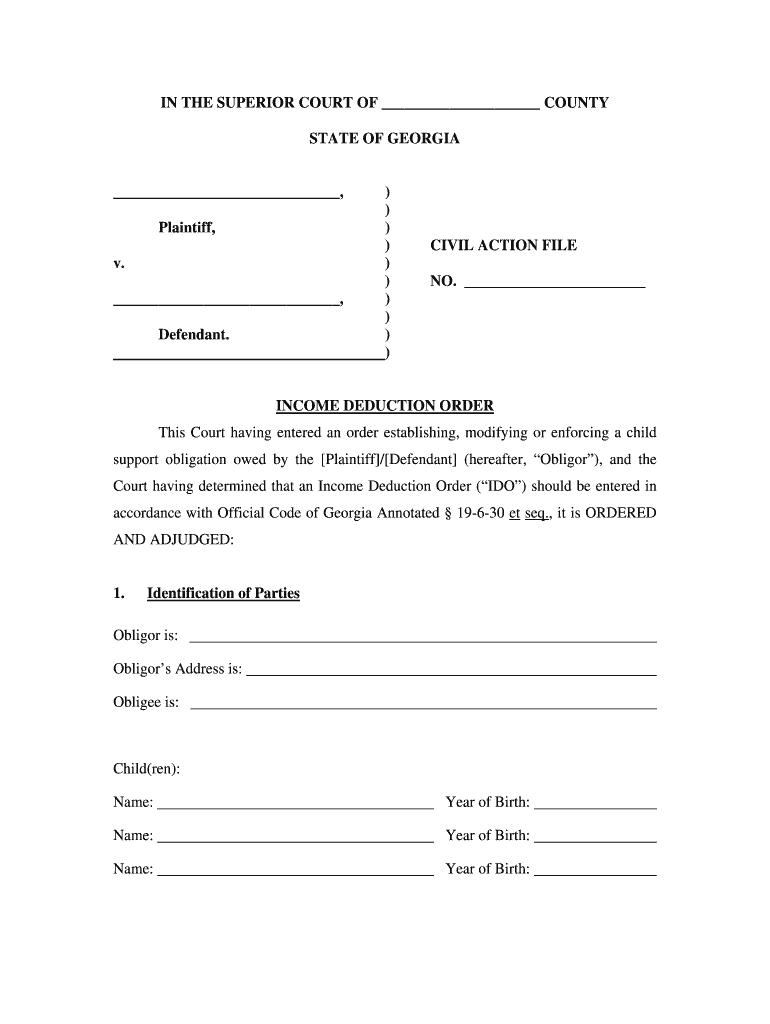

Income Deduction Order Georgiacourts Form

What is the income deduction order in Georgia?

The income deduction order in Georgia is a legal document that allows a court to direct an employer to withhold a portion of an employee's wages for the purpose of satisfying a debt, such as child support or alimony. This order is typically issued in family law cases and helps ensure that payments are made consistently and on time. The income deduction order is a vital tool for enforcing financial obligations and protecting the rights of dependents.

Steps to complete the income deduction order in Georgia

Completing the income deduction order in Georgia involves several key steps:

- Obtain the Georgia income deduction order form from the appropriate court or online resources.

- Fill out the form with accurate information, including the names of the parties involved, the amount to be deducted, and the frequency of payments.

- Sign the form in the presence of a notary public or as required by the court.

- File the completed form with the court that issued the original support order.

- Serve a copy of the income deduction order to the employer of the individual whose wages are to be withheld.

Key elements of the income deduction order in Georgia

Understanding the key elements of the income deduction order is essential for proper completion and compliance. The primary components include:

- Parties involved: Names and addresses of the creditor and debtor.

- Amount to be deducted: Specify the exact dollar amount or percentage of wages to be withheld.

- Payment frequency: Indicate how often the deductions should occur, such as weekly or biweekly.

- Employer information: Include the employer's name and address to ensure proper service of the order.

Legal use of the income deduction order in Georgia

The legal use of the income deduction order is governed by state laws and regulations. It is crucial that the order complies with the Georgia Child Support Guidelines and any other relevant statutes. The order must be properly served to the employer, and the employer is legally obligated to comply with the order once received. Failure to do so may result in penalties for the employer, while the creditor may seek further legal remedies to enforce the order.

Filing deadlines and important dates

When dealing with the income deduction order in Georgia, it is important to be aware of filing deadlines and important dates. Typically, the order should be filed promptly after it is completed to avoid delays in wage deductions. Additionally, parties involved should keep track of any court dates related to the enforcement of the order, as these can affect the timing of payments and compliance.

Required documents for the income deduction order

To successfully file an income deduction order in Georgia, certain documents are required. These typically include:

- The completed income deduction order form.

- A copy of the original support order or judgment.

- Any additional documentation that may be required by the court, such as proof of income or employment verification.

Quick guide on how to complete income deduction order georgiacourts

Effortlessly Prepare Income Deduction Order Georgiacourts on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal sustainable alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly and without complications. Manage Income Deduction Order Georgiacourts on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related processes today.

The Easiest Way to Alter and Electronically Sign Income Deduction Order Georgiacourts Effortlessly

- Obtain Income Deduction Order Georgiacourts and then click Get Form to initiate the process.

- Utilize the features we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced files, tedious form searches, or mistakes requiring new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adapt and electronically sign Income Deduction Order Georgiacourts to ensure excellent communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

Create this form in 5 minutes!

How to create an eSignature for the income deduction order georgiacourts

How to generate an eSignature for your Income Deduction Order Georgiacourts online

How to create an eSignature for your Income Deduction Order Georgiacourts in Google Chrome

How to generate an electronic signature for putting it on the Income Deduction Order Georgiacourts in Gmail

How to make an electronic signature for the Income Deduction Order Georgiacourts straight from your smartphone

How to generate an eSignature for the Income Deduction Order Georgiacourts on iOS devices

How to make an eSignature for the Income Deduction Order Georgiacourts on Android OS

People also ask

-

What is a Georgia income deduction order?

A Georgia income deduction order is a legal document that instructs an employer to withhold a portion of an employee's wages for the payment of child support or other debts. This order is issued by the court and must be adhered to by the employer. Understanding how a Georgia income deduction order works is crucial for both employees and employers involved in such arrangements.

-

How does airSlate SignNow assist with Georgia income deduction orders?

AirSlate SignNow provides a streamlined solution to create, send, and eSign Georgia income deduction orders electronically. This simplifies the process, ensuring all necessary parties can easily access and approve these legal documents. With airSlate SignNow, you can ensure compliance and efficient handling of income deduction orders.

-

What are the benefits of using airSlate SignNow for Georgia income deduction orders?

Utilizing airSlate SignNow for Georgia income deduction orders brings numerous benefits, including time savings and improved accuracy. Our platform minimizes the risk of errors common in manual processes and allows for instant tracking of document statuses. Additionally, the ability to quickly eSign ensures that orders are processed without unnecessary delays.

-

Is airSlate SignNow compliant with Georgia income deduction order regulations?

Yes, airSlate SignNow is designed to comply with all relevant regulations surrounding Georgia income deduction orders. Our platform adheres to legal standards, ensuring that all documents processed meet state requirements. This gives users the confidence that their eSigned documents are legally binding and compliant.

-

What features does airSlate SignNow offer for managing income deduction orders?

AirSlate SignNow offers a suite of features for managing Georgia income deduction orders, including customizable templates, secure e-signature options, and automated workflows. This allows users to easily generate orders and ensure they are sent to the right parties. Furthermore, integration with other tools enhances usability and document management.

-

How much does it cost to use airSlate SignNow for Georgia income deduction orders?

The pricing for airSlate SignNow varies based on the plan selected, with options that cater to different business sizes and needs. Many businesses find our solutions to be cost-effective, especially when considering the potential savings in time and administrative costs associated with managing Georgia income deduction orders. For detailed pricing, visit our website or contact our sales team.

-

Can airSlate SignNow integrate with other software for handling Georgia income deduction orders?

Absolutely! airSlate SignNow offers integration with various software platforms, making it easy to incorporate into your existing workflow. This flexibility allows businesses to seamlessly manage Georgia income deduction orders alongside other financial or HR applications. Integrations enhance efficiency and streamline document handling across multiple systems.

Get more for Income Deduction Order Georgiacourts

- Resolucao cnj n 131 de 26052011 publicada em 1062011 ingles form

- Traumatic antecedents questionnaire form

- Haledon borough nj opra request form

- Form 884 pdf

- Outbreak movie worksheet form

- Eviews 11 serial number form

- Aig change of agent form

- Instutition funded special bursary application revised27072015 docx form

Find out other Income Deduction Order Georgiacourts

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document