How to Fill Out Third Party Financing Addendum for Conventional Form

What is the conventional financing addendum?

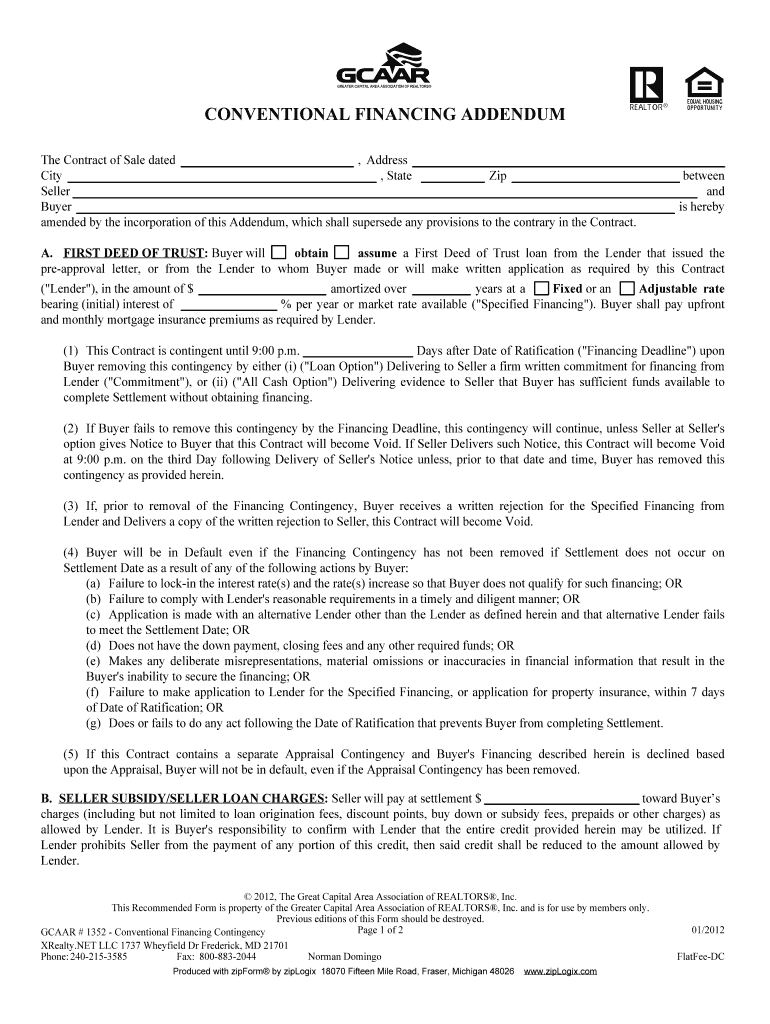

The conventional financing addendum is a legal document that outlines specific terms and conditions related to financing in real estate transactions. It is typically used in conjunction with purchase agreements to clarify the financing arrangements between the buyer and seller. This addendum is essential for ensuring that both parties understand their obligations and the financing process, particularly when conventional loans are involved. By detailing aspects such as loan amounts, interest rates, and contingencies, this document helps to prevent misunderstandings and disputes during the transaction.

Key elements of the conventional financing addendum

Several critical components make up the conventional financing addendum. These include:

- Loan Type: Specifies the type of financing being used, such as a conventional loan, FHA loan, or VA loan.

- Loan Amount: Clearly states the amount of money being borrowed for the property purchase.

- Interest Rate: Outlines the agreed-upon interest rate for the loan.

- Contingencies: Details any conditions that must be met for the financing to proceed, such as appraisal or inspection requirements.

- Closing Date: Indicates the expected timeline for closing the transaction.

Steps to complete the conventional financing addendum

Filling out the conventional financing addendum involves several straightforward steps:

- Gather Information: Collect all necessary details regarding the financing, including loan type, amount, and interest rate.

- Fill Out the Form: Accurately complete the addendum, ensuring all relevant information is included.

- Review Terms: Carefully review the terms and conditions outlined in the addendum to ensure clarity and accuracy.

- Obtain Signatures: Ensure that both the buyer and seller sign the document to make it legally binding.

- Distribute Copies: Provide copies of the signed addendum to all parties involved in the transaction for their records.

Legal use of the conventional financing addendum

The conventional financing addendum serves a crucial legal purpose in real estate transactions. It ensures that both the buyer and seller are on the same page regarding financing terms, thereby reducing the risk of disputes. For the addendum to be legally binding, it must be signed by both parties and included as part of the overall purchase agreement. Compliance with state and federal regulations regarding real estate transactions is also essential to uphold the document's validity.

How to use the conventional financing addendum

To effectively use the conventional financing addendum, it should be incorporated into the purchase agreement at the outset of negotiations. This ensures that all financing terms are clearly defined and agreed upon before moving forward. When completing the addendum, it is important to be thorough and precise, as any inaccuracies could lead to complications later in the transaction. Once completed, the addendum should be shared with all parties involved, including real estate agents and lenders, to ensure everyone is informed of the financing details.

State-specific rules for the conventional financing addendum

Each state may have specific regulations governing the use of financing addendums in real estate transactions. It is important to be aware of these state-specific rules to ensure compliance. For example, some states may require additional disclosures or specific language to be included in the addendum. Consulting with a real estate attorney or local real estate professional can provide valuable insights into the requirements in your state, helping to ensure that the addendum is valid and enforceable.

Quick guide on how to complete how to fill out third party financing addendum for conventional

Complete How To Fill Out Third Party Financing Addendum For Conventional effortlessly on any device

Online document management has become increasingly popular with businesses and individuals. It provides an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage How To Fill Out Third Party Financing Addendum For Conventional on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and electronically sign How To Fill Out Third Party Financing Addendum For Conventional effortlessly

- Locate How To Fill Out Third Party Financing Addendum For Conventional and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your alterations.

- Choose how you wish to send your form: by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign How To Fill Out Third Party Financing Addendum For Conventional to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to fill out third party financing addendum for conventional

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a conventional financing addendum?

A conventional financing addendum is a document used in real estate transactions that outlines the buyer's intent to secure conventional financing for their purchase. This addendum typically includes terms and conditions related to the financing process and helps protect both buyers and sellers. Understanding the conventional financing addendum is crucial for legally binding agreements.

-

How can airSlate SignNow help with managing a conventional financing addendum?

airSlate SignNow simplifies the process of managing a conventional financing addendum by providing an easy-to-use platform for document creation, sharing, and eSigning. With SignNow, you can ensure that all parties involved can quickly review and sign the addendum, streamlining the transaction process. This efficiency helps reduce the chances of delays in your financing agreements.

-

What are the benefits of using a conventional financing addendum?

Using a conventional financing addendum protects both buyers and sellers by clearly outlining expectations regarding financing contingencies. It helps avoid misunderstandings and provides a clear pathway for closing a transaction if financing falls through. This clarity is essential for facilitating smoother real estate deals.

-

Is there a cost associated with using airSlate SignNow for a conventional financing addendum?

AirSlate SignNow offers a cost-effective solution for managing a conventional financing addendum, with various pricing plans to fit different business needs. Depending on the plan selected, users can take advantage of unlimited eSigning and document storage at competitive rates. This makes it an affordable choice for businesses handling multiple real estate transactions.

-

Can I integrate airSlate SignNow with other tools to manage my conventional financing addendum?

Yes, airSlate SignNow offers integrations with various business tools and platforms, allowing for seamless management of your conventional financing addendum. This capability enhances collaboration by connecting your signing processes with tools you already use. It simplifies the workflow and improves the efficiency of your real estate transactions.

-

How secure is the eSigning process for a conventional financing addendum with airSlate SignNow?

The eSigning process for a conventional financing addendum using airSlate SignNow is highly secure, employing advanced encryption to protect sensitive information. Each signed document comes with a secure audit trail to verify signatures and ensure integrity. This level of security reassures users that their legal agreements are protected throughout the signing process.

-

What types of documents can I create besides a conventional financing addendum using airSlate SignNow?

In addition to a conventional financing addendum, airSlate SignNow allows users to create various document types, including contracts, agreements, and form templates. The platform's flexibility caters to a wide range of business needs, enabling personalized document creation. This helps ensure that all your real estate documentation can be efficiently managed in one location.

Get more for How To Fill Out Third Party Financing Addendum For Conventional

- Pre authorized debit pad agreement strata fee form

- Please ensure that all payments destined for the royal bank of scotland international rbs international the remitting bank form

- Wells fargo certificate of authority form

- Excella card form

- Wells fargo application form

- National tax setup change form

- Cosigner addendum form

- Fcna 7141 g cm3 form

Find out other How To Fill Out Third Party Financing Addendum For Conventional

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA