Credit Facility Application Form Icici

Understanding the Credit Facility Application Form Icici

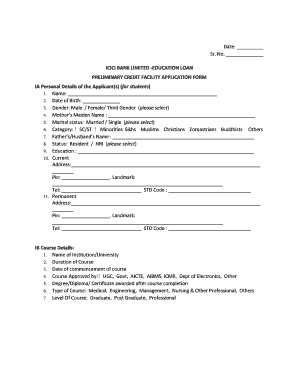

The Credit Facility Application Form Icici is a crucial document for individuals and businesses seeking financial assistance from Icici Bank. This form collects essential information about the applicant's financial status, business operations, and credit history. Properly filling out this form is vital, as it helps the bank assess the applicant's eligibility for a credit facility. The information provided will influence the bank's decision on whether to approve the application and the terms of the credit facility offered.

Steps to Complete the Credit Facility Application Form Icici

Completing the Credit Facility Application Form Icici involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, which may include financial statements, tax returns, and identification. Next, carefully fill out the form, ensuring that all sections are completed with accurate information. Pay special attention to the credit history section, as this will be scrutinized by the bank. Once the form is completed, review it for any errors or omissions before submitting it to Icici Bank.

Required Documents for the Credit Facility Application Form Icici

When applying for a credit facility using the Credit Facility Application Form Icici, certain documents are typically required. These may include:

- Proof of identity (e.g., driver's license, passport)

- Financial statements (e.g., balance sheets, income statements)

- Tax returns for the past two years

- Business registration documents (for business applicants)

- Credit history report

Providing complete and accurate documentation helps streamline the approval process and increases the chances of a successful application.

Legal Use of the Credit Facility Application Form Icici

The Credit Facility Application Form Icici is legally binding once submitted and signed. It is essential that applicants understand the legal implications of the information provided. Misrepresentation or failure to disclose relevant financial information can lead to denial of the application or legal consequences. The form must comply with applicable laws and regulations, including those governing consumer credit and financial disclosures.

Application Process & Approval Time for the Credit Facility Application Form Icici

The application process for the Credit Facility Application Form Icici typically involves several stages. After submission, the bank will review the application and the supporting documents. This review process can take anywhere from a few days to several weeks, depending on the complexity of the application and the bank's workload. Applicants may be contacted for additional information or clarification during this time. Once the review is complete, the bank will notify the applicant of its decision, including any terms and conditions associated with the credit facility.

Eligibility Criteria for the Credit Facility Application Form Icici

Eligibility for a credit facility through the Credit Facility Application Form Icici is determined by several factors. These may include:

- Credit score and credit history

- Income level and financial stability

- Business performance (for business applicants)

- Debt-to-income ratio

Understanding these criteria can help applicants prepare a stronger application and improve their chances of approval.

Quick guide on how to complete credit facility application form icici

Complete Credit Facility Application Form Icici effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents rapidly without delays. Manage Credit Facility Application Form Icici using airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to modify and eSign Credit Facility Application Form Icici with ease

- Find Credit Facility Application Form Icici and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you want to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or absent documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign Credit Facility Application Form Icici and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit facility application form icici

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a credit facility application in airSlate SignNow?

A credit facility application in airSlate SignNow allows businesses to efficiently manage the documentation required for securing credit. This feature streamlines the eSigning process, making it easier for stakeholders to review and approve applications. With airSlate SignNow, you can create, send, and get documents signed digitally, speeding up the approval process.

-

How much does the credit facility application feature cost?

The cost of using airSlate SignNow for your credit facility application will depend on the pricing plan you choose. We offer different tiers to accommodate various business sizes and needs. Each plan includes access to essential features, ensuring that you can efficiently handle your credit facility applications at a competitive price.

-

What are the key benefits of using airSlate SignNow for credit facility applications?

Using airSlate SignNow for credit facility applications provides numerous benefits, including enhanced efficiency and reduced processing times. The platform offers an intuitive interface that simplifies the eSigning process, improving overall user experience. Additionally, it helps maintain compliance and security during the document handling process.

-

Does airSlate SignNow integrate with other financial software for credit facility applications?

Yes, airSlate SignNow offers seamless integrations with various financial software to enhance your credit facility application process. You can easily connect it with popular tools like CRM systems and document management platforms. This integration ensures that your data flows smoothly between applications, facilitating better management of credit facility applications.

-

How secure is my information when using airSlate SignNow for credit facility applications?

Your information is highly secure when using airSlate SignNow for credit facility applications. We implement industry-standard encryption protocols to protect sensitive data during transmission and storage. Additionally, advanced authentication measures ensure that only authorized users can access and manage your documents.

-

Can I track the status of my credit facility applications in airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your credit facility applications in real-time. You'll receive notifications when documents are viewed, signed, or completed, helping you stay informed about the progress of your applications. This feature enhances communication and accountability between all parties involved.

-

Is training available for using airSlate SignNow for credit facility applications?

Yes, we provide comprehensive training resources for users to maximize the capabilities of airSlate SignNow when managing credit facility applications. These include user guides, video tutorials, and live support options. Our goal is to ensure that you can easily navigate the platform and make the most of its features.

Get more for Credit Facility Application Form Icici

- School of electrical electronic and information engineering ecce3 lsbu ac

- Lifetime membership fee refund form sigma phi epsilon fraternity sigep

- Summer term or winter term visiting student office of oes umd form

- Orange unified school district office of child welfare and orangeusd k12 ca form

- Incontrol purchase control implementation michigan credit mcul form

- Korean employee performance appraisal 8tharmy korea army

- Add a new party to an account personalnatwestcom form

- Custom orthotic rx form the langer biomechanics

Find out other Credit Facility Application Form Icici

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document