Affidavit of Consideration for Use by Buyer Form

What is the affidavit of consideration for use by buyer?

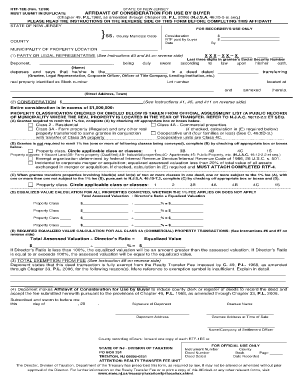

The affidavit of consideration for use by buyer is a legal document that serves to confirm the amount of consideration exchanged in a real estate transaction. This affidavit is typically required by state law to ensure transparency and compliance during property transfers. It outlines the financial aspects of the transaction, including the purchase price, and provides a sworn statement from the buyer regarding the legitimacy of the transaction. This document plays a crucial role in protecting both buyers and sellers by providing a clear record of the agreed-upon terms.

Key elements of the affidavit of consideration for use by buyer

Several key elements must be included in the affidavit of consideration for it to be valid. These elements typically include:

- Identification of Parties: The full names and addresses of both the buyer and the seller.

- Description of Property: A detailed description of the property being transferred, including its address and any relevant identifiers.

- Consideration Amount: The total purchase price agreed upon by both parties.

- Sworn Statement: A declaration by the buyer affirming the truthfulness of the information provided.

- Signatures: The signatures of both the buyer and a notary public to validate the document.

Steps to complete the affidavit of consideration for use by buyer

Completing the affidavit of consideration involves several important steps:

- Gather Information: Collect all necessary details about the transaction, including the buyer's and seller's information and property details.

- Draft the Affidavit: Use a template or create a document that includes all key elements, ensuring accuracy in the information provided.

- Review the Document: Both parties should review the affidavit for accuracy and completeness before signing.

- Notarization: Schedule a meeting with a notary public to have the document officially notarized.

- File the Affidavit: Submit the notarized affidavit to the appropriate local government office, if required by state law.

Legal use of the affidavit of consideration for use by buyer

The legal use of the affidavit of consideration is essential in real estate transactions. It serves as a formal record that can be referenced in case of disputes or legal inquiries. By providing a sworn statement regarding the transaction's details, the affidavit helps prevent fraud and ensures that all parties adhere to the agreed-upon terms. Additionally, it may be required by local jurisdictions to complete the transfer of property ownership legally.

How to use the affidavit of consideration for use by buyer

Using the affidavit of consideration effectively involves understanding its purpose and following the correct procedures. Buyers should ensure they fill out the affidavit accurately, reflecting the true nature of the transaction. After completing the document, it should be signed in the presence of a notary public to ensure its legal standing. Finally, the affidavit may need to be submitted to local authorities, depending on state requirements, to finalize the property transfer.

State-specific rules for the affidavit of consideration for use by buyer

Each state may have specific rules governing the affidavit of consideration for use by buyer. It is important for buyers to familiarize themselves with their state's requirements, as these can affect the validity of the document. Some states may have particular forms or additional information that must be included. Consulting with a real estate attorney or local government office can provide clarity on the necessary regulations and ensure compliance with state laws.

Quick guide on how to complete affidavit of consideration for use by buyer

Complete Affidavit Of Consideration For Use By Buyer effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the correct version and securely store it online. airSlate SignNow equips you with all the necessary tools to create, adjust, and electronically sign your documents quickly and without delays. Manage Affidavit Of Consideration For Use By Buyer on any gadget using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest method to modify and electronically sign Affidavit Of Consideration For Use By Buyer with ease

- Locate Affidavit Of Consideration For Use By Buyer and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight important sections of the files or redact sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you’d like to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Affidavit Of Consideration For Use By Buyer while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the affidavit of consideration for use by buyer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an affidavit of consideration for use by buyer?

An affidavit of consideration for use by buyer is a legal document that outlines the verification of a payment or consideration involved in a transaction. This document is crucial in real estate transactions as it provides clarity on the buyer's financial commitment. Using airSlate SignNow can streamline the process of creating and signing this affidavit securely.

-

How does airSlate SignNow help with affidavit of consideration for use by buyer?

airSlate SignNow simplifies the process of creating and eSigning an affidavit of consideration for use by buyer. Our platform provides easy-to-use templates and automated workflows that save time and reduce errors. With our electronic signature solution, you can expedite the approval process while ensuring legal compliance.

-

What are the pricing options for airSlate SignNow when using it for affidavits?

airSlate SignNow offers flexible pricing plans that are designed to meet the needs of businesses of all sizes. Our pricing is competitive and allows you to pay only for what you need, including specific features for processing affidavits such as the affidavit of consideration for use by buyer. You can choose from basic to premium packages depending on your volume and requirements.

-

Can airSlate SignNow integrate with other software for managing affidavits?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance your document management capabilities. Whether you’re using CRM systems, cloud storage services, or collaboration tools, integrating with airSlate SignNow simplifies the workflow for processing affidavits, including the affidavit of consideration for use by buyer.

-

What features does airSlate SignNow offer for handling affidavits?

airSlate SignNow includes features such as customizable templates, workflow automation, and secure electronic signatures that are ideal for creating an affidavit of consideration for use by buyer. Additionally, you can track the status of your documents in real time and receive notifications when your affidavit is signed, ensuring a smooth process.

-

Is airSlate SignNow compliant with legal standards for affidavits?

Absolutely! airSlate SignNow is designed to comply with legal standards for electronic signatures, making it a reliable choice for creating an affidavit of consideration for use by buyer. Our platform adheres to regulations such as ESIGN and UETA, ensuring that your documents are valid and enforceable.

-

How can I get started with airSlate SignNow for my affidavits?

Getting started with airSlate SignNow is simple and quick. You can sign up for an account on our website and explore our features for handling the affidavit of consideration for use by buyer. Our user-friendly interface makes it easy to create, send, and manage your documents effectively.

Get more for Affidavit Of Consideration For Use By Buyer

- Hvac air balancing forms

- Work schedule change request form

- Frederikshavn kommune fuldmagt center for teknik og frederikshavn form

- Spaghetti dinner order form

- Shift coverage form

- Acvp phase ii sponsor verification form

- Rabun county animal hospital form

- Five guys crunchtime user manual pdf docplayer net form

Find out other Affidavit Of Consideration For Use By Buyer

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile