolina Department Of Revenue?

airSlate SignNow simplifies the process of filling out and submitting the WH 1606A The South Carolina Department Of Revenue by providing an intuitive platform for electronic signatures and document management. This ensures that your tax submissions are accurate and timely.

-

What features does airSlate SignNow offer for handling WH 1606A The South Carolina Department Of Revenue?

With airSlate SignNow, you can easily eSign, store, and share your WH 1606A The South Carolina Department Of Revenue securely. Key features include mobile access, customizable templates, and automated workflows to streamline the filing process.

-

Is airSlate SignNow cost-effective for small businesses managing the WH 1606A The South Carolina Department Of Revenue?

Yes, airSlate SignNow offers flexible pricing plans that are budget-friendly for small businesses. By using our service, you can save time and reduce costs associated with paper filings and manual processes for the WH 1606A The South Carolina Department Of Revenue.

-

Can I integrate airSlate SignNow with other accounting software for WH 1606A The South Carolina Department Of Revenue?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to connect all your systems when working on the WH 1606A The South Carolina Department Of Revenue. This integration enhances your efficiency and keeps your financial records organized.

-

What are the benefits of using airSlate SignNow for WH 1606A The South Carolina Department Of Revenue?

Using airSlate SignNow for the WH 1606A The South Carolina Department Of Revenue provides signNow benefits such as improved accuracy in form submission, expedited processing times, and reduced administrative burdens. Our platform ensures you meet state requirements effortlessly.

-

How secure is airSlate SignNow when handling WH 1606A The South Carolina Department Of Revenue documents?

airSlate SignNow employs top-notch security measures to protect your data, including encryption and secure cloud storage. When managing sensitive documents like the WH 1606A The South Carolina Department Of Revenue, your information remains confidential and secure.

Get more for WH 1606A The South Carolina Department Of Revenue

Find out other WH 1606A The South Carolina Department Of Revenue

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document