Pt1 Form Malta

What is the Pt1 Form Malta

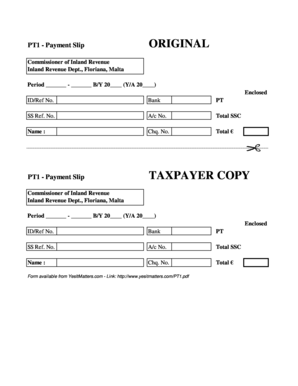

The Pt1 form is a specific document used in Malta, primarily for tax purposes. It is essential for individuals and businesses who need to report their income, deductions, and other relevant financial information to the tax authorities. This form plays a crucial role in ensuring compliance with Maltese tax laws and regulations. Understanding its purpose and requirements is vital for anyone navigating the tax landscape in Malta.

How to use the Pt1 Form Malta

Using the Pt1 form involves several key steps to ensure accurate reporting of financial information. First, gather all necessary financial documents, such as income statements and receipts for deductions. Next, fill out the form with the required details, ensuring that all information is accurate and complete. Finally, submit the form to the appropriate tax authority, either online or via mail, depending on your preference and the guidelines provided by the Maltese tax office.

Steps to complete the Pt1 Form Malta

Completing the Pt1 form requires careful attention to detail. Here are the steps to follow:

- Collect all relevant financial documents, including income statements and expense receipts.

- Access the Pt1 form, either in digital format or as a printed copy.

- Fill in personal information, such as your name, address, and tax identification number.

- Report your income accurately, including all sources of revenue.

- Detail any deductions you are eligible for, providing supporting documentation where necessary.

- Review the completed form for accuracy before submission.

- Submit the form according to the guidelines set by the tax authority.

Legal use of the Pt1 Form Malta

The legal use of the Pt1 form is governed by Maltese tax laws, which dictate how individuals and businesses must report their financial activities. To ensure compliance, it is essential to fill out the form accurately and submit it by the specified deadlines. Failure to do so may result in penalties or legal repercussions. Understanding these legal requirements helps individuals and businesses avoid complications with tax authorities.

Key elements of the Pt1 Form Malta

The Pt1 form includes several key elements that must be completed for it to be valid. These elements typically include:

- Personal identification information, such as name and address.

- Tax identification number.

- Details of income sources, including salaries, business income, and other earnings.

- Information on eligible deductions, such as business expenses and personal allowances.

- Signature and date to confirm the accuracy of the information provided.

Who Issues the Form

The Pt1 form is issued by the Maltese tax authorities, specifically the Inland Revenue Department. This government body is responsible for administering tax laws and ensuring compliance among taxpayers. It provides the necessary forms and guidance for individuals and businesses to fulfill their tax obligations accurately and on time.

Quick guide on how to complete pt1 form malta

Effortlessly prepare Pt1 Form Malta on any device

Managing documents online has gained traction among businesses and individuals alike. It offers a fantastic environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Pt1 Form Malta on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to edit and eSign Pt1 Form Malta with ease

- Find Pt1 Form Malta and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your desktop.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Pt1 Form Malta and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pt1 form malta

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a pt1 form and how is it used in airSlate SignNow?

The pt1 form is a digital document template that allows users to collect information seamlessly. In airSlate SignNow, it can be customized for various purposes such as contracts, agreements, or consent forms. This functionality streamlines the signing process while ensuring compliance and security.

-

How can I create a pt1 form using airSlate SignNow?

Creating a pt1 form in airSlate SignNow is straightforward. Users can start by selecting a template or creating a new document from scratch, then adding fields for signatures, texts, and checkboxes. This flexibility makes it easy to tailor the pt1 form to meet specific organizational needs.

-

What are the pricing options for airSlate SignNow when using pt1 forms?

airSlate SignNow offers several pricing tiers to accommodate different business sizes and needs. Each plan allows users to create and manage pt1 forms along with other e-signing features. Additionally, users can explore a free trial to test the functionality before committing to a subscription.

-

Can I integrate pt1 forms with other applications?

Yes, airSlate SignNow provides robust integration capabilities with various third-party applications. You can easily connect pt1 forms with CRM systems, cloud storage services, and other business tools to enhance productivity and streamline workflows. This integration helps ensure that information flows seamlessly across your organization.

-

What security measures does airSlate SignNow have for pt1 forms?

Security is a top priority for airSlate SignNow, especially when it comes to sensitive documents like pt1 forms. The platform implements advanced encryption protocols and secure data storage to protect your information. Users also benefit from features like two-factor authentication and audit trails for increased reliability.

-

How do I share a pt1 form with clients or team members?

Sharing a pt1 form in airSlate SignNow is quick and efficient. You can send the document directly via email or generate a shareable link that can be sent through various communication channels. This ease of sharing facilitates collaboration and expedites the signing process.

-

What are the benefits of using a pt1 form over traditional paper forms?

Using a pt1 form in airSlate SignNow offers numerous advantages over traditional paper forms. Digital forms save time, reduce costs related to printing and postage, and minimize human errors. Furthermore, they enhance accessibility, allowing users to sign documents from anywhere, at any time.

Get more for Pt1 Form Malta

Find out other Pt1 Form Malta

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now