How to Calculate Occupational Tax Withheld in Alabama Form

Understanding Occupational Tax Withholding in Alabama

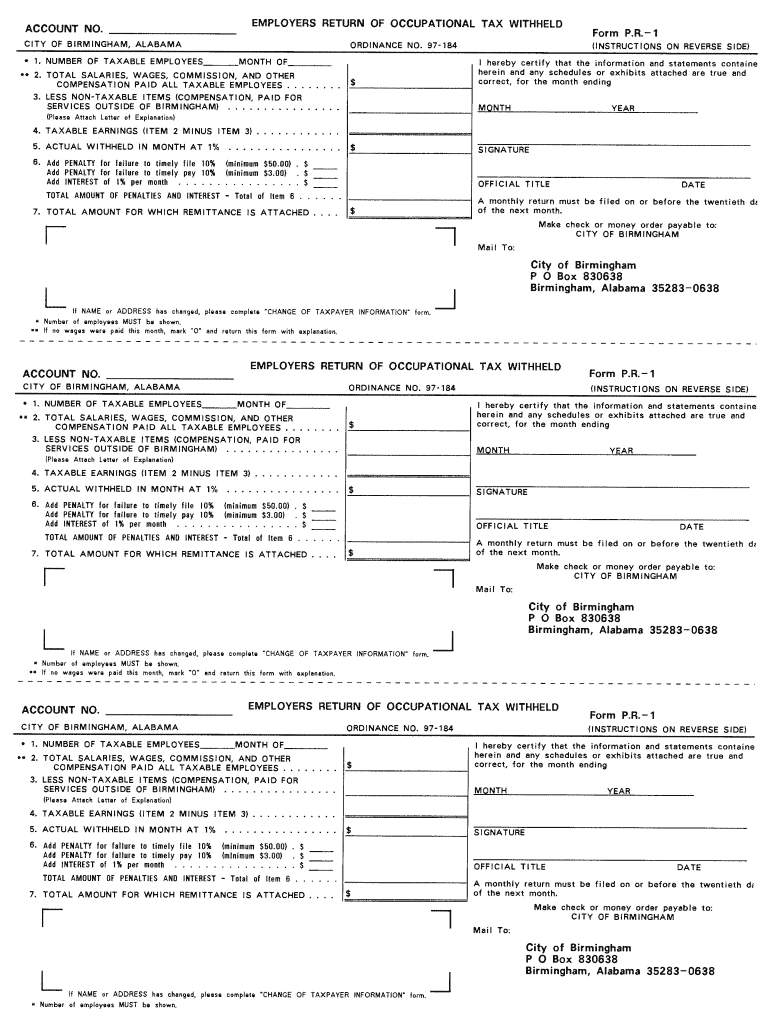

Occupational tax in Alabama is a tax imposed on individuals working within certain municipalities. This tax is typically withheld from employees' wages by their employers. The amount withheld can vary based on the local jurisdiction and the employee's earnings. Understanding how to calculate this tax is essential for both employers and employees to ensure compliance with local tax regulations.

Steps to Calculate Occupational Tax Withheld in Alabama

Calculating the occupational tax withheld involves several straightforward steps:

- Determine the employee's gross wages for the pay period.

- Identify the applicable occupational tax rate for the specific municipality where the employee works.

- Multiply the gross wages by the occupational tax rate to find the total amount to be withheld.

- Ensure that the calculated amount aligns with any local regulations or guidelines.

Required Documents for Occupational Tax Compliance

To ensure proper calculation and withholding of occupational tax, certain documents are necessary:

- The employee's W-4 form, which provides information on withholding allowances.

- Any local tax registration forms specific to the municipality.

- Documentation of the employee's gross wages, such as pay stubs or payroll records.

Filing Deadlines for Occupational Tax in Alabama

Employers must be aware of specific filing deadlines to remain compliant with occupational tax regulations. Generally, occupational tax returns are due quarterly, but this can vary by municipality. It is essential to check local guidelines to avoid penalties for late filing.

Penalties for Non-Compliance with Occupational Tax Regulations

Failure to comply with occupational tax regulations can result in significant penalties. These may include:

- Fines imposed by the local government.

- Interest on unpaid taxes.

- Potential legal action for continued non-compliance.

Digital vs. Paper Submission of Occupational Tax Forms

Submitting occupational tax forms digitally is often more efficient than using paper methods. Digital submissions can reduce processing times and minimize errors associated with manual entry. Many municipalities now offer online portals for tax filing, making it easier for employers to comply with regulations.

Quick guide on how to complete form occupational tax

Your assistance manual on how to prepare your How To Calculate Occupational Tax Withheld In Alabama

If you’re interested in learning how to generate and transmit your How To Calculate Occupational Tax Withheld In Alabama, here are some concise instructions on how to simplify tax processing.

First, you need to create an airSlate SignNow profile to change the way you manage documents online. airSlate SignNow is an extremely intuitive and powerful document management tool that allows you to modify, produce, and finalize your income tax paperwork effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, returning to adjust information as necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and straightforward sharing.

Follow the steps below to complete your How To Calculate Occupational Tax Withheld In Alabama in a matter of minutes:

- Set up your account and start editing PDFs in no time.

- Utilize our directory to locate any IRS tax form; explore variations and schedules.

- Click Obtain form to access your How To Calculate Occupational Tax Withheld In Alabama in our editor.

- Populate the mandatory fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and amend any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Be aware that submitting on paper can increase return mistakes and prolong reimbursements. Certainly, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

FAQs

-

How can I get better at small talk?

5 Ways To Instantly Turn Small Talk Into BIG TALK:Let me preface this by presenting the following idea: nobody is boring. Whenever I hear colleagues or friends complain about small talk I always ask them "Did you make an effort to elevate the conversation?" Or did you just ask them the same jibber jabber questions that you do with 80% of the people in your life? Conversations may be a two way street but you always have the power to make it more dynamic and engaging. Ask boring questions and you'll receive boring answers. Simple as that.People can only show as much as you let them within the context of the conversation. Not everyone shines under the same light and it's your job as a social being to figure out how you can help them show off their dazzling personality. A classic conversational trap is asking people questions that you can easily anticipate the answers to.For instance you'll ask "How’s your day?" and they'll respond with "Good." That's boring, uneventful and you feel like you're just going through the motions. In this article I'll explain how to morph those typical small talk questions into meaningful opportunities for relationship growth.1) What you normally ask: "How's your day?"What to ask instead: "What's the most surprising thing that happened to you recently?"--Doing this entices them to give better answers and actually reflect on the highs and lows of the past week. Giving them the opportunity to be insightful will compel them to open up and give intimate details about their life that they wouldn't normally share.2) What you normally ask: "What do you do for a living?"What to ask instead: "What gets you up in the morning? What are you most passionate about?"--Feeding people generic questions is only setting ourselves up to receive generic answers. Giving someone a positive and encouraging context to bring up their job, sets them up to talk about it with passion. Often times we worry about answering questions in an easily digestible way. This trend of thinking is toxic for those trying to maximize the output of daily interactions. Make people remember you by actively engaging with them. Become unforgettable and you'll move up on their mental list.3) What you normally ask: How are you holding up?What to ask instead: What's holding you up? What motivates you to keep moving forward?--This question is typically saved for someone going through a rough patch in their life. There's a line in the 2000 Danny Boyle movie The Beach that says, "Either get better or die. It's the hanging around in between that really pisses people off." Asking someone about their mental state when they're clearly in distress will only encourage them to lie and say everything's fine, so they can alleviate any discomfort.By focusing on the positive aspects of sadness such as hope and inspiration, you are subconsciously allowing that person to release their repressed feelings in a healthy and uplifting way. Hearing the thought process behind their coping strategies will give you insight into the severity of their issues without having to ask outright. They say the quickest way to a persons heart is through their stomach, but it's actually through subtlety.4. What you normally ask: How was ________? (Your date, your trip to New York, your hike up Torrey Pines)What to ask instead: If you had to do ________ all over again, what would you do differently?The broader your questions are, the less details people will give in return. Asking them about the overall quality of their experience will garner a common response ensuring that their time wasn't wasted. Answers like "It was good. I had tons of fun", are the ones you want to avoid. Ask poignant questions that will actually make them think. This thought train you send them on will make other stops organically along the way, providing you a better shot at finding out how_________ truly was for them.5. What you normally ask: Are you married?What to ask instead: Do you think life partners are over or underrated?The best way to get someone to talk about something specific is to bring up questions surrounding the central topic you secretly want them to elaborate on. If you want to know about their husband/wife, you have to get there incrementally by first talking about friendships, relationships, love etc. This question serves two functions: (a) it gives you their perspective on love and (b) personal values. Someone who puts a high premium on having someone by their side has a much different psychology than a person who is indifferent to the idea. Their answer to this is a natural transition into volunteering information about their own personal experiences.Getting information through the proverbial front door of someone's brain will always be underwhelming and overrated. Small talk is normally inconsequential and monotonous. But it doesn't have to be that way! Getting to know someone is like trying to break into a house. You can't just bust the door down right away. You need a plan of attack. Could you get in through the window? Maybe sneak into the garage? Going from small talk to big talk is allowing the other person to open up the doors for you. People want to be heard and understood. You just have to give them permission first.When life hands you small lemons, make big lemonade. Happy talking!Thomas

-

How do I pay occupancy & hotel taxes in NYC for hosting on Airbnb?

IMO that would be unwise. Even with the landlord's permission, renting on Airbnb is illegal in NYC unless your building is zoned and permitted for transient occupancy. I would suggest not filing to pay taxes as that would evidence and record income from unlawful rental activity.

-

How can a gun owner get a class 3 license?

Other answers have covered the fine points well, but speaking to the crux of the q: this an incredibly common misunderstanding amongst many gun owners, that those who own legal machine guns “got their Class 3 license” in order to do so.(It’s also a misnomer to refer to transferable machine guns, suppressors, short-barrel rifles et al as “class 3 items”. “NFA items” or even “Title II weapons” would be more apt and accurate.)If you can lawfully purchase a “regular” (semi, revolver, shotgun, lever-action rifle, whatever) gun, and your state does not preclude ownership of the NFA item you’d like…you ALREADY have all the “licensure” you need.There are the jumpable hoops of fingerprinting, filling out the ATF paperwork, paying the (usually) $200 tax for the transfer, background check, and waiting 6–15 months of processing; there’s also the matter of the market price of the items (thousands to tens of thousand for machine guns, due to finite supply of transferable guns).But a license just to buy a machine gun? Nope.The more you know. Now, please help stop this erroneous belief amongst our fellow gun owners…and gently correct them when they speak of “getting your class 3 license”.

-

What challenges do private investigators face?

As someone who has been in the business since 2001, I can attest to the fact that private investigators face a lot of challenges. From the mundane to the life-threatening, it will vary depending on the individual’s specialty, his geographical location, his status within his agency and other factors.If the private investigator is just an investigator (and sometimes I wish I were — more on that below), his greatest challenges are mostly going to be directly related to the cases he is assigned to. For example and in no particular order:Running surveillance on someone who is “surveillance conscious” (in other words, looking over their shoulder/in their rear-view mirror to see if they are being followed). This might be because the subject of the surveillance has had prior training (we recently surveilled a cheating NYPD detective), because they’ve been tipped-off by someone or perhaps the subject is just paranoid in general and ALWAYS thinks they are being followed.Doing database/courthouse research (for a locate or a background search) when the client has provided very minimal or even incorrect info as a starting point. We have excellent (non-public) databases at our disposal but the old expression, “garbage in, garbage out” still applies. For example, a client asked us to locate a man she had met (and been charmed by) at an out-of-state business conference. All she could tell us was his (quite common) name, David Johnson, his age, 37, and his (very large) city of residence. After days of unsuccessful research, we finally (and semi-miraculously) located her mystery boyfriend who turned out to be Arnold David Jonson (he goes by his middle name), age 42 (he had lied about his age). At least she got the city right.Getting used to people being mad at you. I suppose this also happens if you’re a dentist or an A/C repairman but I’m guessing those guys seldom if ever have people threatening to (and, in some instances, attempting to) physically injure them. Whether it’s an infidelity investigation, a bodyguarding gig, a fake injury scam or a child custody clash, in the P.I. business, most cases dictate that someone — usually the adversary of our client — ends up getting the short end of the stick. And, often, they don’t take it well.Assuming that the private investigator is also a manager or owner (keep in mind that most P.I.s are one-man-shows so the investigator, manager and owner are all the same guy), he will have another category of headaches (challenges) with which to contend. My partner and I are co-owners of our agency and have been since the beginning. We now have other investigators working for us so, although we still try to share in the fun stuff (the actual, street-level investigations) as much as possible, more and more we find ourselves dealing with the administrative challenges of the P.I. world:The paperwork. Like any business (and probably more so than some) private investigation entails a lot of paper pushing. There are certifications and licensing required, insurance, bonding, association memberships, bookkeeping, taxes, etc. And this is all just the “bureaucratic” end of it. The proposal-writing, invoicing and reporting to the clients is another huge time-eater. If you run a fairly large agency like my partner and I do, these desk-bound chores can take up the majority of your day. And trust me, no one gets into the private investigation business because they love to fill out forms!The clients can be a handful. Dealing with unreasonable, emotional and unstable clients is part of the game. I’m convinced that a private investigator draws more “difficult” (I’m trying to be diplomatic here) clients than any other professional apart from, maybe, psychiatrist. People often come to us in a very agitated state. Someone has lied to them, ripped them off or otherwise deceived them and their nerves can be pretty raw and the P.I. they hire can be a convenient target. Add to that the crazy, illegal, immoral or impossible things they see investigators do on their favorite television show (Spoiler Alert: TV’s not real) and handling some clients becomes a nightmare.The growing (largely unqualified) competition. I have no actual, statistical evidence of this but I suspect that there may be more unqualified P.I.s (aka, wannabes) than there are in all other professions combined. The reason? It’s a fantasy occupation for many kids growing up in a world that glorifies the exploits of fictional investigators like Magnum, P.I., Dirk Gently and Sherlock Holmes. Moreover, it’s an occupation that tempts newcomers to “fake it until you make it”. A teenager who dreams of being a rock star or a pro football player either has what it takes or he doesn’t. You can’t sort of be an astronaut. But anyone with a computer and a Nikon can pretend to be a well-trained, licensed, experienced investigator even if they are none of the above. They can even advertise on Facebook or Craigslist or the bulletin board at Starbucks and, perhaps, draw in some naive, paying clients. This does two things. It drives down revenue industry-wide when the newcomer operating out of his parents’ basement offers unrealistically low prices. Secondly, it damages the overall reputation of the profession when the aforementioned phonies inevitably screw up their clients’ investigations. I’ve lost track of the number of prospective clients who have told us, “I’m tempted to hire your agency but that last P.I. ripped me off bad!”For more on this topic, see my response to a previous, related Quora question: Brad Robinson's answer to How dangerous is it to be a private investigator?Home#DetectiveChallenges

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

If you could pick one subject to master that would lead to a better life in general, what would it be?

This is an opinion, not a definitive answer.If you are able — mathematics. Most of sought after and well paid jobs are based on mathematics.If not (the majority of the people are in this case) something about living successfully in society (how to fill out the tax form, how to repair your car, how to organise your finances, etc)At least learn a honest, sought after profession. Something that would offer you fiancial stability and allow you the pursuit of other dreams and ideas.Btw, the “living successfully” part can an should be a complement for any path that you take.It is listed with the idea that if you want to concentrate on it you will cover more subjects and in more detail than when it is a secondary occupation.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

Create this form in 5 minutes!

How to create an eSignature for the form occupational tax

How to generate an electronic signature for your Form Occupational Tax in the online mode

How to create an eSignature for your Form Occupational Tax in Google Chrome

How to generate an electronic signature for signing the Form Occupational Tax in Gmail

How to generate an eSignature for the Form Occupational Tax right from your mobile device

How to generate an electronic signature for the Form Occupational Tax on iOS devices

How to create an eSignature for the Form Occupational Tax on Android OS

People also ask

-

What is occupational tax and how does it affect businesses?

Occupational tax is a tax levied on individuals and businesses engaged in a trade or profession within a specific jurisdiction. It can affect businesses by increasing operational costs, impacting employee salaries, and requiring compliance with local regulations. Understanding occupational tax is crucial for maintaining financial health and avoiding penalties.

-

How can airSlate SignNow help with managing occupational tax documentation?

airSlate SignNow simplifies handling all documentation related to occupational tax, such as forms and reports, through a seamless eSigning process. This ensures that all documents are compliant, securely stored, and easily accessible. The platform enhances productivity by reducing the time spent on paperwork.

-

What features of airSlate SignNow are beneficial for dealing with occupational tax?

Key features of airSlate SignNow that assist with occupational tax include customizable templates for tax forms, automated reminders for submission deadlines, and secure eSigning capabilities. These features streamline the process of completing and submitting occupational tax documents, ensuring efficiency and compliance.

-

Is airSlate SignNow cost-effective for managing occupational tax related tasks?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing occupational tax. The pricing plans are flexible, allowing companies to choose options that fit their budget while still gaining access to powerful features. This affordability helps reduce the financial burden associated with keeping up-to-date with occupational tax compliance.

-

Does airSlate SignNow integrate with other tools crucial for occupational tax filing?

Absolutely! airSlate SignNow offers integrations with popular accounting and tax software that are essential for managing occupational tax. These integrations facilitate seamless data transfer and ensure that all necessary information stays synchronized, making tax filing more efficient and less prone to errors.

-

Can airSlate SignNow assist in tracking occupational tax deadlines?

Yes, airSlate SignNow features automated reminders that help businesses keep track of important occupational tax deadlines. By notifying users ahead of time, companies can ensure that they submit their documents on time, thus avoiding penalties and maintaining compliance with tax regulations.

-

How does airSlate SignNow ensure security for occupational tax documents?

airSlate SignNow prioritizes security by employing advanced encryption methods to protect all occupational tax documents. Moreover, the platform offers authentication options and audit trails, ensuring complete control over who accesses and modifies sensitive information. This commitment to security helps businesses safeguard their tax-related data.

Get more for How To Calculate Occupational Tax Withheld In Alabama

Find out other How To Calculate Occupational Tax Withheld In Alabama

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document