New York Tax Exempt Form

What is the New York Tax Exempt Form

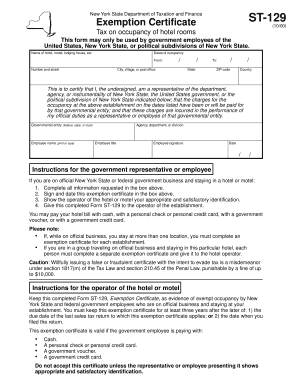

The New York Tax Exempt Form, also known as the ST-129, is a crucial document that allows eligible organizations to claim exemption from certain state taxes. This form is primarily used by non-profit entities, educational institutions, and governmental bodies to avoid paying sales tax on purchases related to their exempt purposes. Understanding the specifics of this form is essential for organizations seeking to maximize their financial resources while complying with state tax regulations.

How to use the New York Tax Exempt Form

To effectively use the New York Tax Exempt Form, an organization must first ensure that it qualifies for tax exemption under New York state law. This involves confirming that the entity meets the criteria set forth by the state for tax-exempt status. Once eligibility is established, the form can be filled out to indicate the nature of the purchases and the specific tax exemption being claimed. It is important to keep the completed form on file for record-keeping and to present it to vendors when making tax-exempt purchases.

Steps to complete the New York Tax Exempt Form

Completing the New York Tax Exempt Form involves several key steps:

- Gather necessary documentation to prove eligibility for tax exemption.

- Carefully fill out the form, providing accurate information about the organization and the nature of the purchases.

- Ensure that all required signatures are obtained to validate the form.

- Keep a copy of the completed form for your records.

Following these steps will help ensure that the form is filled out correctly and can be used effectively for tax-exempt purchases.

Legal use of the New York Tax Exempt Form

The legal use of the New York Tax Exempt Form is defined by state regulations that govern tax exemptions. Organizations must use the form only for purchases that are directly related to their exempt purposes. Misuse of the form can lead to penalties, including back taxes owed and potential fines. Therefore, it is critical for organizations to understand the legal implications of using the form and to ensure compliance with all applicable laws.

Eligibility Criteria

To qualify for the New York Tax Exempt Form, an organization must meet specific eligibility criteria. Generally, this includes being a non-profit entity, educational institution, or government body. Additionally, the purchases made must be directly related to the organization's exempt purpose. It is advisable for organizations to review the detailed eligibility requirements set forth by the New York State Department of Taxation and Finance to ensure compliance.

Form Submission Methods

The New York Tax Exempt Form can be submitted through various methods, including online, by mail, or in person. Organizations should choose the method that best suits their operational needs. For online submissions, ensure that you have a secure platform for electronic filing. When submitting by mail, it is important to send the form to the correct address to avoid delays. In-person submissions may require an appointment, depending on the local tax office's policies.

Quick guide on how to complete new york tax exempt form

Finalize New York Tax Exempt Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitution for traditional printed and signed documents, enabling you to locate the correct form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your files swiftly without interruptions. Handle New York Tax Exempt Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven procedure today.

How to alter and eSign New York Tax Exempt Form with ease

- Obtain New York Tax Exempt Form and click on Get Form to initiate.

- Use the tools we provide to fill out your document.

- Emphasize signNow sections of your documents or conceal sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Formulate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Adjust and eSign New York Tax Exempt Form and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new york tax exempt form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax exempt form New York and how is it used?

A tax exempt form New York allows certain organizations to make purchases without paying sales tax. This form is primarily used by non-profit entities, government agencies, and certain educational organizations. Using this form simplifies transactions and ensures compliance with state tax laws.

-

How can airSlate SignNow help with the tax exempt form New York?

airSlate SignNow provides a user-friendly platform for businesses to create, send, and eSign the tax exempt form New York quickly. With its intuitive interface, users can easily fill out and submit this form, ensuring all necessary information is provided accurately and promptly. This streamlines the process of tax exemption and reduces paperwork.

-

Is there a cost associated with using airSlate SignNow for tax exempt forms?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs, including the management of the tax exempt form New York. These plans vary based on features and the number of users. Each plan provides value through efficient document management and eSigning capabilities.

-

Can I integrate airSlate SignNow with other applications for tax exempt forms?

Absolutely! airSlate SignNow offers integrations with various applications to facilitate the use of the tax exempt form New York. This includes CRM systems, cloud storage services, and other document management tools, allowing for seamless workflow and enhanced productivity.

-

What are the benefits of using airSlate SignNow for handling tax exempt forms?

Using airSlate SignNow for the tax exempt form New York boosts efficiency and ensures accuracy in form submissions. The platform allows for easy tracking of document status, secure storage, and the ability to access forms from any device. This convenience helps businesses save time and reduce errors.

-

Are there any templates available for the tax exempt form New York in airSlate SignNow?

Yes, airSlate SignNow provides templates for the tax exempt form New York, making it quicker and easier for users to get started. These templates are customizable, allowing organizations to tailor each form to their specific needs while ensuring compliance with local tax regulations.

-

How secure is my information when using airSlate SignNow for tax exempt forms?

Security is a top priority for airSlate SignNow. When using the platform for the tax exempt form New York, your data is protected with advanced encryption and secure access controls. This ensures that all sensitive information remains confidential and is only accessible to authorized users.

Get more for New York Tax Exempt Form

- Maryland dept of labor licensing amp regulation form

- Osha first report of injury fillable 2013 2018 form

- Quarterly client list form

- Affidavit of exemption for workers compensation insurance form

- The departments implementation of the contractor edgov form

- Ncic form 28u 2017 2019

- Pd 107 state application fillable 2005 2019 form

- Private career school pcs renewal application state of new jersey form

Find out other New York Tax Exempt Form

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation