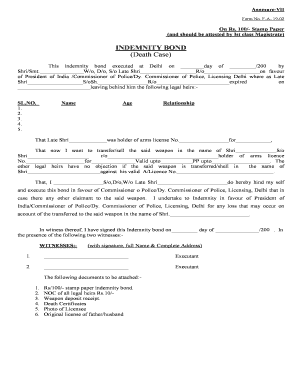

Indemnity Bond Form

What is the indemnity bond?

An indemnity bond is a legally binding document that provides a guarantee from one party to another, ensuring compensation for any potential losses or damages that may occur under specified conditions. This bond is often used in situations involving financial transactions, property transfers, or legal claims. The purpose of the indemnity bond is to protect the party receiving the bond from any financial harm that may arise due to the actions or inactions of the party providing the bond. In the context of lost instruments, the indemnity bond serves to reassure the issuer that they will not incur losses if the original instrument is presented after the bond has been executed.

How to use the indemnity bond

Using an indemnity bond involves several steps to ensure its validity and effectiveness. First, identify the specific purpose of the bond, such as protecting against losses from lost instruments or ensuring compliance with contractual obligations. Next, gather the necessary information, including the parties involved, the amount of the bond, and the conditions under which it will be enforced. Once the details are established, the bond should be drafted, ensuring it includes all required elements such as signatures, dates, and any applicable legal language. After execution, the bond should be stored securely and shared with relevant parties as needed.

Steps to complete the indemnity bond

Completing an indemnity bond involves a series of clear steps:

- Gather information: Collect details about the parties involved, the purpose of the bond, and any specific conditions that must be met.

- Draft the document: Create the indemnity bond using a reliable template, ensuring it includes all necessary legal language and clauses.

- Review: Carefully review the bond for accuracy and completeness, confirming that all parties understand their obligations.

- Sign the bond: Ensure that all parties sign the document, which may require notarization depending on state laws.

- Store securely: Keep the executed bond in a safe place and provide copies to relevant parties.

Key elements of the indemnity bond

Several key elements must be included in an indemnity bond to ensure its effectiveness and legal standing. These elements include:

- Parties involved: Clearly identify the indemnitor (the party providing the bond) and the indemnitee (the party protected by the bond).

- Bond amount: Specify the financial limit of the bond, which defines the maximum liability of the indemnitor.

- Conditions: Outline the specific circumstances under which the bond will be enforced, including any obligations the indemnitor must fulfill.

- Signatures: Ensure that all parties sign the document, which may also require notarization to enhance its legal validity.

Legal use of the indemnity bond

The legal use of an indemnity bond is governed by state laws and regulations, which can vary significantly. In general, indemnity bonds are enforceable as long as they meet certain legal criteria, such as being executed voluntarily by all parties and containing clear terms. It is important to ensure that the bond complies with any specific legal requirements relevant to its purpose, such as those applicable to lost instruments or property transactions. Consulting with a legal professional can provide guidance on the appropriate use of an indemnity bond in various contexts.

Examples of using the indemnity bond

Indemnity bonds are utilized in various scenarios, including:

- Lost instruments: When a financial instrument, such as a check or promissory note, is lost, an indemnity bond can protect the issuer from claims if the instrument is later presented.

- Property transactions: In real estate, indemnity bonds may be used to ensure that a buyer is protected against any claims that may arise from previous ownership.

- Legal claims: Businesses may use indemnity bonds to safeguard against potential legal claims arising from their operations or contractual obligations.

Quick guide on how to complete indemnity bond 48701571

Prepare Indemnity Bond effortlessly on any device

Online document administration has become popular among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents quickly without delays. Manage Indemnity Bond on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to alter and eSign Indemnity Bond without breaking a sweat

- Acquire Indemnity Bond and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature with the Sign tool, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Recheck the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new copies of documents. airSlate SignNow addresses your needs in document management in just a few clicks from any device of your choice. Modify and eSign Indemnity Bond and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indemnity bond 48701571

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an indemnity bond and how does it work?

An indemnity bond is a legally binding agreement that protects one party from losses incurred by another party's actions. It ensures that if one party fails to fulfill their obligations, the other party is compensated for any resulting losses. This bond is often used in various business transactions to provide an additional layer of security.

-

How can airSlate SignNow help with managing indemnity bonds?

airSlate SignNow simplifies the process of managing indemnity bonds by providing an intuitive platform for eSigning and sending documents securely. With features such as templates and automated workflows, businesses can easily create and manage indemnity bonds, ensuring compliance and efficient documentation handling. This solution streamlines the process, making it more cost-effective.

-

What are the benefits of using an indemnity bond?

The benefits of using an indemnity bond include protection against financial loss and risk mitigation for parties involved in a contract. It assures that obligations will be met, enhancing trust and reliability in business transactions. Using an indemnity bond reinforces a business's commitment to accountability and professionalism.

-

Is there a cost associated with obtaining an indemnity bond through airSlate SignNow?

Yes, there may be costs associated with obtaining an indemnity bond through airSlate SignNow, generally depending on various factors like the bond amount and duration. However, airSlate SignNow offers a cost-effective solution for document management and eSigning, which potentially reduces overall costs. Contact our support team for a detailed quote and pricing options.

-

Can indemnity bonds be customized in airSlate SignNow?

Absolutely! airSlate SignNow provides customizable templates for indemnity bonds, allowing businesses to tailor the bonds to specific needs and requirements. Users can modify the content, add specific terms, and include necessary details to ensure that the indemnity bond aligns perfectly with their legal and business necessities.

-

What industries commonly use indemnity bonds?

Indemnity bonds are commonly used in various industries such as construction, real estate, and finance. They are essential for contractors, subcontractors, and service providers who want to protect themselves from potential losses. By ensuring the availability of indemnity bonds, businesses in these industries can operate with reduced financial risk.

-

What integrations does airSlate SignNow offer for managing indemnity bonds?

airSlate SignNow offers integrations with a variety of popular business applications, enhancing the management of indemnity bonds. Integrations with platforms like Google Drive, Dropbox, and CRM systems streamline document storage and retrieval. This ensures that all relevant documents, including indemnity bonds, are easily accessible and organized.

Get more for Indemnity Bond

- Painting contractor package mississippi form

- Framing contractor package mississippi form

- Foundation contractor package mississippi form

- Plumbing contractor package mississippi form

- Brick mason contractor package mississippi form

- Roofing contractor package mississippi form

- Electrical contractor package mississippi form

- Sheetrock drywall contractor package mississippi form

Find out other Indemnity Bond

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF