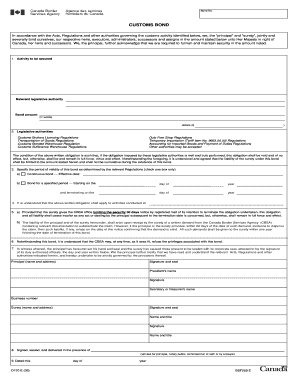

D120 Customs Bond Form

What is the D120 Customs Bond

The D120 Customs Bond is a crucial document for importers and exporters in the United States. It serves as a guarantee to the customs authority that any duties, taxes, and penalties associated with imported goods will be paid. This bond is particularly important for businesses that engage in international trade, as it ensures compliance with customs regulations. The D120 form is specifically designed for customs bond obligations and is essential for the smooth processing of customs goods.

How to Use the D120 Customs Bond

Using the D120 Customs Bond involves several steps. First, importers must complete the D120 form accurately, providing all necessary information regarding the goods being imported. Once the form is filled out, it must be submitted to the customs authority along with any required documentation. The bond acts as a financial guarantee, ensuring that the customs authority can collect any owed duties or taxes. It is important for businesses to keep a copy of the bond for their records and to ensure that all information is up to date.

Steps to Complete the D120 Customs Bond

Completing the D120 Customs Bond requires careful attention to detail. Here are the steps involved:

- Gather necessary information about the goods being imported, including descriptions and values.

- Fill out the D120 form, ensuring all fields are completed accurately.

- Attach any required documentation, such as invoices or shipping manifests.

- Review the completed form and documentation for accuracy.

- Submit the D120 form to the customs authority through the designated method.

Legal Use of the D120 Customs Bond

The D120 Customs Bond must be used in accordance with U.S. customs regulations. It is legally binding and ensures that all obligations related to customs duties and taxes are met. Failure to comply with the terms of the bond can result in penalties, including fines and delays in the processing of customs goods. Businesses must understand their responsibilities as customs importers to avoid legal issues.

Key Elements of the D120 Customs Bond

Several key elements define the D120 Customs Bond. These include:

- Principal: The party responsible for the customs obligations.

- Surety: The entity that guarantees payment of duties and taxes.

- Obligee: The customs authority that requires the bond.

- Bond Amount: The financial limit set for the bond, which reflects potential duties and taxes.

Required Documents

To complete the D120 Customs Bond, certain documents are required. These typically include:

- Completed D120 form.

- Invoices detailing the goods being imported.

- Shipping documents, such as bills of lading.

- Any additional documentation requested by the customs authority.

Quick guide on how to complete d120 customs bond

Complete D120 Customs Bond effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle D120 Customs Bond on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to alter and electronically sign D120 Customs Bond with ease

- Obtain D120 Customs Bond and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method of delivering your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Alter and eSign D120 Customs Bond to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the d120 customs bond

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of customs authority in document processing?

The customs authority plays a crucial role in overseeing the import and export of goods. When using airSlate SignNow, understanding the requirements from customs authorities can ensure your documents are compliant and processed efficiently, reducing delays and potential fines.

-

How does airSlate SignNow help with customs authority compliance?

airSlate SignNow provides tools for creating and managing documents that meet the necessary regulations set by customs authority. With features like templates and customizable fields, you can ensure your documentation is tailored to meet all compliance needs.

-

What features does airSlate SignNow offer to streamline customs authority documentation?

Our platform offers advanced features like real-time tracking, electronic signatures, and document storage, all designed to simplify the process of fulfilling customs authority requirements. This minimizes errors and enhances the speed of your documentation workflow.

-

How does pricing work for airSlate SignNow in relation to customs authority documentation?

airSlate SignNow offers various pricing plans tailored to different business needs, ensuring affordability while maintaining compliance with customs authority regulations. Our cost-effective solutions allow you to manage your document needs without compromising on quality or features.

-

Can airSlate SignNow integrate with other tools to assist with customs authority requirements?

Yes, airSlate SignNow seamlessly integrates with various third-party applications that are vital for customs authority documentation. This ensures that you have a comprehensive solution that meets all your needs while facilitating smooth collaboration across platforms.

-

What are the benefits of using airSlate SignNow for customs authority documentation?

Using airSlate SignNow for your customs authority documentation offers numerous benefits, including faster processing times, reduced paperwork, and enhanced accuracy. Our platform is designed to empower businesses to manage their documents effectively and maintain compliance effortlessly.

-

Is airSlate SignNow user-friendly for managing customs authority forms?

Absolutely! airSlate SignNow is built with an intuitive interface that makes it easy for anyone to manage customs authority forms. With drag-and-drop features and customizable workflows, you can create and send documents without any hassle.

Get more for D120 Customs Bond

Find out other D120 Customs Bond

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form