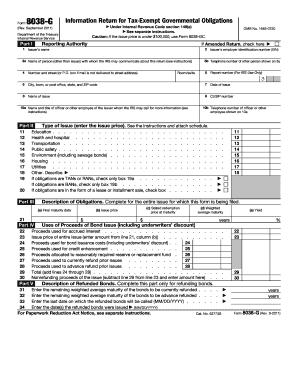

Irs Form 8038 G

What is the IRS Form 8038-G?

The IRS Form 8038-G is a tax form used by governmental entities to report information related to tax-exempt bonds. This form is essential for issuers of tax-exempt bonds to comply with federal tax regulations. It provides the IRS with key details about the bonds issued, including the amount, purpose, and the specific terms of the bond issuance. Understanding this form is crucial for ensuring that the tax-exempt status of the bonds is maintained and that the issuer complies with all reporting requirements.

How to Use the IRS Form 8038-G

Using the IRS Form 8038-G involves several steps to ensure accurate reporting. First, gather all necessary information related to the bond issuance, including the date of issuance, the bond amount, and the purpose of the bonds. Next, complete the form by filling in the required fields accurately. It is important to review the form for any errors before submission. Finally, submit the completed form to the IRS by the required deadline to avoid penalties and ensure compliance with tax regulations.

Steps to Complete the IRS Form 8038-G

Completing the IRS Form 8038-G requires careful attention to detail. Follow these steps:

- Gather necessary documentation, including the bond resolution and any related financial statements.

- Fill out the form, ensuring all fields are completed accurately, including issuer information and bond details.

- Double-check the form for accuracy, ensuring that all calculations are correct.

- Sign and date the form where required.

- Submit the form to the IRS by the specified deadline, either electronically or by mail.

Legal Use of the IRS Form 8038-G

The legal use of the IRS Form 8038-G is governed by federal tax laws. This form must be filed to maintain the tax-exempt status of the bonds issued. Failure to file or inaccuracies in the form can result in penalties, including the loss of tax-exempt status. It is essential for issuers to understand the legal implications of this form and ensure compliance with all related regulations.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8038-G are critical for compliance. Generally, the form must be filed within 90 days after the bond issuance date. However, specific deadlines may vary based on the type of bonds issued and other factors. It is important to stay informed about these deadlines to avoid any penalties associated with late filing.

Required Documents

To complete the IRS Form 8038-G, certain documents are required. These typically include:

- Bond resolution or ordinance that authorizes the bond issuance.

- Financial statements related to the bond issuance.

- Any other supporting documentation that provides context for the bond terms and purpose.

Penalties for Non-Compliance

Non-compliance with the filing requirements of the IRS Form 8038-G can lead to significant penalties. These may include fines and the potential loss of tax-exempt status for the bonds issued. It is crucial for issuers to understand these risks and ensure that the form is filed accurately and on time to avoid any adverse consequences.

Quick guide on how to complete irs form 8038 g

Complete Irs Form 8038 G effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers a sustainable alternative to conventional printed and signed documentation, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Irs Form 8038 G on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign Irs Form 8038 G with ease

- Find Irs Form 8038 G and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Edit and eSign Irs Form 8038 G to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 8038 g

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8083 and why do I need it?

Form 8083 is a document used to report the sale or exchange of certain forms of property. Businesses may need it to comply with IRS regulations. Using airSlate SignNow to eSign Form 8083 ensures a streamlined, efficient process, making your documentation needs simpler.

-

How can airSlate SignNow help me with Form 8083?

airSlate SignNow allows users to easily prepare, send, and eSign Form 8083 securely. Our platform offers templates and user-friendly tools to help you manage your documents efficiently. Additionally, you can track the status of your form in real-time.

-

Is there a cost associated with using airSlate SignNow for Form 8083?

airSlate SignNow offers a variety of pricing plans that cater to different business needs, including features optimized for managing Form 8083. We provide a cost-effective solution that ensures compliance and efficiency, allowing you to choose the plan that best fits your budget.

-

Can I customize Form 8083 within airSlate SignNow?

Yes, airSlate SignNow allows you to customize Form 8083 according to your specific business needs. You can add logos, fields, and additional text to tailor the form's appearance and functionality. This flexibility helps ensure that your documents meet your business branding.

-

What integrations does airSlate SignNow offer for Form 8083?

airSlate SignNow integrates seamlessly with various applications and workflows, facilitating easy processing of Form 8083. You can connect it with CRM systems, cloud storage, and productivity tools to streamline your document management process. These integrations enhance collaboration and efficiency.

-

How secure is my Form 8083 when using airSlate SignNow?

Security is a top priority at airSlate SignNow, especially when dealing with important documents like Form 8083. Our platform uses advanced encryption and secure cloud storage to protect your information. You can rest assured that your documents are safe and confidential.

-

Can I access Form 8083 from my mobile device?

Absolutely! With airSlate SignNow, you can access, fill out, and eSign Form 8083 from any mobile device. Our mobile-friendly platform allows you to manage your documents on the go, making it convenient for busy professionals.

Get more for Irs Form 8038 G

- Indiana cash farm lease form

- F212 055 000 form

- Request for hearing miami dade county 2011 form

- Pdffiller insurance card form

- Texas residential lease agreement dwellbestcom form

- State farm business plan template form

- Cw8a statement of facts 2013 form

- Me puede ayudar una orden de restriccin pordv500in form

Find out other Irs Form 8038 G

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors