Annual Return Form Form VAT XV a Himachal Pradesh Forms Himachalforms Nic

What is the Annual Return Form Form VAT XV A Himachal Pradesh Forms Himachalforms Nic

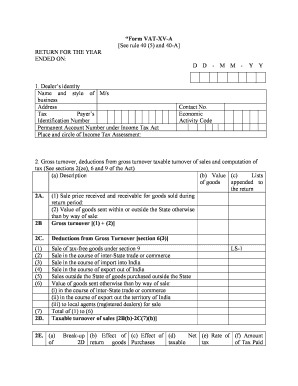

The Annual Return Form Form VAT XV A is a key document used in Himachal Pradesh for reporting value-added tax (VAT) obligations. This form is essential for businesses operating within the state, as it consolidates tax information for the fiscal year. It serves as a comprehensive summary of a business's sales, purchases, and tax collected, ensuring compliance with local tax regulations. Understanding this form is crucial for accurate reporting and maintaining good standing with tax authorities.

Steps to Complete the Annual Return Form Form VAT XV A Himachal Pradesh Forms Himachalforms Nic

Completing the Annual Return Form Form VAT XV A involves several important steps:

- Gather necessary financial documents, including sales and purchase records for the year.

- Calculate total sales and purchases, ensuring all transactions are accounted for.

- Determine the total VAT collected and paid during the reporting period.

- Fill out the form accurately, entering all required information in the designated fields.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically or via mail, adhering to the specified deadlines.

Legal Use of the Annual Return Form Form VAT XV A Himachal Pradesh Forms Himachalforms Nic

The Annual Return Form Form VAT XV A is legally binding when completed and submitted according to the regulations set forth by the Himachal Pradesh tax authorities. It is important to ensure that all information provided is accurate and truthful, as discrepancies can lead to penalties or legal issues. Utilizing electronic signatures through secure platforms can enhance the legal validity of the submission, ensuring compliance with electronic signature laws.

Filing Deadlines / Important Dates

Timely submission of the Annual Return Form Form VAT XV A is crucial to avoid penalties. The filing deadlines typically align with the end of the fiscal year, and it is advisable to check for any specific dates set by the Himachal Pradesh tax authorities. Missing these deadlines can result in fines and interest on unpaid taxes, making it essential for businesses to stay informed about their obligations.

Required Documents

To successfully complete the Annual Return Form Form VAT XV A, several documents are required:

- Sales invoices and purchase receipts for the reporting period.

- Records of VAT collected and paid.

- Bank statements reflecting relevant transactions.

- Any previous VAT returns filed during the year.

Who Issues the Form

The Annual Return Form Form VAT XV A is issued by the Himachal Pradesh tax authorities. This governmental body oversees tax compliance and ensures that businesses adhere to local VAT regulations. It is important for businesses to obtain the latest version of the form directly from official sources to ensure compliance with current requirements.

Quick guide on how to complete annual return form form vat xv a himachal pradesh forms himachalforms nic

Manage Annual Return Form Form VAT XV A Himachal Pradesh Forms Himachalforms Nic effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers an excellent eco-conscious alternative to conventional printed and signed paperwork, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without hold-ups. Manage Annual Return Form Form VAT XV A Himachal Pradesh Forms Himachalforms Nic on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and electronically sign Annual Return Form Form VAT XV A Himachal Pradesh Forms Himachalforms Nic without hassle

- Find Annual Return Form Form VAT XV A Himachal Pradesh Forms Himachalforms Nic and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Annual Return Form Form VAT XV A Himachal Pradesh Forms Himachalforms Nic to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the annual return form form vat xv a himachal pradesh forms himachalforms nic

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Annual Return Form Form VAT XV A for Himachal Pradesh?

The Annual Return Form Form VAT XV A is a mandatory document for businesses in Himachal Pradesh that provides detailed information on VAT transactions during the financial year. It is essential for compliance with state tax regulations. Utilizing airSlate SignNow simplifies the process of filling out and submitting this form, making it a preferred choice for businesses.

-

How does airSlate SignNow help with the Annual Return Form Form VAT XV A?

airSlate SignNow offers an intuitive platform for businesses to fill, eSign, and submit the Annual Return Form Form VAT XV A effortlessly. The solution reduces paperwork and enhances efficiency by allowing users to complete documents online. This streamlines the entire process, ensuring timely submissions and compliance.

-

Is there a cost associated with using airSlate SignNow for the Annual Return Form Form VAT XV A?

Yes, airSlate SignNow offers various pricing plans tailored to fit small to large businesses, providing great value for those needing to manage the Annual Return Form Form VAT XV A. The pricing is designed to be budget-friendly, especially considering the time and cost savings achieved through digital document management. Check our website for specific pricing details.

-

What features does airSlate SignNow provide for the Annual Return Form Form VAT XV A?

airSlate SignNow includes features such as easy form filling, electronic signatures, and document tracking, which are crucial for handling the Annual Return Form Form VAT XV A efficiently. Additionally, it offers cloud storage and integration options with popular business tools, enhancing overall user experience. These features ensure that managing VAT forms becomes hassle-free.

-

Can I track the status of my Annual Return Form Form VAT XV A submissions?

Absolutely! airSlate SignNow allows users to track the status of the Annual Return Form Form VAT XV A submission in real-time. Notifications will alert you once your document is viewed or signed, making it easy to manage compliance deadlines. This feature provides peace of mind by keeping you updated throughout the submission process.

-

How secure is the information submitted through airSlate SignNow?

The security of your documents is a top priority at airSlate SignNow. We use advanced encryption and secure servers to protect all data related to the Annual Return Form Form VAT XV A. This ensures that your information remains confidential and safe from unauthorized access, allowing you to submit important forms with confidence.

-

What kind of customer support does airSlate SignNow offer?

airSlate SignNow provides comprehensive customer support through various channels, including email, phone, and live chat. Whether you have questions about the Annual Return Form Form VAT XV A or need assistance with the platform, our team is ready to help you. We are committed to ensuring a seamless experience for all our users.

Get more for Annual Return Form Form VAT XV A Himachal Pradesh Forms Himachalforms Nic

Find out other Annual Return Form Form VAT XV A Himachal Pradesh Forms Himachalforms Nic

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice