Form 89 224 Penalty Waiver

What is the Form 89 224 Penalty Waiver

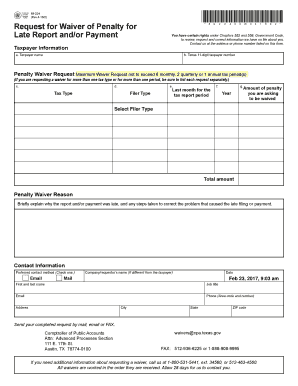

The Form 89 224 Penalty Waiver is a document used in Texas to request a waiver for penalties associated with sales and use tax. This form is particularly relevant for businesses that may have incurred penalties due to late payments or other compliance issues. By submitting this form, taxpayers can explain their circumstances and seek relief from penalties that may otherwise be imposed by the Texas Comptroller of Public Accounts.

How to use the Form 89 224 Penalty Waiver

To effectively use the Form 89 224 Penalty Waiver, taxpayers should first ensure they meet the eligibility criteria for a penalty waiver. This includes demonstrating reasonable cause for the failure to comply with tax obligations. Once eligibility is confirmed, complete the form by providing all required information, including details about the penalties incurred and the reasons for the request. It is essential to be thorough and honest in the explanation to increase the chances of approval.

Steps to complete the Form 89 224 Penalty Waiver

Completing the Form 89 224 Penalty Waiver involves several key steps:

- Gather necessary documentation that supports your case for a penalty waiver.

- Fill out the form with accurate information, including your business details and specifics about the penalties.

- Provide a clear explanation of the reasons for the penalty waiver request.

- Review the form for completeness and accuracy before submission.

- Submit the completed form to the Texas Comptroller's office via the preferred method.

Key elements of the Form 89 224 Penalty Waiver

Several key elements must be included in the Form 89 224 Penalty Waiver to ensure it is considered valid. These include:

- Taxpayer Information: Complete details about the business, including name, address, and taxpayer identification number.

- Penalty Details: Specifics about the penalties being contested, including amounts and dates.

- Reason for Waiver: A detailed explanation of the circumstances that led to the penalties.

- Supporting Documentation: Any relevant documents that support the request for a waiver.

Eligibility Criteria

To qualify for the Form 89 224 Penalty Waiver, taxpayers must meet certain eligibility criteria. Generally, the Texas Comptroller considers factors such as:

- The nature of the penalty incurred and the taxpayer's compliance history.

- Evidence of reasonable cause for the failure to comply with tax obligations.

- Timeliness of the waiver request relative to the penalties.

Form Submission Methods

The Form 89 224 Penalty Waiver can be submitted through various methods to accommodate different taxpayer preferences. These methods include:

- Online Submission: Taxpayers can submit the form electronically through the Texas Comptroller's online portal.

- Mail: The completed form can be sent via postal mail to the appropriate address provided by the Comptroller's office.

- In-Person: Taxpayers may also choose to deliver the form in person at designated Comptroller offices.

Quick guide on how to complete form 89 224 penalty waiver

Complete Form 89 224 Penalty Waiver effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the needed form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Form 89 224 Penalty Waiver on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to modify and eSign Form 89 224 Penalty Waiver with ease

- Find Form 89 224 Penalty Waiver and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors that necessitate printing new document versions. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and eSign Form 89 224 Penalty Waiver and maintain excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 89 224 penalty waiver

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 89 224, and why is it important?

The form 89 224 is a standardized document used for various business processes, including contracts and agreements. It ensures that all relevant information is captured accurately, making it essential for legal and compliance purposes.

-

How can airSlate SignNow help with filling out the form 89 224?

AirSlate SignNow simplifies the process of completing the form 89 224 by providing an intuitive interface that guides users through each step. This allows you to fill out the necessary fields easily and reduces the chance of errors.

-

What features does airSlate SignNow offer for handling the form 89 224?

AirSlate SignNow provides features like electronic signatures, document templates, and real-time collaboration that enhance the handling of the form 89 224. These tools streamline the workflow and ensure that your documents are processed quickly and securely.

-

Is there a cost associated with using airSlate SignNow for form 89 224?

Yes, airSlate SignNow offers different pricing plans based on your business needs. The pricing is competitive, providing excellent value for managing documents like the form 89 224 efficiently.

-

Can I integrate airSlate SignNow with other applications while using form 89 224?

Absolutely! AirSlate SignNow offers integration capabilities with various applications, allowing you to streamline your workflow while working with the form 89 224. This ensures that all your business tools work seamlessly together.

-

What are the benefits of using airSlate SignNow for the form 89 224?

Using airSlate SignNow for the form 89 224 offers numerous benefits, including time savings, enhanced security, and improved accuracy. It allows businesses to sign documents electronically, reducing paper use and improving overall efficiency.

-

Is airSlate SignNow user-friendly when completing the form 89 224?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the form 89 224. Its straightforward interface ensures that even those not tech-savvy can navigate and use the platform effectively.

Get more for Form 89 224 Penalty Waiver

Find out other Form 89 224 Penalty Waiver

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online