Wr1 Form

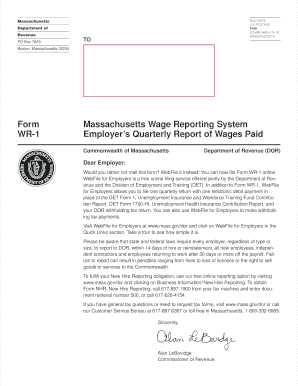

What is the WR1 Form?

The WR1 form, officially known as the Massachusetts Quarterly Wage Statement, is a crucial document used by employers in Massachusetts to report wages paid to employees and the taxes withheld from those wages. This form is essential for compliance with state tax regulations and is submitted to the Massachusetts Department of Revenue (DOR). It captures important information such as employee names, Social Security numbers, total wages, and the amount of state income tax withheld. Understanding the WR1 form is vital for businesses to ensure they meet their reporting obligations accurately and on time.

How to Obtain the WR1 Form

Employers can easily obtain the WR1 form from the Massachusetts Department of Revenue's official website. The form is available in a printable format, allowing businesses to fill it out manually if preferred. Additionally, many payroll software solutions offer the option to generate the WR1 form automatically, streamlining the process for employers. It is important to ensure that the most current version of the form is used to comply with any updates in state regulations.

Steps to Complete the WR1 Form

Completing the WR1 form involves several key steps to ensure accuracy and compliance:

- Gather Employee Information: Collect the necessary details for each employee, including their full name, Social Security number, and total wages paid during the quarter.

- Calculate Withholdings: Determine the total amount of state income tax withheld from each employee's wages.

- Fill Out the Form: Enter the gathered information into the appropriate sections of the WR1 form, ensuring all entries are accurate.

- Review for Errors: Double-check all entries for accuracy to avoid potential penalties for incorrect reporting.

- Submit the Form: File the completed WR1 form with the Massachusetts DOR by the designated deadlines.

Legal Use of the WR1 Form

The WR1 form is legally required for all employers in Massachusetts who pay wages to employees. Failure to file this form can result in penalties and interest on unpaid taxes. It is essential for employers to understand the legal implications of the WR1 form, as it serves as a record of employment and tax withholdings. Properly completing and submitting the form helps maintain compliance with state tax laws and protects the employer from potential legal issues.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for filing the WR1 form to avoid penalties. The form is typically due on the last day of the month following the end of each quarter. For example:

- First Quarter (January - March): Due by April 30

- Second Quarter (April - June): Due by July 31

- Third Quarter (July - September): Due by October 31

- Fourth Quarter (October - December): Due by January 31 of the following year

Staying informed about these deadlines is crucial for employers to ensure timely compliance.

Form Submission Methods

Employers have several options for submitting the WR1 form to the Massachusetts Department of Revenue. The form can be filed electronically through the DOR's online portal, which is often the most efficient method. Alternatively, employers may choose to mail a printed copy of the form or submit it in person at a local DOR office. Each submission method has its own set of guidelines and requirements, so employers should select the method that best suits their operational needs.

Quick guide on how to complete wr1 form

Manage Wr1 Form effortlessly across any device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and store it securely online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Handle Wr1 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to adjust and eSign Wr1 Form with ease

- Locate Wr1 Form and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools offered by airSlate SignNow specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your PC.

Eliminate the worry of lost or misfiled documents, laborious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Wr1 Form to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wr1 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mass dor form wr 1 used for?

The mass dor form wr 1 is used for reporting withheld income tax in Massachusetts. It is essential for businesses to ensure compliance with state tax regulations. Filling out this form accurately can help prevent penalties and fines related to withholding taxes.

-

How can airSlate SignNow help me with the mass dor form wr 1?

airSlate SignNow provides a seamless platform for electronically signing and managing the mass dor form wr 1. You can easily send the form to recipients for eSignature, ensuring that all parties can quickly complete their necessary tasks without delays.

-

What features does airSlate SignNow offer for mass dor form wr 1?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure document storage for the mass dor form wr 1. These tools simplify the signing process and enhance overall document management efficiency for businesses.

-

Is airSlate SignNow cost-effective for handling the mass dor form wr 1?

Yes, airSlate SignNow is a cost-effective solution for managing the mass dor form wr 1. Our pricing plans are designed to fit businesses of all sizes, enabling you to streamline your document signing process without overspending.

-

Can I integrate airSlate SignNow with other software for mass dor form wr 1?

Absolutely! airSlate SignNow integrates with various software applications to facilitate a smoother workflow for the mass dor form wr 1. Whether you're using CRM systems, document management apps, or email platforms, we have integration options to meet your needs.

-

What are the benefits of using airSlate SignNow for the mass dor form wr 1?

Using airSlate SignNow for the mass dor form wr 1 offers numerous benefits, including reduced turnaround times and increased document security. You can track document status in real-time, and our user-friendly interface ensures that everyone can easily navigate the signing process.

-

Is airSlate SignNow legally compliant for mass dor form wr 1?

Yes, airSlate SignNow complies with all signNow eSignature laws, including the ESIGN Act and UETA, making it legally acceptable for the mass dor form wr 1. You can confidently present signed documents for business and legal purposes, knowing they meet all regulatory standards.

Get more for Wr1 Form

- Release or obtain information consent

- Fashion show contract form

- Rs form

- Inspection and test quality system as9003 aerojet rocketdyne form

- Received paycheck signature sheets template form

- General license agreement restaurants taverns nightclubs and similar establishments general license agreement restaurants form

- Pathfinder character sheet form

- 2006 polaris amp victory new dealer tools polariscz form

Find out other Wr1 Form

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy