Voluntary Escrow Prepayment Designation Form

What is the Voluntary Escrow Prepayment Designation

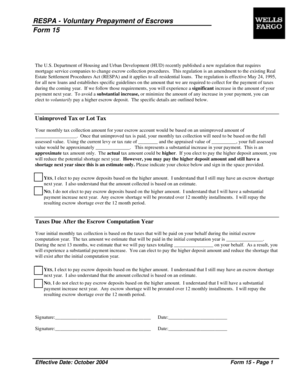

The voluntary escrow prepayment designation is a formal document that allows borrowers to make additional payments towards their escrow account. This can help reduce the overall balance of the escrow account, which is typically used to cover property taxes and insurance premiums. By designating voluntary prepayments, borrowers can manage their finances more effectively and potentially lower their monthly mortgage payments.

Steps to Complete the Voluntary Escrow Prepayment Designation

Completing the voluntary escrow prepayment designation involves several key steps:

- Obtain the form, ensuring it is the correct version for your needs.

- Fill in the required personal and property information accurately.

- Specify the amount you wish to prepay into the escrow account.

- Sign and date the form to validate your request.

- Submit the completed form to your mortgage lender or servicer.

Legal Use of the Voluntary Escrow Prepayment Designation

The voluntary escrow prepayment designation is legally recognized when completed correctly. It must adhere to federal and state regulations regarding escrow accounts. The document serves as a record of the borrower's intent to make additional payments, which can help prevent misunderstandings with the lender. It is important to retain a copy of the signed form for your records.

Key Elements of the Voluntary Escrow Prepayment Designation

Understanding the key elements of the voluntary escrow prepayment designation is essential for effective use:

- Borrower Information: Includes the name, address, and contact details of the borrower.

- Property Details: Information about the property associated with the escrow account.

- Payment Amount: The specific amount being prepaid into the escrow account.

- Signature: The borrower's signature is necessary to validate the designation.

How to Use the Voluntary Escrow Prepayment Designation

Using the voluntary escrow prepayment designation effectively can enhance your financial management. Once you have completed the form, submit it to your lender as part of your mortgage agreement. This designation allows you to control how much you contribute to your escrow account, ensuring that you have adequate funds available for property taxes and insurance when due.

Examples of Using the Voluntary Escrow Prepayment Designation

There are various scenarios where a borrower might utilize the voluntary escrow prepayment designation:

- A homeowner receives a bonus and decides to make a one-time prepayment to reduce future escrow payments.

- A borrower refinances their mortgage and opts to increase their escrow contributions to cover higher property taxes.

- A property owner anticipates an increase in insurance premiums and chooses to prepay to mitigate future costs.

Quick guide on how to complete voluntary escrow prepayment designation

Effortlessly prepare Voluntary Escrow Prepayment Designation on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents swiftly without delays. Handle Voluntary Escrow Prepayment Designation on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Voluntary Escrow Prepayment Designation with ease

- Find Voluntary Escrow Prepayment Designation and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important parts of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature with the Sign feature, which only takes a few seconds and carries the same legal significance as a standard wet ink signature.

- Review all the details and click the Done button to save your amendments.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require new document prints. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Voluntary Escrow Prepayment Designation while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the voluntary escrow prepayment designation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a voluntary escrow prepayment designation?

A voluntary escrow prepayment designation is a specific request made by a borrower to prepay a portion of their loan in an escrow account. This designation allows for more flexible payment options and can lead to signNow savings over time. Understanding this concept is crucial for individuals looking to manage their financial commitments efficiently.

-

How does airSlate SignNow support voluntary escrow prepayment designation?

airSlate SignNow provides a streamlined platform that allows businesses to manage documents related to the voluntary escrow prepayment designation easily. Our solution encompasses electronic signatures and document management tools, enabling users to complete the prepayment process quickly and securely. This efficiency reduces the time spent on paperwork, allowing you to focus on other important tasks.

-

What are the pricing options for using airSlate SignNow with voluntary escrow prepayment designation?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs, including those managing voluntary escrow prepayment designation. Users can choose from monthly or annual subscriptions based on their usage requirements. Additionally, prospective customers can take advantage of free trials to explore features before committing.

-

What features of airSlate SignNow enhance the process of voluntary escrow prepayment designation?

Key features of airSlate SignNow, such as customizable templates, in-app notifications, and secure cloud storage, signNowly enhance the handling of voluntary escrow prepayment designation. These features simplify document creation and tracking, ensuring that all necessary paperwork is managed effectively. With these tools, users can confidently navigate the complexities of financial transactions.

-

What benefits can businesses expect from using airSlate SignNow for voluntary escrow prepayment designation?

Businesses can expect increased efficiency and reduced administrative burden when utilizing airSlate SignNow for voluntary escrow prepayment designation. Our platform automates tedious tasks and minimizes errors, leading to faster transactions and improved customer satisfaction. Ultimately, this enhances workflow and allows your team to focus on growth and strategy.

-

Can airSlate SignNow integrate with other tools for managing voluntary escrow prepayment designation?

Yes, airSlate SignNow provides seamless integration with various business tools, including CRM and accounting software, facilitating efficient management of voluntary escrow prepayment designation. These integrations allow for data consistent management across platforms, reducing the need to duplicate efforts. This interconnected approach leads to improved productivity and streamlined workflows.

-

Is training available for using airSlate SignNow in relation to voluntary escrow prepayment designation?

airSlate SignNow offers comprehensive training resources to help users understand how to effectively use the platform for voluntary escrow prepayment designation. These resources include video tutorials, user guides, and dedicated customer support. This ensures that all users can maximize the functionalities of the platform, ultimately enhancing their experience.

Get more for Voluntary Escrow Prepayment Designation

Find out other Voluntary Escrow Prepayment Designation

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation