Georgia Sales and Use Tax Application Form

What is the Georgia Sales and Use Tax Application Form

The Georgia Sales and Use Tax Application Form is a crucial document used by businesses to register for sales tax in the state of Georgia. This form allows businesses to collect and remit sales tax on taxable goods and services sold within the state. It is essential for compliance with Georgia tax laws and helps ensure that businesses operate within legal frameworks. The form captures important information about the business, including its name, address, and type of business entity, which is necessary for the Georgia Department of Revenue to process the application effectively.

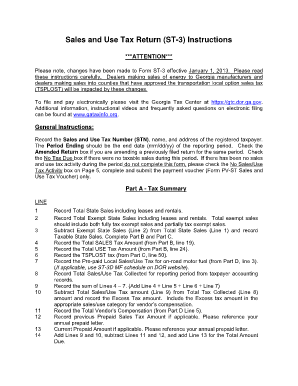

How to Use the Georgia Sales and Use Tax Application Form

Using the Georgia Sales and Use Tax Application Form involves several straightforward steps. First, businesses must accurately fill out the required fields, ensuring that all information is correct and up to date. Next, businesses should review the form for completeness before submission. Once completed, the form can be submitted electronically or via mail, depending on the business's preference. It is crucial to keep a copy of the submitted form for record-keeping and future reference. Additionally, businesses should familiarize themselves with Georgia's sales tax regulations to ensure compliance.

Steps to Complete the Georgia Sales and Use Tax Application Form

Completing the Georgia Sales and Use Tax Application Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including business name, address, and federal employer identification number (FEIN).

- Determine the type of business entity (e.g., sole proprietorship, LLC, corporation).

- Fill out the form accurately, ensuring all fields are completed.

- Review the form for any errors or missing information.

- Submit the form electronically through the Georgia Department of Revenue website or mail it to the appropriate address.

Legal Use of the Georgia Sales and Use Tax Application Form

The legal use of the Georgia Sales and Use Tax Application Form is governed by state tax laws. To be considered valid, the form must be filled out accurately and submitted in accordance with the guidelines set by the Georgia Department of Revenue. Electronic submissions are legally recognized, provided they comply with the requirements of the ESIGN Act and other relevant regulations. It is important for businesses to understand the legal implications of the information provided on the form, as inaccuracies or omissions can lead to penalties or legal issues.

Form Submission Methods

Businesses have multiple options for submitting the Georgia Sales and Use Tax Application Form. The form can be submitted electronically through the Georgia Department of Revenue's online portal, which offers a streamlined process for registration. Alternatively, businesses can choose to print the form and submit it by mail. For those who prefer in-person interactions, visiting a local Georgia Department of Revenue office is also an option. Regardless of the method chosen, it is important to retain a copy of the submitted form for future reference.

Required Documents

When completing the Georgia Sales and Use Tax Application Form, certain documents may be required to support the application. These documents typically include:

- Federal Employer Identification Number (FEIN) or Social Security Number (SSN) for sole proprietors.

- Proof of business registration, such as a business license or certificate of incorporation.

- Any relevant permits or licenses specific to the industry.

Having these documents ready can facilitate a smoother application process and ensure compliance with state regulations.

Quick guide on how to complete georgia sales and use tax application form

Complete Georgia Sales And Use Tax Application Form effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, as you can locate the desired form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Georgia Sales And Use Tax Application Form on any platform using airSlate SignNow’s Android or iOS applications and simplify your document-related tasks today.

The easiest method to edit and eSign Georgia Sales And Use Tax Application Form without any hassle

- Locate Georgia Sales And Use Tax Application Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Georgia Sales And Use Tax Application Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the georgia sales and use tax application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Georgia sales tax?

airSlate SignNow is a cost-effective eSignature solution that allows businesses to send and sign documents electronically. Understanding Georgia sales tax is crucial for businesses operating in the state, and SignNow helps streamline the process of documenting tax-related agreements and contracts efficiently.

-

How can airSlate SignNow help with managing Georgia sales tax documents?

Using airSlate SignNow, businesses can easily create, send, and sign documents related to Georgia sales tax compliance. This ensures that all tax forms and agreements are handled promptly and securely, reducing the risk of errors and legal issues.

-

Is airSlate SignNow suitable for small businesses handling Georgia sales tax?

Yes, airSlate SignNow is ideal for small businesses managing Georgia sales tax responsibilities. Its user-friendly interface and affordable pricing make it accessible for small businesses that need to streamline their tax documentation and ensure compliance.

-

What features does airSlate SignNow offer for dealing with Georgia sales tax?

airSlate SignNow offers features such as customizable templates, secure storage, and automated reminders, which are beneficial for businesses navigating Georgia sales tax paperwork. These features simplify the signing process and help ensure timely compliance with tax regulations.

-

Can airSlate SignNow integrate with my existing accounting software for Georgia sales tax?

Yes, airSlate SignNow integrates with various accounting software that may assist with Georgia sales tax tracking and reporting. This integration allows for seamless workflow management, making it easier to keep documentation organized and accessible.

-

What are the benefits of eSigning documents regarding Georgia sales tax with airSlate SignNow?

eSigning with airSlate SignNow offers numerous benefits, including faster turnaround times and reduced paperwork associated with Georgia sales tax documents. Digital signatures are legally binding and help businesses maintain compliance while minimizing the risk of document loss.

-

How secure is airSlate SignNow for handling sensitive Georgia sales tax documents?

airSlate SignNow prioritizes security and uses advanced encryption methods to protect sensitive data, including Georgia sales tax documents. Users can trust that their financial information and tax-related agreements are stored securely and handled with utmost confidentiality.

Get more for Georgia Sales And Use Tax Application Form

- Motor vehicle appraisal for tax collector hearingbonded title form vtr 125 dmv texas

- Title and register your vehicle form

- California dmv form reg 124 2016 2019

- Va blanket permit 2015 2019 form

- 24 hours prior to starting work city of lakewood form

- Power of attorney vehicle odometer disclosure and transfer of ownership form

- Mv2162 2015 2019 form

- Repo order 2014 2019 form

Find out other Georgia Sales And Use Tax Application Form

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement