Non Tax Filer Statement College Board Form

What is the Non Tax Filer Statement College Board

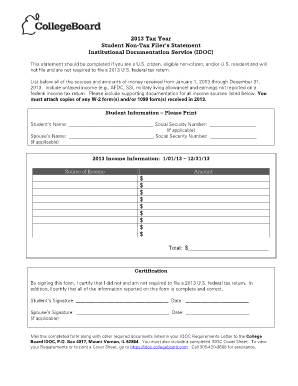

The non tax filer statement, particularly in the context of the College Board, is a document used by students and their families to declare that they did not file a federal income tax return for a specific year. This statement is often required for financial aid applications, especially for programs like the FAFSA (Free Application for Federal Student Aid). It serves as a formal declaration that the individual did not have an income that necessitated filing taxes, which can be crucial for determining eligibility for financial assistance.

How to use the Non Tax Filer Statement College Board

Using the non tax filer statement involves several steps to ensure that it meets the requirements set by educational institutions. First, gather the necessary information, including personal identification details and financial information for the year in question. Next, accurately complete the statement, ensuring that all fields are filled out correctly. After completing the form, it may need to be submitted along with other financial aid documents. Institutions may require this statement to verify income levels and assess eligibility for aid.

Steps to complete the Non Tax Filer Statement College Board

Completing the non tax filer statement involves a systematic approach:

- Gather relevant personal information, including your Social Security number and any financial records.

- Access the non tax filer statement form from the College Board or your educational institution's website.

- Fill in the required fields, ensuring accuracy in all entries.

- Review the completed statement for any errors or omissions.

- Submit the statement as instructed, either online or through physical mail.

Key elements of the Non Tax Filer Statement College Board

When preparing the non tax filer statement, it is essential to include several key elements:

- Personal Information: Full name, Social Security number, and contact details.

- Year of Non-Filing: Specify the tax year for which you did not file.

- Income Information: A declaration of income sources, if any, during that year.

- Signature: The statement must be signed and dated to validate the information provided.

Legal use of the Non Tax Filer Statement College Board

The non tax filer statement is legally binding when completed accurately and submitted as part of financial aid applications. It serves to affirm that the individual did not earn enough income to necessitate filing a tax return. Educational institutions rely on this statement to ensure compliance with federal regulations regarding financial aid eligibility. It is important to provide truthful information, as inaccuracies can lead to penalties or loss of financial aid.

Examples of using the Non Tax Filer Statement College Board

There are various scenarios where the non tax filer statement is utilized:

- A student applying for financial aid who did not work or earn income during the previous year may need to submit this statement.

- Parents of dependent students may also need to provide a non tax filer statement if they did not file taxes.

- Individuals who are self-employed but did not earn enough to file may use this statement to clarify their financial situation.

Quick guide on how to complete non tax filer statement college board

Prepare Non Tax Filer Statement College Board effortlessly on any device

Online document management has gained popularity among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Non Tax Filer Statement College Board on any device with airSlate SignNow's Android or iOS applications and simplify any document-oriented process today.

How to modify and eSign Non Tax Filer Statement College Board with ease

- Obtain Non Tax Filer Statement College Board and click on Get Form to initiate the process.

- Make use of the tools we provide to complete your document.

- Highlight necessary sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Craft your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you prefer to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Non Tax Filer Statement College Board and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the non tax filer statement college board

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a non tax filer statement and why is it important?

A non tax filer statement is a document that indicates an individual's or business's status of not filing a tax return. It's essential for various purposes, such as applying for loans, grants, or aid programs, as it provides financial institutions with relevant information regarding income status. Using airSlate SignNow, you can efficiently create and manage non tax filer statements for your needs.

-

How does airSlate SignNow simplify the process of creating a non tax filer statement?

airSlate SignNow offers an intuitive platform that allows users to easily create and customize their non tax filer statements. With our user-friendly templates and eSigning features, you can ensure that the document meets legal requirements while saving time. Plus, our platform allows for quick edits and collaboration with multiple parties.

-

What features does airSlate SignNow provide for managing non tax filer statements?

With airSlate SignNow, you get features like customizable templates, the ability to add multiple signers, and automated reminders for document signing. These functionalities ensure that your non tax filer statement is processed swiftly and efficiently. Additionally, our cloud storage solution keeps all your documents secure and accessible.

-

Is there a cost associated with using airSlate SignNow for non tax filer statements?

Yes, airSlate SignNow offers several pricing plans tailored to fit different business needs, including options for managing non tax filer statements. Our pricing is competitive and provides signNow cost savings compared to traditional methods of document management. You can choose a plan that includes essential features while only paying for what you need.

-

Can I integrate airSlate SignNow with other software to streamline my non tax filer statement process?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and Microsoft Office. This means you can easily transfer data and manage your documents, including non tax filer statements, between platforms without any hassle. This integration enhances productivity and keeps your workflow smooth.

-

What are the benefits of using airSlate SignNow for non tax filer statements compared to paper methods?

Using airSlate SignNow for non tax filer statements offers numerous benefits over traditional paper methods. It not only saves time with faster document preparation and signing but also reduces the risk of errors and loss of documents. Additionally, electronic storage and access improve organization and enhance security.

-

How secure are the documents created through airSlate SignNow, especially non tax filer statements?

Security is a top priority for airSlate SignNow. All documents, including non tax filer statements, are encrypted and stored in a secure environment. We comply with industry standards for data protection, ensuring that your sensitive information is kept safe and confidential throughout the document lifecycle.

Get more for Non Tax Filer Statement College Board

- Medication error report from form

- Dhs 1139f rev med quest form

- Background check form pdf barnes jewish hospital barnesjewish

- Wind mitigation form 2010

- Delta dental address change form

- Dhr cdc 1951 adobe 2001 form

- Threshold override application for medicaid ny 2010 form

- Patient authorization for release of medical mssm form

Find out other Non Tax Filer Statement College Board

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form