5227 Form

What is the 5227 Form

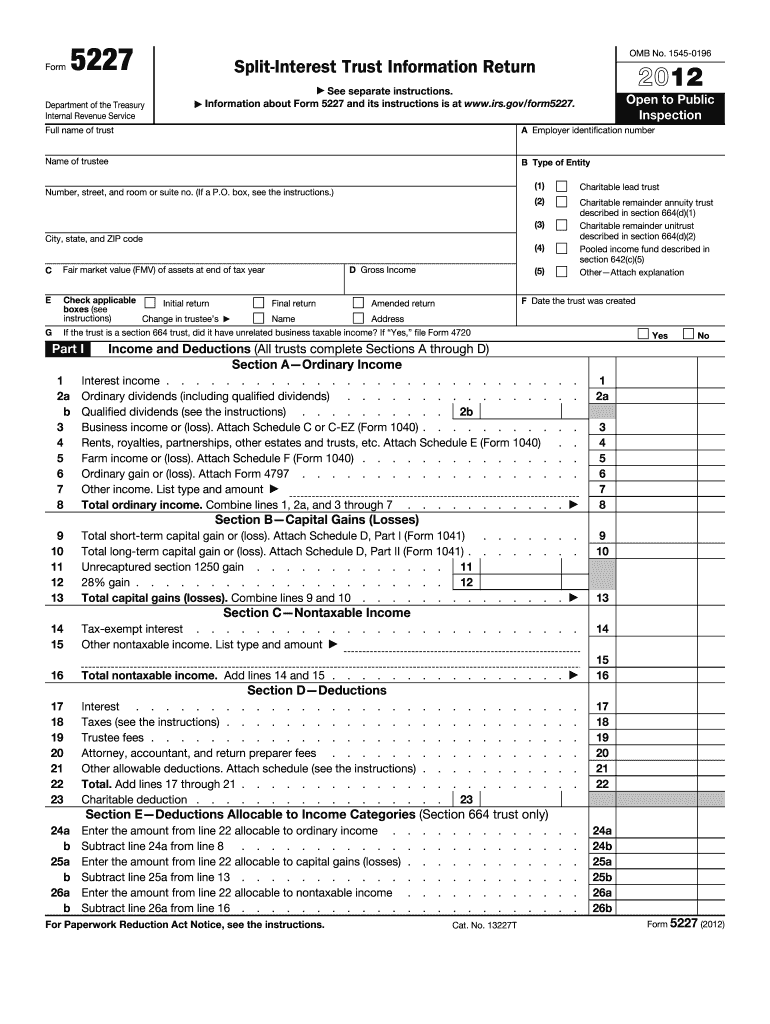

The 5227 form, officially known as the "Split-Interest Trust Information Return," is a tax document used in the United States. It is primarily utilized by split-interest trusts to report their financial activities to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations and provides detailed information about the trust's income, deductions, and distributions. Understanding the purpose of the 5227 form is crucial for trustees and beneficiaries to maintain transparency and adhere to tax obligations.

How to use the 5227 Form

Using the 5227 form involves several steps that ensure accurate reporting of the trust's financial activities. First, trustees must gather all relevant financial information, including income generated by the trust, expenses incurred, and distributions made to beneficiaries. Next, the form must be filled out completely, providing detailed information in the required sections. It is important to follow IRS guidelines closely to avoid errors. Once completed, the form should be submitted to the IRS by the designated deadline, ensuring compliance with tax regulations.

Steps to complete the 5227 Form

Completing the 5227 form requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial documents, including income statements and expense records.

- Begin filling out the form by entering the trust's identifying information, such as name and tax identification number.

- Report all income generated by the trust in the appropriate sections.

- List any deductions that are applicable to the trust's operations.

- Detail distributions made to beneficiaries, ensuring accurate reporting of amounts and dates.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS by the specified deadline.

Legal use of the 5227 Form

The legal use of the 5227 form is governed by IRS regulations, which stipulate that split-interest trusts must report their financial activities annually. This form serves as a crucial tool for maintaining compliance with tax laws. Failure to file the 5227 form or providing inaccurate information can result in penalties and legal consequences. Therefore, it is essential for trustees to understand their responsibilities and ensure that the form is completed and submitted correctly.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the 5227 form. These guidelines outline the necessary information required, the format in which it should be presented, and the deadlines for submission. It is important to consult the latest IRS instructions for the 5227 form to ensure compliance. Adhering to these guidelines helps prevent errors and potential audits, ensuring that the trust remains in good standing with tax authorities.

Penalties for Non-Compliance

Non-compliance with the requirements for the 5227 form can lead to significant penalties. The IRS may impose fines for late submissions or for failing to file the form altogether. Additionally, inaccuracies in reporting can trigger audits, resulting in further complications and potential financial liabilities. Therefore, it is crucial for trustees to prioritize the timely and accurate completion of the 5227 form to avoid these consequences.

Quick guide on how to complete 5227 form

Effortlessly manage 5227 Form on any device

Digital document management has become increasingly favored by enterprises and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to quickly create, edit, and eSign your documents without delays. Manage 5227 Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign 5227 Form effortlessly

- Find 5227 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify all details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign 5227 Form and guarantee excellent communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 5227 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 5227?

Form 5227 is a financial document used to report details related to certain tax and legal obligations. Understanding how to accurately complete form 5227 is crucial for compliance. Using airSlate SignNow, you can easily fill out and eSign form 5227, streamlining the process.

-

How can airSlate SignNow help with form 5227?

airSlate SignNow provides an intuitive platform for completing and eSigning form 5227 quickly and securely. With its user-friendly interface, you can ensure that all necessary fields are filled accurately. The platform also supports document storage and retrieval, making it easier for users to manage their forms.

-

Is there a cost for using airSlate SignNow for form 5227?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of all sizes. While the costs may vary depending on selected features, using airSlate SignNow for form 5227 can be a cost-effective solution compared to traditional paper methods. You can also take advantage of a free trial to explore its features.

-

What features does airSlate SignNow provide for form 5227?

airSlate SignNow includes features like eSignature, document templates, and mobile access tailored for form 5227. These features enhance the accuracy and efficiency of filling out the form. Additionally, real-time notifications and status tracking ensure you stay updated on the document’s progress.

-

Can I save my progress on form 5227 in airSlate SignNow?

Yes, airSlate SignNow allows you to save your progress on form 5227 so you can continue later. This flexibility ensures that you can review your entries and make any necessary changes. It also helps prevent errors and omissions, which is crucial for compliance.

-

Does airSlate SignNow integrate with other applications for form 5227?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your workflow for form 5227. Whether using CRM systems, cloud storage, or productivity tools, these integrations help streamline the document management process.

-

Is airSlate SignNow secure for handling form 5227?

Yes, airSlate SignNow prioritizes security by utilizing advanced encryption and compliance measures to protect your data when handling form 5227. The platform is designed to ensure that your sensitive information remains confidential and secure. You can confidently eSign and share your forms knowing they are protected.

Get more for 5227 Form

Find out other 5227 Form

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy