Llc 1011 Virginia Fillable PDF Form

What is the LLC 1011 Virginia Fillable PDF

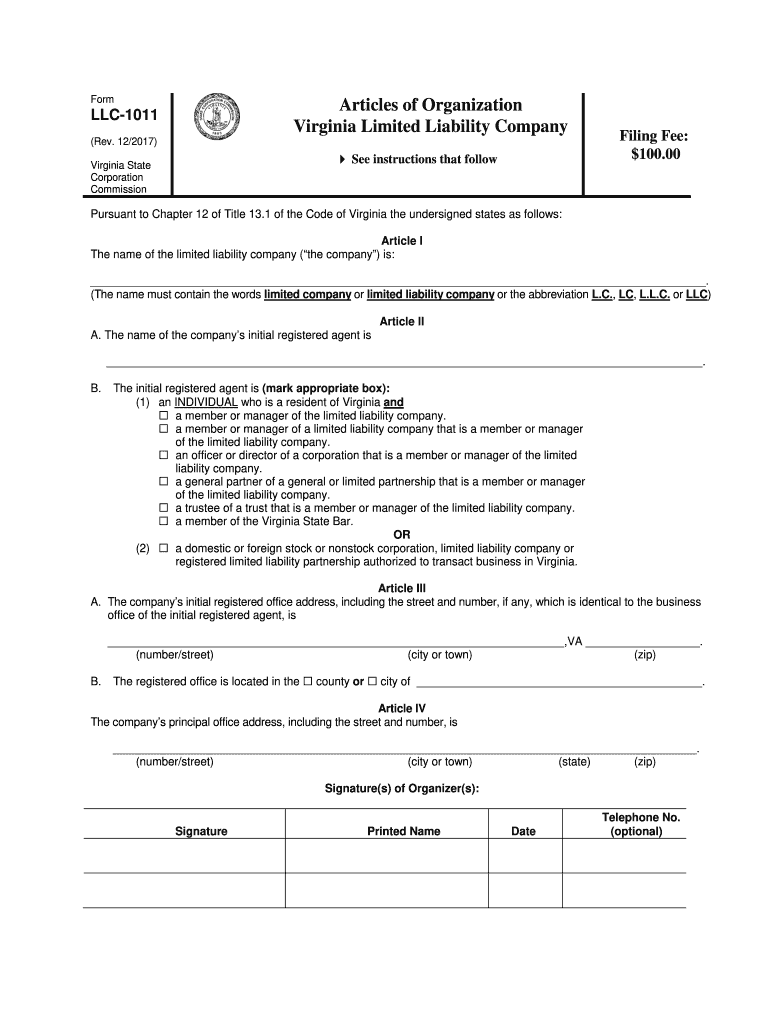

The LLC 1011 Virginia Fillable PDF is an official document used for the formation of a Limited Liability Company (LLC) in the state of Virginia. This form is essential for individuals or groups looking to establish a legal business entity that provides liability protection while allowing for flexible management and tax benefits. The fillable PDF format allows users to complete the document electronically, ensuring accuracy and ease of submission. It includes fields for essential information such as the LLC's name, registered agent, and business address, which are critical for the registration process.

Steps to Complete the LLC 1011 Virginia Fillable PDF

Completing the LLC 1011 Virginia Fillable PDF involves several key steps:

- Download the form from the Virginia State Corporation Commission's website.

- Open the PDF in a compatible reader that allows for form filling.

- Provide the required information, including the LLC name, registered agent details, and the principal office address.

- Review the information for accuracy to avoid delays in processing.

- Sign and date the form electronically, if applicable.

- Save the completed document to your device for submission.

How to Obtain the LLC 1011 Virginia Fillable PDF

The LLC 1011 Virginia Fillable PDF can be obtained directly from the Virginia State Corporation Commission's website. This ensures that you are using the most current version of the form. Users can navigate to the forms section of the website, locate the LLC formation documents, and download the fillable PDF. It is advisable to check for any updates or changes to the form before filling it out to ensure compliance with the latest regulations.

Legal Use of the LLC 1011 Virginia Fillable PDF

The legal use of the LLC 1011 Virginia Fillable PDF is governed by Virginia state law. To ensure that the document is valid, it must be completed accurately and submitted to the appropriate state authorities. The form serves as a declaration of the LLC's existence and must include all pertinent information required by the state. Failure to comply with the legal requirements can result in delays or denial of the LLC registration.

Key Elements of the LLC 1011 Virginia Fillable PDF

Key elements of the LLC 1011 Virginia Fillable PDF include:

- The name of the LLC, which must be unique and comply with state naming requirements.

- The registered agent's name and address, who will receive legal documents on behalf of the LLC.

- The principal office address, which must be a physical location in Virginia.

- The duration of the LLC, if not perpetual.

- The signature of the organizer, affirming the accuracy of the information provided.

Form Submission Methods

The completed LLC 1011 Virginia Fillable PDF can be submitted through various methods:

- Online: Submit the form electronically through the Virginia State Corporation Commission's online portal.

- By Mail: Print the completed form and mail it to the appropriate address provided by the state.

- In-Person: Deliver the completed form directly to the Virginia State Corporation Commission office.

Quick guide on how to complete register an llc in virginia form

Handle Llc 1011 Virginia Fillable Pdf effortlessly on any gadget

Digital document management has gained traction among organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed files, allowing you to obtain the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Llc 1011 Virginia Fillable Pdf on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Llc 1011 Virginia Fillable Pdf without hassle

- Locate Llc 1011 Virginia Fillable Pdf and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether it be email, text message (SMS), invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tiresome form searches, or mistakes that necessitate printing additional copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you choose. Edit and eSign Llc 1011 Virginia Fillable Pdf and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

-

Which W-8 form should I fill out as an LLC company?

How do they know to request a W-8 instead of a W-9? Are you Foreign?Assuming you need to submit a W-8 instead of a W-9, here are the questions to guide your W-8 decision.Do you have other members in your LLC? If you are the only member, a Single Member LLC is a Disregarded Entity taxed on your personal tax return. So you would submit the W-8BEN.If you have other members, are you subject to the default status or have you elected corporate status?If you are subject to the default status, your LLC is taxed as a partnership so submit the W-8IMYIf you elected Corporate status, submit the W-8BEN-E.https://www.irs.gov/pub/irs-pdf/...Other great answers here. Especially good advice from Carl and Mark, get to a CPA.

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

Is it best to form an LLC in Virginia or Washington DC?

It depends. If you do not intend to ever pursue outside financing, then I suggest you form the LLC in the state in which your principal place of business will be situated - typically, that is where you live. If, however, you do intend to pursue outside financing, or you at least want to keep that option available, then I would not form your LLC in either Virginia or Washington D.C. I am not familiar with the LLC laws of Virginia or Washington D.C., and the same can be said of most investors. For that reason, we would typically recommend a Delaware LLC. To that end, you may also want to consider whether a corporation might be a better choice, and there are many responses on Quora dsicussing the same. Disclaimer. All of my responses on Quora are subject to the Disclaimer set forth in my Quora Profile.

-

I do have a EIN number and LLC DE that sell online. People say that if you are incorporated in DE as a LLC than the only thing you pay is 300$ for a year and a fill out a form 1040NR. Do I have to get register to some other permits or do I have to pay any other tax?

For the sales tax issues here, check out www.taxjar.com. They’ve got this nailed.You do NOT need to file a 1040NR. You only need to file a 1040NR if you are subject to US federal income tax. That’s the case only where you have your own people on the ground in the US operating your business.Here’s more detail on how this works: Non-US Entrepreneurs: You Can Sell Products into the US without Paying US Tax - U.S Tax Services

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

Create this form in 5 minutes!

How to create an eSignature for the register an llc in virginia form

How to make an eSignature for your Register An Llc In Virginia Form online

How to generate an eSignature for your Register An Llc In Virginia Form in Chrome

How to make an electronic signature for signing the Register An Llc In Virginia Form in Gmail

How to generate an eSignature for the Register An Llc In Virginia Form right from your smartphone

How to generate an eSignature for the Register An Llc In Virginia Form on iOS

How to make an eSignature for the Register An Llc In Virginia Form on Android OS

People also ask

-

What is an articles of organization sample?

An articles of organization sample is a template that provides a structured format for creating an LLC's legal formation document. This sample typically includes essential details such as the company name, registered agent, and management structure. Using a sample ensures you cover all necessary components, simplifying the filing process.

-

How can airSlate SignNow help with articles of organization samples?

airSlate SignNow allows you to easily upload, edit, and eSign your articles of organization sample, streamlining the documentation process. With user-friendly features, you can customize your sample to fit your LLC’s specific needs. Additionally, electronic signing speeds up approvals and filings, positioning your business for a swift start.

-

Are there any costs associated with using articles of organization samples on airSlate SignNow?

Using airSlate SignNow involves affordable subscription plans, which include access to articles of organization samples. The pricing is designed to suit various business needs, ensuring that small businesses can harness this powerful tool without breaking the bank. You'll find that the return on investment far outweighs the initial costs when you utilize our solution.

-

What are the key features of airSlate SignNow for managing articles of organization samples?

Key features include straightforward document upload, customizable templates, and efficient eSigning options. These features make it easy to manage your articles of organization sample from start to finish. Additionally, you can track document status and receive notifications, ensuring you never miss an important step.

-

What benefits can I expect when using airSlate SignNow for my articles of organization?

By using airSlate SignNow for your articles of organization sample, you benefit from enhanced collaboration and faster turnaround times. The electronic signing process eliminates the need for physical documents, reducing delays. Furthermore, you can store your documents securely in the cloud, allowing easy access and management from anywhere.

-

Can I integrate airSlate SignNow with other tools for managing articles of organization samples?

Yes, airSlate SignNow supports integration with a variety of productivity and business management tools. This capability allows you to seamlessly incorporate your articles of organization sample into your existing workflows. Popular integrations include Google Drive, Dropbox, and CRM systems, enhancing your document management efficiency.

-

Is it easy to create an articles of organization sample on airSlate SignNow?

Absolutely! airSlate SignNow provides intuitive tools that make it easy to create and customize your articles of organization sample. With guided step-by-step processes, you can ensure that your document meets all legal requirements with minimal effort, making it accessible for users of all experience levels.

Get more for Llc 1011 Virginia Fillable Pdf

Find out other Llc 1011 Virginia Fillable Pdf

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement