The Kerala Value Added Tax Rules2005 Form

What is the Kerala Value Added Tax Rules 2005 Form

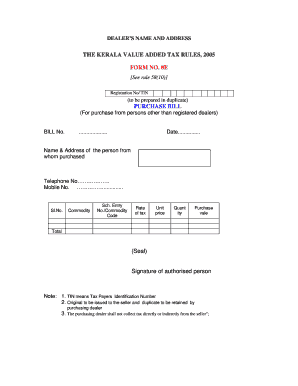

The Kerala Value Added Tax Rules 2005 Form is a crucial document used for the reporting and payment of value-added tax in the state of Kerala, India. This form is designed for businesses operating within the state to comply with local tax regulations. It captures essential information regarding sales, purchases, and tax liabilities, ensuring that businesses adhere to the legal requirements set forth by the Kerala government.

How to use the Kerala Value Added Tax Rules 2005 Form

To effectively use the Kerala Value Added Tax Rules 2005 Form, businesses must first obtain the form from the appropriate state tax authority. Once acquired, it is essential to fill in the required details accurately, including business information, transaction values, and applicable tax rates. After completing the form, businesses can submit it either online or through traditional mail, depending on the guidelines provided by the tax authority.

Steps to complete the Kerala Value Added Tax Rules 2005 Form

Completing the Kerala Value Added Tax Rules 2005 Form involves several key steps:

- Gather all relevant financial documents, including sales and purchase invoices.

- Enter your business details, such as the name, address, and tax identification number.

- Detail your sales and purchases for the reporting period, ensuring accuracy in figures.

- Calculate the total value-added tax payable based on the applicable rates.

- Review the form for any errors or omissions before submission.

Legal use of the Kerala Value Added Tax Rules 2005 Form

The legal use of the Kerala Value Added Tax Rules 2005 Form is paramount for businesses to ensure compliance with state tax laws. The form must be completed in accordance with the guidelines set by the Kerala government. Failure to adhere to these regulations may result in penalties or legal repercussions. It is advisable for businesses to maintain accurate records and submit the form within the stipulated deadlines to avoid any issues.

Required Documents

When filling out the Kerala Value Added Tax Rules 2005 Form, several documents are typically required to support the information provided. These may include:

- Sales and purchase invoices

- Previous tax returns

- Bank statements related to business transactions

- Any additional documentation requested by the tax authority

Form Submission Methods

The Kerala Value Added Tax Rules 2005 Form can be submitted through various methods to accommodate different business needs:

- Online Submission: Many businesses prefer to submit the form electronically through the state tax authority's website, which often provides a more streamlined process.

- Mail Submission: Businesses may also choose to print the completed form and send it via postal service to the designated tax office.

- In-Person Submission: Some businesses opt to deliver the form directly to the tax office, allowing for immediate confirmation of receipt.

Quick guide on how to complete the kerala value added tax rules2005 form

Complete The Kerala Value Added Tax Rules2005 Form effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents swiftly without delays. Manage The Kerala Value Added Tax Rules2005 Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

The easiest method to modify and eSign The Kerala Value Added Tax Rules2005 Form without hassle

- Locate The Kerala Value Added Tax Rules2005 Form and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with specialized tools provided by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign The Kerala Value Added Tax Rules2005 Form and ensure excellent communication throughout any phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the kerala value added tax rules2005 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is The Kerala Value Added Tax Rules2005 Form?

The Kerala Value Added Tax Rules2005 Form is a statutory document required for compliance with the VAT regulations in Kerala, India. This form allows businesses to declare their VAT liability and ensure they adhere to local tax laws. Understanding how to complete this form is essential for avoiding penalties and maintaining good standing with tax authorities.

-

How can airSlate SignNow assist with The Kerala Value Added Tax Rules2005 Form?

airSlate SignNow simplifies the process of filling and eSigning The Kerala Value Added Tax Rules2005 Form. Our intuitive platform allows users to upload, edit, and send this form digitally, ensuring compliance and efficiency. By streamlining document handling, airSlate SignNow helps businesses save valuable time and resources.

-

What are the pricing options for using airSlate SignNow for The Kerala Value Added Tax Rules2005 Form?

airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes, specifically for tasks like managing The Kerala Value Added Tax Rules2005 Form. By providing affordable options, we make it easy for companies to choose a plan that fits their budget without sacrificing functionality. Review our pricing page for detailed information on plans and features.

-

Can I integrate airSlate SignNow with other software for processing The Kerala Value Added Tax Rules2005 Form?

Yes, airSlate SignNow integrates seamlessly with various productivity tools, enhancing your ability to manage The Kerala Value Added Tax Rules2005 Form. Whether using accounting software or CRM platforms, our integrations help streamline workflows. This means you can easily send, sign, and store your VAT forms alongside other essential business documents.

-

What features does airSlate SignNow offer for managing The Kerala Value Added Tax Rules2005 Form?

airSlate SignNow provides features like document sharing, templates, and secure eSigning specifically for The Kerala Value Added Tax Rules2005 Form. These capabilities ensure that your documents are processed efficiently and securely. Additionally, our user-friendly interface simplifies the entire process, making it accessible for all users.

-

Is it secure to eSign The Kerala Value Added Tax Rules2005 Form using airSlate SignNow?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including The Kerala Value Added Tax Rules2005 Form. Our platform is compliant with industry standards for data security and encryption, ensuring that your sensitive information remains confidential. You can trust airSlate SignNow for secure and efficient document management.

-

Can multiple users collaborate on The Kerala Value Added Tax Rules2005 Form using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate in real-time on The Kerala Value Added Tax Rules2005 Form. This feature facilitates teamwork, enabling your team to review and make necessary edits to the document before finalizing it. Collaboration features ensure that all stakeholders are involved and informed throughout the process.

Get more for The Kerala Value Added Tax Rules2005 Form

- Csd 43 form 2015 2019

- Revised child adaptive behavior summary providers performcare nj revised child adaptive behavior summary

- The federalist society for law public policy studies fed soc form

- Ethos pathos logos read each passage and determine answers form

- Prewriting template form

- Ice machine cleaning log form

- Utorrent download hollywood movies in hindi dubbed 1080p form

- Edi lesson plan template dataworks educational research form

Find out other The Kerala Value Added Tax Rules2005 Form

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer