Form 14017

What is the Form 14017

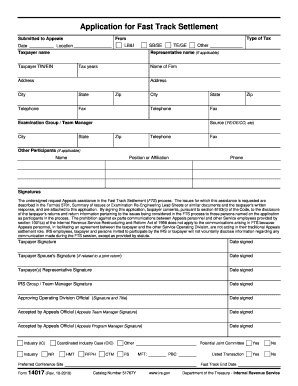

The Form 14017 is a specific document used primarily for tax-related purposes in the United States. It serves as a request for certain tax information or benefits, often associated with various tax filings or adjustments. Understanding the purpose of this form is essential for taxpayers who need to navigate their tax obligations effectively. It is crucial to ensure that the form is completed accurately to avoid delays or complications with the Internal Revenue Service (IRS).

How to use the Form 14017

Using the Form 14017 involves several key steps to ensure proper completion and submission. First, gather all necessary information, including personal identification details and any relevant financial data. Next, fill out the form carefully, ensuring that all fields are completed accurately. It is advisable to review the form for errors before submission. Once completed, the form can be submitted electronically or via traditional mail, depending on the specific requirements outlined by the IRS.

Steps to complete the Form 14017

Completing the Form 14017 requires a systematic approach to ensure all information is accurately provided. Follow these steps:

- Start by downloading the form from the official IRS website or accessing it through a trusted tax software.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide any additional information required, such as income details or previous tax filings.

- Double-check all entries for accuracy to avoid potential issues.

- Sign and date the form, confirming that all information is correct.

Legal use of the Form 14017

The legal use of the Form 14017 hinges on compliance with IRS regulations. When completed and submitted correctly, the form is considered legally binding. It is essential to adhere to all guidelines provided by the IRS to ensure that the form meets legal standards. Additionally, using a reliable eSignature solution can enhance the legal validity of the document, providing a secure method for signing and submitting the form electronically.

Required Documents

When preparing to complete the Form 14017, certain documents may be required to support your application. These may include:

- Proof of identity, such as a driver's license or passport.

- Income statements, including W-2s or 1099s.

- Previous tax returns, if applicable.

- Any correspondence from the IRS related to your tax situation.

Having these documents on hand will facilitate a smoother completion process and help ensure that all necessary information is included.

Form Submission Methods

The Form 14017 can be submitted through various methods, depending on the preferences of the taxpayer and the requirements set by the IRS. The primary submission methods include:

- Online Submission: Many taxpayers choose to submit the form electronically through authorized tax software, which can streamline the process and provide immediate confirmation of receipt.

- Mail Submission: Alternatively, the form can be printed and mailed to the appropriate IRS address. Ensure that you use the correct mailing address based on your location and the nature of your submission.

- In-Person Submission: In some cases, taxpayers may opt to deliver the form in person at a local IRS office, though this is less common.

Quick guide on how to complete form 14017

Complete Form 14017 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as a superb environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct format and safely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your paperwork quickly and efficiently. Manage Form 14017 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to adjust and eSign Form 14017 without hassle

- Obtain Form 14017 and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate the worry of lost or mislaid files, tedious document searching, or mistakes that necessitate printing out new copies. airSlate SignNow addresses your requirements in document management with just a few clicks from your selected device. Modify and eSign Form 14017 and ensure outstanding communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 14017

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 14017 and why is it important?

Form 14017 is an essential document used for specific regulatory purposes in various industries. It ensures compliance and standardization within processes. By utilizing airSlate SignNow, you can easily create, send, and eSign Form 14017 securely and efficiently.

-

How does airSlate SignNow simplify the use of Form 14017?

AirSlate SignNow provides a user-friendly interface for creating and managing Form 14017. Our platform allows users to fill out, sign, and store the document all in one place. This streamlines the process and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow with Form 14017?

AirSlate SignNow offers flexible pricing plans suited for businesses of all sizes. Whether you need basic features or advanced capabilities for Form 14017, we provide budget-friendly options. Explore our plans to find the best fit for your needs.

-

Can I integrate Form 14017 with other applications using airSlate SignNow?

Yes, airSlate SignNow allows you to integrate Form 14017 with various applications. This integration enhances workflow automation and ensures seamless data transfer between platforms. Connect with tools you already use to optimize your processes.

-

What security features are included when using airSlate SignNow for Form 14017?

When using airSlate SignNow for Form 14017, your documents are protected by advanced security measures. This includes encryption, secure cloud storage, and compliance with industry standards. Rest assured that your information remains safe and confidential.

-

Is there a mobile app for managing Form 14017 with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that enables you to manage Form 14017 on the go. Whether you need to send, sign, or review documents, our app provides the flexibility you need. Stay productive anytime, anywhere with our mobile solution.

-

How does airSlate SignNow improve the efficiency of processing Form 14017?

AirSlate SignNow signNowly improves the efficiency of processing Form 14017 by automating many manual tasks. Our platform reduces turnaround time through expedited eSigning and straightforward field completion. Experience faster workflows and enhanced productivity.

Get more for Form 14017

- Wellstar medical release form

- Molecular genomic pathology genetic test requisition form

- Protective life insurance change of beneficiary form

- Naic filing instructions form

- Icare behaviors barnesjewish form

- Sun life claim forms

- Northeast guidance c records deposition service inc form

- St 129 786689251 form

Find out other Form 14017

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile