Hpml Form

What is the Hpml

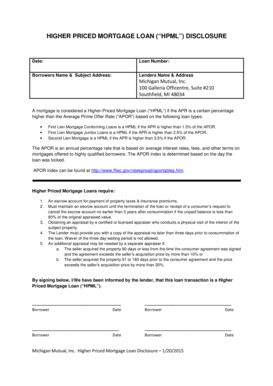

The Hpml, or High-Priced Mortgage Loan form, is a critical document used in the mortgage industry to disclose specific information regarding loans that exceed certain thresholds set by federal regulations. This form ensures that borrowers are aware of the terms and conditions associated with high-priced loans, including interest rates, fees, and potential risks. By providing clear and comprehensive information, the Hpml aims to protect consumers and promote transparency in the lending process.

How to use the Hpml

Using the Hpml form involves several key steps that ensure compliance with legal requirements. First, lenders must determine whether a loan qualifies as a high-priced mortgage based on the annual percentage rate (APR) and other associated costs. If the loan meets the criteria, the lender must complete the Hpml form accurately, detailing all relevant information. This form must then be provided to the borrower before the loan closing, allowing them to review the terms and make informed decisions.

Steps to complete the Hpml

Completing the Hpml form requires attention to detail and adherence to specific guidelines. Here are the essential steps:

- Identify if the loan qualifies as a high-priced mortgage based on APR and fees.

- Gather necessary information, including loan terms, interest rates, and any applicable fees.

- Fill out the Hpml form accurately, ensuring all required fields are completed.

- Review the form for accuracy and compliance with federal regulations.

- Provide the completed form to the borrower prior to loan closing.

Legal use of the Hpml

The legal use of the Hpml form is governed by various federal regulations, including the Truth in Lending Act (TILA). These laws mandate that lenders disclose specific information about high-priced loans to protect consumers from predatory lending practices. Compliance with these regulations is crucial, as failure to provide the Hpml form or inaccuracies within it can lead to legal repercussions for lenders. Ensuring that the form is completed correctly and provided in a timely manner is essential for maintaining legal compliance.

Key elements of the Hpml

The Hpml form includes several key elements that are vital for both lenders and borrowers. These elements typically encompass:

- Loan amount and terms

- Annual percentage rate (APR)

- Fees associated with the loan

- Disclosure of potential risks

- Borrower’s rights and responsibilities

Understanding these components helps borrowers make informed decisions regarding their mortgage options.

Disclosure Requirements

Disclosure requirements for the Hpml form are designed to ensure that borrowers receive all necessary information about high-priced loans. Lenders must disclose the APR, any points or fees charged, and the total cost of the loan over its term. Additionally, lenders must inform borrowers about their rights, including the right to cancel the loan within a specified period. These disclosures must be clear and comprehensible to facilitate informed decision-making.

Quick guide on how to complete hpml

Complete Hpml easily on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without hassles. Manage Hpml on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Hpml effortlessly

- Find Hpml and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Decide how you want to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Hpml and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hpml

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is hpml and how does it relate to airSlate SignNow?

HPML stands for High-Priced Mortgage Loan, which is a designation for loans that come with specific regulations. airSlate SignNow provides essential features for businesses managing HPML documents, ensuring compliance and ease of use. With our eSigning solution, you can streamline the document approval process while adhering to HPML regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business needs, providing the best value for managing HPML documents. Our plans include both monthly and annual options, enabling you to choose a budget that suits your organization. Each plan includes features specifically designed for efficient document signing and compliance with HPML requirements.

-

What features does airSlate SignNow offer for hpml documents?

airSlate SignNow includes robust features like secure eSigning, templates, and automated workflows specifically for handling HPML documents. Our platform ensures that your documents are signed quickly and securely, reducing time spent on manual processes. This not only enhances productivity but also ensures adherence to HPML guidelines.

-

How can airSlate SignNow help with compliance for hpml loans?

Compliance is critical when dealing with hpml loans, and airSlate SignNow is designed to help businesses maintain it effortlessly. Our platform allows for secure storage, audit trails, and customizable templates that align with HPML regulations. By using airSlate SignNow, you can ensure that your documents are compliant and ready when needed.

-

Can airSlate SignNow integrate with my existing software for hpml management?

Yes, airSlate SignNow offers seamless integrations with various software tools that can assist in managing HPML documentation. Whether you use CRM systems, document management solutions, or other applications, our platform can connect with these to streamline your workflow. This integration simplifies the management of HPML documents and enhances overall efficiency.

-

What are the benefits of using airSlate SignNow for hpml documentation?

Using airSlate SignNow for HPML documentation brings numerous benefits, including improved efficiency, compliance, and user experience. The platform's user-friendly interface and powerful features make it easy to send and sign HPML documents quickly. Our solution reduces paperwork and accelerates transactions, ultimately boosting your business operations.

-

Is airSlate SignNow secure for handling sensitive hpml information?

Absolutely, airSlate SignNow prioritizes security, especially when handling sensitive HPML information. Our platform uses advanced encryption and secure access protocols to protect your data. This commitment to security helps ensure that your HPML documents are safe from unauthorized access or bsignNowes.

Get more for Hpml

- Critical care skills checklist form

- X ray and imaging outpatient order form lake forest hospital lfh

- Adult medical history form rush copley medical center

- Chicago fire department ride along program form

- By laws of the medical staff new york presbyterian hospital form

- Rex assist form

- Methodist uniform orders

- Westerly hospital medical authorization form

Find out other Hpml

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast