Loan Repayment Form

What is the Loan Repayment Form

The loan repayment form is a legal document used to outline the terms and conditions of repaying a loan. This form typically includes essential details such as the loan amount, interest rate, payment schedule, and any penalties for late payments. It serves as a record of the borrower's commitment to repay the loan and is crucial for both lenders and borrowers to maintain clarity regarding repayment obligations.

How to use the Loan Repayment Form

Using the loan repayment form involves several key steps. First, gather all necessary information, including the loan details and personal identification. Next, fill out the form accurately, ensuring that all required fields are completed. After filling out the form, review it for any errors before signing it. Finally, submit the completed form to the lender as per their specified submission methods, which may include online, mail, or in-person delivery.

Steps to complete the Loan Repayment Form

Completing the loan repayment form can be straightforward if you follow these steps:

- Collect necessary information, including loan details and personal identification.

- Access the loan repayment form, either digitally or in print.

- Fill in the required fields, ensuring accuracy in all entries.

- Review the form for completeness and correctness.

- Sign the form to validate your commitment to the repayment terms.

- Submit the form to your lender using the preferred method.

Legal use of the Loan Repayment Form

The loan repayment form is legally binding when completed correctly and signed by both parties involved. To ensure its legal validity, the form must comply with specific regulations, including adherence to eSignature laws such as the ESIGN Act and UETA. This compliance helps protect the rights of both the borrower and the lender, making the document enforceable in a court of law if disputes arise.

Key elements of the Loan Repayment Form

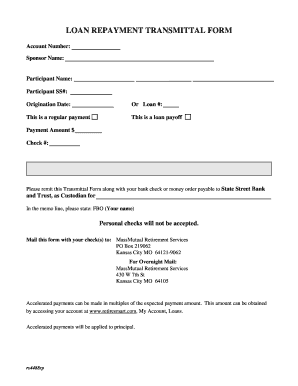

Several key elements are essential for the loan repayment form to be effective and legally binding. These include:

- Borrower's Information: Full name, address, and contact details.

- Lender's Information: Name and contact details of the lending institution.

- Loan Details: Amount borrowed, interest rate, and total repayment amount.

- Payment Schedule: Dates and amounts of scheduled payments.

- Signatures: Signatures of both borrower and lender to validate the agreement.

Form Submission Methods

Submitting the loan repayment form can be done through various methods, depending on the lender's preferences. Common submission methods include:

- Online Submission: Many lenders allow borrowers to submit forms electronically through secure portals.

- Mail: Completed forms can be sent via postal service to the lender's designated address.

- In-Person: Some borrowers may choose to deliver the form directly to a lender's branch for immediate processing.

Quick guide on how to complete loan repayment form

Prepare Loan Repayment Form with ease on any device

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely archive it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Loan Repayment Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Loan Repayment Form effortlessly

- Locate Loan Repayment Form and click on Get Form to begin.

- Use the tools available to complete your form.

- Emphasize relevant parts of the documents or conceal confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature utilizing the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Loan Repayment Form and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan repayment form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loan repayment form?

A loan repayment form is a legal document that outlines the terms under which a borrower agrees to repay their loan. This form typically includes payment amounts, due dates, and interest rates, helping both parties understand their responsibilities. Utilizing a loan repayment form can streamline the repayment process and ensure clarity.

-

How can airSlate SignNow enhance my loan repayment form process?

AirSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning your loan repayment form. By integrating our solution, you can automate the document flow, reducing manual errors and speeding up the execution process. This results in a more efficient and organized approach to managing loan agreements.

-

Is airSlate SignNow cost-effective for managing loan repayment forms?

Yes, airSlate SignNow offers competitive pricing plans suited for businesses of all sizes, making it a cost-effective solution for managing loan repayment forms. With various features available at a reasonable price, you can digitize your processes without breaking the bank. This ensures you have the tools necessary for effective document management.

-

Can I customize my loan repayment form using airSlate SignNow?

Absolutely! AirSlate SignNow allows you to customize your loan repayment form to fit your specific needs. You can add fields, incorporate branding, and adjust layouts, ensuring the document reflects your organization’s identity. Customization enhances the user experience and improves the professionalism of your documents.

-

What features does airSlate SignNow offer for creating a loan repayment form?

AirSlate SignNow provides features like drag-and-drop document creation, real-time collaboration, and eSigning for your loan repayment form. These tools make it easy to construct and modify documents quickly. Additionally, you can track document status and share files securely with relevant parties.

-

How does eSigning a loan repayment form work?

eSigning a loan repayment form with airSlate SignNow is simple and secure. After creating the form, you can invite signers to electronically sign it from any device, ensuring convenience and speed. Once signed, the document is automatically stored in your account, allowing for easy retrieval and tracking.

-

What are the benefits of using airSlate SignNow for loan repayment forms?

The benefits of using airSlate SignNow for loan repayment forms include enhanced efficiency, improved accuracy, and better organization. By digitizing your documents, you reduce the likelihood of errors and document loss. Moreover, the user-friendly interface simplifies the process for both borrowers and lenders.

Get more for Loan Repayment Form

Find out other Loan Repayment Form

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document