Form Il 1000 E

What is the Form IL 1000 E

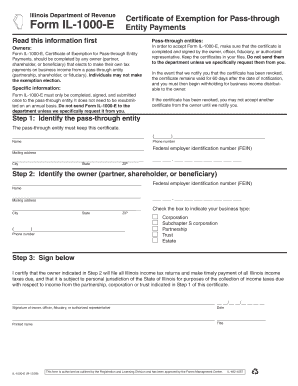

The Form IL 1000 E is an Illinois tax exempt form designed for specific entities to claim exemption from certain taxes. This form is primarily used by organizations that qualify under state regulations, allowing them to avoid paying sales tax on eligible purchases. Understanding the purpose and requirements of this form is essential for organizations seeking to benefit from tax exemptions in Illinois.

How to use the Form IL 1000 E

Using the Form IL 1000 E involves several straightforward steps. First, ensure that your organization qualifies for tax-exempt status under Illinois law. Next, download the form from the appropriate state resources or obtain it through your local tax office. Fill in the required information accurately, including the organization's name, address, and tax identification number. Once completed, present the form to vendors at the time of purchase to claim your tax exemption.

Steps to complete the Form IL 1000 E

Completing the Form IL 1000 E requires careful attention to detail. Follow these steps:

- Gather necessary information, including your organization’s legal name and tax identification number.

- Clearly state the reason for the exemption, ensuring it aligns with state regulations.

- Review the form for accuracy and completeness before submission.

- Submit the form to the vendor at the time of purchase to ensure tax exemption is applied.

Legal use of the Form IL 1000 E

The legal use of the Form IL 1000 E is governed by Illinois tax laws. Organizations must ensure they meet the eligibility criteria to use this form legitimately. Misuse of the form can lead to penalties, including back taxes and fines. It is crucial to maintain accurate records and documentation supporting the tax-exempt status to avoid legal issues.

Key elements of the Form IL 1000 E

Key elements of the Form IL 1000 E include:

- Organization Information: Name, address, and tax ID number.

- Exemption Reason: A clear statement of the reason for tax exemption.

- Signature: An authorized representative must sign the form to validate it.

Filing Deadlines / Important Dates

While the Form IL 1000 E does not have a specific filing deadline, it is essential to present it at the time of purchase to ensure tax exemption. Organizations should remain aware of any changes in state tax laws that may affect their eligibility and compliance requirements.

Quick guide on how to complete form il 1000 e

Access Form Il 1000 E easily on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can find the appropriate form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents promptly without delays. Manage Form Il 1000 E on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest method to modify and eSign Form Il 1000 E effortlessly

- Find Form Il 1000 E and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with features that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes seconds and has the same legal validity as a conventional pen-and-ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, cumbersome form searches, or errors that require printing additional document copies. airSlate SignNow addresses your needs in document management in a few clicks from a device of your choice. Modify and eSign Form Il 1000 E to ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form il 1000 e

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is il 1000 e and how does it relate to airSlate SignNow?

Il 1000 e is a powerful electronic signature tool offered by airSlate SignNow that simplifies the signing of documents. This solution allows businesses to streamline their document workflows and ensure compliance with legal standards, making it easier for clients to eSign important paperwork.

-

How much does airSlate SignNow cost with the il 1000 e feature?

The pricing plan for airSlate SignNow varies, but it offers competitive rates for businesses looking to utilize the il 1000 e feature. By choosing this solution, you gain access to affordable subscription options that cater to different business sizes and needs, ensuring cost-effective document management.

-

What features does il 1000 e provide?

Il 1000 e offers a variety of features, including customizable templates, document tracking, and secure storage. Additionally, this feature ensures that your eSignatures are legally binding and compliant with global regulations, enhancing your business's efficiency and reliability.

-

What are the benefits of using il 1000 e for my business?

Using il 1000 e can signNowly reduce the time spent on document signing processes and improve overall productivity. This feature provides businesses with a user-friendly interface, making it easy for teams to collaborate and manage their documents effectively, rising customer satisfaction.

-

Can il 1000 e integrate with other software applications?

Yes, il 1000 e seamlessly integrates with various platforms like CRM systems, cloud storage services, and project management tools. This allows businesses to enhance their workflow by connecting airSlate SignNow with their existing software ecosystem, improving efficiency in document management.

-

Is il 1000 e secure for my sensitive documents?

Absolutely. Il 1000 e prioritizes security by using advanced encryption standards to protect your sensitive documents. Additionally, airSlate SignNow complies with legal requirements for electronic signatures, ensuring that your data remains confidential and secure throughout the signing process.

-

How can I get started with il 1000 e?

Getting started with il 1000 e is simple. You can sign up for an airSlate SignNow account, choose the right pricing plan for your needs, and start using the electronic signature feature immediately. Onboarding resources are available to help you maximize the use of il 1000 e effectively.

Get more for Form Il 1000 E

- Supervisors medical treatment authorization form nc state

- Graduate school admission application una form

- Irell ampamp manella graduate school of biological sciences at city form

- Massasoit transcript form

- Teachers details format

- Non custodial parents form office of communications

- 17 161 form 105 194indd

- Igetc de anza form

Find out other Form Il 1000 E

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure