Home Loan Toolkit Acknowledgement Form

What is the Home Loan Toolkit Acknowledgement

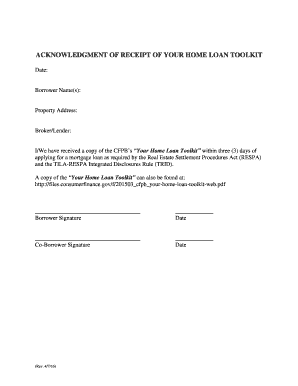

The Home Loan Toolkit Acknowledgement is a crucial document designed to inform borrowers about the home loan process. It serves as a formal acknowledgment that the borrower has received the Home Loan Toolkit, which contains essential information regarding their rights and responsibilities when obtaining a mortgage. This toolkit is provided by lenders to ensure that borrowers understand the terms of their loan, the costs involved, and the potential risks associated with homeownership.

How to use the Home Loan Toolkit Acknowledgement

Using the Home Loan Toolkit Acknowledgement involves several steps to ensure that the document is filled out correctly and submitted in a timely manner. First, borrowers should carefully read the Home Loan Toolkit provided by their lender. After reviewing the information, they should complete the acknowledgment form, confirming their receipt of the toolkit. This form can typically be submitted electronically or in paper form, depending on the lender's requirements.

Steps to complete the Home Loan Toolkit Acknowledgement

Completing the Home Loan Toolkit Acknowledgement involves a straightforward process:

- Read the Home Loan Toolkit thoroughly to understand your rights and responsibilities.

- Fill out the Home Loan Toolkit Acknowledgement form with accurate personal information.

- Sign and date the form to validate your acknowledgment.

- Submit the completed form to your lender as instructed, either online or via mail.

Key elements of the Home Loan Toolkit Acknowledgement

The Home Loan Toolkit Acknowledgement includes several key elements that are vital for both the borrower and lender. These elements typically consist of:

- Borrower's name and contact information.

- Date of receipt of the Home Loan Toolkit.

- Signature of the borrower, indicating acknowledgment.

- Information about the lender and the loan being applied for.

Legal use of the Home Loan Toolkit Acknowledgement

The Home Loan Toolkit Acknowledgement is legally binding once signed by the borrower. It confirms that the borrower has received the necessary information to make informed decisions about their mortgage. Compliance with federal and state regulations is essential, as it protects both the borrower and the lender. The acknowledgment helps ensure that the borrower is aware of their rights, including the right to receive clear and accurate information regarding their loan terms.

How to obtain the Home Loan Toolkit Acknowledgement

Obtaining the Home Loan Toolkit Acknowledgement is a straightforward process. Borrowers typically receive this acknowledgment form from their lender as part of the loan application process. If it is not provided, borrowers can request it directly from their lender. Additionally, some lenders may offer the form through their online portals, allowing for easy access and submission.

Quick guide on how to complete home loan toolkit acknowledgement

Effortlessly Prepare Home Loan Toolkit Acknowledgement on Any Device

Digital document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitute to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Home Loan Toolkit Acknowledgement across any platform using airSlate SignNow's Android or iOS applications and streamline any document-based procedure today.

How to Modify and Electronically Sign Home Loan Toolkit Acknowledgement with Ease

- Obtain Home Loan Toolkit Acknowledgement and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of the documents or mask sensitive information with tools specifically supplied by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Modify and electronically sign Home Loan Toolkit Acknowledgement and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the home loan toolkit acknowledgement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the home loan toolkit acknowledgement?

The home loan toolkit acknowledgement is an essential document that ensures borrowers understand the mortgage process, including their rights and responsibilities. By providing a clear outline of the steps involved in obtaining a home loan, the toolkit acknowledgment serves to educate borrowers and facilitate informed decisions.

-

How does airSlate SignNow help with the home loan toolkit acknowledgement?

airSlate SignNow streamlines the process of sending and eSigning the home loan toolkit acknowledgement. Our user-friendly platform allows lenders to easily distribute the toolkit documentation to clients and securely collect their signatures, making compliance simple and efficient.

-

What are the benefits of using airSlate SignNow for my home loan toolkit acknowledgement?

Using airSlate SignNow for your home loan toolkit acknowledgement offers several advantages, such as saving time, reducing paperwork, and ensuring secure document handling. Our platform's automation features enhance the customer experience, helping you close loans faster while maintaining compliance.

-

Is there a cost associated with airSlate SignNow for managing home loan toolkit acknowledgements?

Yes, airSlate SignNow offers various pricing plans that are designed to meet the needs of businesses of all sizes. Our pricing structure is cost-effective, allowing you to effectively manage home loan toolkit acknowledgements without breaking the bank.

-

Can I integrate airSlate SignNow with my existing systems for home loan toolkit acknowledgements?

Absolutely! airSlate SignNow provides seamless integrations with popular CRM systems and document management software, allowing you to incorporate the home loan toolkit acknowledgement into your existing workflow. This ensures a smooth transition and boosts overall productivity.

-

How secure is the eSigning process for the home loan toolkit acknowledgement?

Security is our top priority at airSlate SignNow. The eSigning process for the home loan toolkit acknowledgement employs advanced encryption and authentication measures, ensuring that your documents are protected and compliant with industry regulations.

-

What features does airSlate SignNow offer for managing home loan toolkit acknowledgements?

airSlate SignNow includes a variety of features tailored for managing home loan toolkit acknowledgements, such as customizable templates, automated reminders, and real-time tracking. These tools enhance efficiency and improve the overall client experience throughout the home loan process.

Get more for Home Loan Toolkit Acknowledgement

Find out other Home Loan Toolkit Acknowledgement

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document