Mt40 Filing Address Form

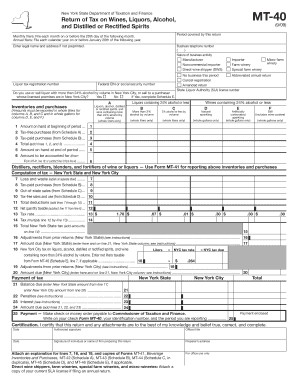

What is the Mt40 Filing Address Form

The Mt40 Filing Address Form is a specific document used primarily for tax purposes in the United States. It serves to provide the Internal Revenue Service (IRS) with the necessary information regarding an individual's or entity's filing address. This form is essential for ensuring that tax documents are sent to the correct location, thereby facilitating accurate communication between taxpayers and the IRS.

How to use the Mt40 Filing Address Form

Using the Mt40 Filing Address Form involves several straightforward steps. First, ensure you have the most current version of the form, which can be obtained from the IRS website or authorized tax software. Next, accurately fill in your personal or business details, including your name, address, and any relevant identification numbers. After completing the form, review it for accuracy before submitting it according to the specified guidelines.

Steps to complete the Mt40 Filing Address Form

Completing the Mt40 Filing Address Form requires attention to detail. Follow these steps:

- Obtain the latest version of the form.

- Fill in your name and address accurately.

- Include any required identification numbers, such as your Social Security Number (SSN) or Employer Identification Number (EIN).

- Review the form for any errors or omissions.

- Submit the form via the appropriate method, whether online, by mail, or in person.

Legal use of the Mt40 Filing Address Form

The Mt40 Filing Address Form is legally binding once completed and submitted according to IRS regulations. It is crucial to ensure that all information provided is accurate and truthful, as any discrepancies may lead to penalties or delays in processing. The form must be submitted within the designated time frames to maintain compliance with tax laws.

Required Documents

When completing the Mt40 Filing Address Form, certain documents may be required to ensure accuracy and compliance. These typically include:

- Your Social Security Number (SSN) or Employer Identification Number (EIN).

- Proof of residency or business address, such as utility bills or lease agreements.

- Previous tax returns, if applicable, to verify your filing history.

Form Submission Methods

The Mt40 Filing Address Form can be submitted through various methods, accommodating different preferences and needs. These methods include:

- Online submission through authorized tax software.

- Mailing the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices.

Penalties for Non-Compliance

Failing to submit the Mt40 Filing Address Form or providing inaccurate information can result in penalties. These may include fines, delayed processing of tax returns, or complications in receiving tax refunds. It is important to adhere to all filing requirements to avoid these potential issues.

Quick guide on how to complete mt40 filing address form

Prepare Mt40 Filing Address Form seamlessly on any device

Web-based document management has gained traction among enterprises and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can acquire the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly and without hassle. Manage Mt40 Filing Address Form on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest way to modify and eSign Mt40 Filing Address Form without hassle

- Locate Mt40 Filing Address Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form, whether via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes requiring new printed document copies. airSlate SignNow meets your document management requirements with just a few clicks from any device of your choice. Modify and eSign Mt40 Filing Address Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mt40 filing address form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Mt40 Filing Address Form?

The Mt40 Filing Address Form is a specific document used for official filings in various regulatory contexts. This form helps streamline the process of submitting essential information, ensuring that your filings signNow the appropriate recipients promptly and accurately.

-

How can I easily fill out the Mt40 Filing Address Form?

You can fill out the Mt40 Filing Address Form effortlessly with airSlate SignNow. Our platform provides intuitive features that enable users to fill in and eSign forms quickly, ensuring all necessary information is captured accurately without any paperwork hassle.

-

Is there a cost associated with using the Mt40 Filing Address Form through airSlate SignNow?

Yes, there are affordable pricing plans for using the Mt40 Filing Address Form via airSlate SignNow. We offer various subscription options tailored to meet different business needs, making it cost-effective for organizations of any size.

-

What features does airSlate SignNow offer for the Mt40 Filing Address Form?

AirSlate SignNow offers numerous features for the Mt40 Filing Address Form, including customizable templates, electronic signatures, real-time tracking, and secure storage. These features enhance your filing process, making it more efficient and compliant with regulations.

-

How does using the Mt40 Filing Address Form benefit my business?

Utilizing the Mt40 Filing Address Form can signNowly benefit your business by reducing the time spent on paperwork and minimizing errors. With airSlate SignNow’s automated workflow, you can focus on more critical tasks while ensuring compliance and accuracy in your filings.

-

Can I integrate the Mt40 Filing Address Form with other software?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, allowing you to use the Mt40 Filing Address Form alongside your existing tools. This integration enhances your overall workflow and improves document management signNowly.

-

What security measures are in place for the Mt40 Filing Address Form?

When using the Mt40 Filing Address Form, airSlate SignNow prioritizes your data security with advanced measures. We employ encryption, multi-factor authentication, and strict access controls to ensure that all your documents and information remain secure and confidential.

Get more for Mt40 Filing Address Form

Find out other Mt40 Filing Address Form

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word