Gold Loan Form PDF

What is the Gold Loan Form PDF

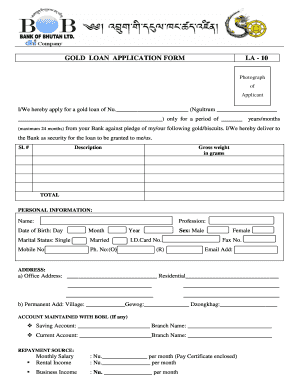

The gold loan application form is a crucial document used by individuals seeking to secure a loan against their gold assets. This form typically includes personal information, details about the gold being pledged, and financial information necessary for the lender to assess the application. The gold loan form can be found in PDF format, which allows for easy downloading, printing, and filling out either digitally or by hand. This format ensures that the document maintains its structure and integrity, making it suitable for submission to financial institutions.

Steps to Complete the Gold Loan Form PDF

Completing the gold loan application form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal and financial documents, such as identification, proof of income, and details about the gold being pledged. Next, fill out the form with accurate information, including your name, address, and contact details. Be sure to provide specific details about the gold, including its weight and purity. After completing the form, review it carefully for any errors or omissions before signing. Finally, submit the form either online or in person, depending on the lender's requirements.

Legal Use of the Gold Loan Form PDF

The gold loan application form is legally binding once it has been completed and signed. To ensure its legality, it is important to comply with relevant eSignature laws, such as the ESIGN Act and UETA, which govern electronic signatures in the United States. Additionally, the form must be filled out truthfully, as providing false information could lead to legal repercussions. Lenders may also require specific disclosures to be included in the application, which must be adhered to for the form to be valid.

Required Documents

When applying for a gold loan, several documents are typically required to support your application. These may include:

- Government-issued identification (e.g., driver's license, passport)

- Proof of address (e.g., utility bill, lease agreement)

- Income proof (e.g., pay stubs, tax returns)

- Details of the gold being pledged (e.g., purchase receipts, appraisals)

Providing these documents along with the gold loan application form helps the lender verify your identity and assess your financial situation, facilitating a smoother approval process.

Application Process & Approval Time

The application process for a gold loan typically involves submitting the completed gold loan application form along with the required documents. Once submitted, the lender will review the application, which may include assessing the value of the gold and your creditworthiness. The approval time can vary depending on the lender, but many institutions aim to provide a decision within a few hours to a couple of days. It is advisable to check with the lender for their specific timelines and any additional requirements that may affect the approval process.

Digital vs. Paper Version

When it comes to the gold loan application form, applicants have the option to choose between a digital version and a paper version. The digital version allows for easier completion and submission, as it can be filled out electronically and sent directly to the lender. This method often speeds up the process and reduces the risk of errors. On the other hand, the paper version may be preferred by those who feel more comfortable with traditional methods. Regardless of the format chosen, it is essential to ensure that all information is accurately provided and that the form is submitted according to the lender's guidelines.

Quick guide on how to complete gold loan form pdf

Complete Gold Loan Form Pdf effortlessly on any device

Online document management has become widely favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Gold Loan Form Pdf on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to modify and eSign Gold Loan Form Pdf effortlessly

- Locate Gold Loan Form Pdf and click on Get Form to initiate the process.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, either via email, text message (SMS), invite link, or download it to your computer.

Put an end to the hassle of lost or misplaced documents, cumbersome form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Modify and eSign Gold Loan Form Pdf and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gold loan form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a gold loan application form?

A gold loan application form is a document used by individuals to request a loan against their gold assets. This form typically requires personal information, details about the gold being offered as collateral, and income verification. Completing this form accurately is essential for the loan approval process.

-

How can I find the gold loan application form?

You can easily access the gold loan application form online through our website or by contacting your nearest bank or financial institution offering gold loans. Digital formats make the process seamless, allowing you to fill out the form anytime, anywhere. Ensure that you have all necessary documents ready while filling out the form.

-

What information is required in the gold loan application form?

The gold loan application form requires your personal details such as name, address, contact information, and identification proof. Additionally, you need to provide specifics about the gold you wish to pledge, including its purity and weight. Having accurate and complete information will expedite your loan approval process.

-

Are there any fees associated with the gold loan application form?

While filling out the gold loan application form is typically free, there may be associated processing fees depending on the lender. It’s important to review all costs related to the gold loan, including interest rates and any additional charges that may apply. Comparing fees across lenders can help you find a better deal.

-

What are the benefits of using a gold loan application form?

Using a gold loan application form streamlines the process of securing a loan against your gold assets. It helps lenders assess the value of your gold and determine your eligibility quickly. Additionally, gold loans often offer lower interest rates compared to unsecured loans, providing a cost-effective borrowing option.

-

Can I apply for a gold loan online using the application form?

Yes, most financial institutions allow you to apply for a gold loan online using their digital gold loan application form. This convenience lets you submit your information securely from the comfort of your home. Ensure you have scanned copies of required documents ready to upload with your application.

-

How long does it take to process the gold loan application form?

The processing time for the gold loan application form can vary by lender, but many institutions offer quick approvals within a few hours to a couple of days. Factors influencing the speed include the completeness of your application and the evaluation of your gold's value. Always check with your specific lender for expected timelines.

Get more for Gold Loan Form Pdf

Find out other Gold Loan Form Pdf

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document