Form 2106

What is the Form 2106

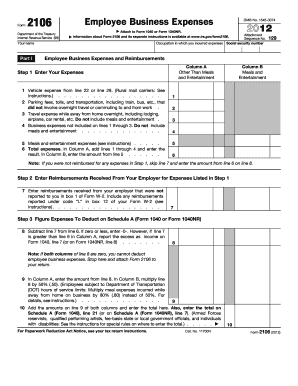

The Form 2106, also known as the Employee Business Expenses form, is used by employees to report unreimbursed business expenses. This form allows individuals to deduct certain costs incurred while performing their job duties, which can include travel, meals, and other necessary expenses. It is essential for employees who do not receive reimbursement from their employers for these expenses, enabling them to potentially reduce their taxable income.

How to use the Form 2106

Using the Form 2106 involves several steps. First, gather all relevant documentation related to business expenses, such as receipts and invoices. Next, accurately fill out the form, detailing each expense type and amount. It is crucial to categorize expenses correctly, as this will impact the deductions available. After completing the form, it should be submitted with your tax return to the IRS, ensuring that all information is accurate and supported by documentation.

Steps to complete the Form 2106

Completing the Form 2106 requires careful attention to detail. Follow these steps for successful completion:

- Collect all necessary receipts and records of business expenses.

- Fill out your personal information at the top of the form.

- List your business expenses in the appropriate sections, including transportation, meals, and lodging.

- Calculate the total of your expenses and ensure they align with IRS guidelines.

- Sign and date the form before submitting it with your tax return.

Legal use of the Form 2106

The legal use of the Form 2106 is governed by IRS regulations. To ensure compliance, it is important to keep accurate records of all expenses claimed. The form must be used correctly to substantiate any deductions taken on your tax return. Failure to comply with IRS rules can result in penalties or disallowance of deductions, making it essential to understand the legal implications of using this form.

IRS Guidelines

The IRS provides specific guidelines for using the Form 2106. These guidelines outline what qualifies as a deductible expense, the documentation required, and the process for filing. It is important to refer to the latest IRS publications related to employee business expenses to ensure that you are following the most current rules and regulations. Adhering to these guidelines will help maximize your deductions while maintaining compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2106 align with the general tax return deadlines. Typically, individual tax returns are due on April 15 each year. If you require additional time, you may file for an extension, but be aware that any taxes owed are still due by the original deadline. Keeping track of these important dates ensures that you submit your form on time and avoid penalties.

Required Documents

When completing the Form 2106, several documents are required to substantiate your claims. These include:

- Receipts for all business-related expenses.

- Invoices or statements that detail the nature of the expenses.

- Any correspondence from your employer regarding reimbursements.

Having these documents organized and readily available will facilitate a smoother filing process and support your claims if audited by the IRS.

Quick guide on how to complete form 2106 27248984

Complete Form 2106 effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 2106 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to edit and electronically sign Form 2106 with ease

- Obtain Form 2106 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or mistakes that necessitate re-printing. airSlate SignNow fulfills all your document management needs in a few clicks from any device of your choosing. Modify and electronically sign Form 2106 to guarantee excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2106 27248984

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2012 form 2106 used for?

The 2012 form 2106 is primarily used by employees to claim deductions for business expenses related to their job. This form allows taxpayers to report and deduct unreimbursed expenses incurred while performing job duties. Understanding its details can help maximize deductions and minimize taxable income.

-

How can airSlate SignNow assist with the 2012 form 2106?

airSlate SignNow offers a streamlined process for electronically signing and sending the 2012 form 2106. Our platform ensures that your documents are securely signed, stored, and managed, making tax preparation a hassle-free experience. You can focus on what matters while we take care of the eSigning process.

-

Is there a cost to use airSlate SignNow for 2012 form 2106 submissions?

AirSlate SignNow provides a variety of pricing plans that cater to different needs, including free trials for new users. You can efficiently send and eSign the 2012 form 2106 without hidden fees. Evaluate our pricing plans to determine the best options for your business.

-

What features does airSlate SignNow offer for the 2012 form 2106?

With airSlate SignNow, you gain access to essential features like document templates, secure cloud storage, and advanced tracking for your 2012 form 2106. The platform also supports in-person signing and provides a user-friendly interface to streamline your document workflow. This enhances productivity while ensuring compliance.

-

Can airSlate SignNow integrate with accounting software for the 2012 form 2106?

Absolutely! airSlate SignNow seamlessly integrates with several popular accounting software solutions. This allows you to directly manage your 2012 form 2106 and related documents in conjunction with your accounting tools, ensuring all your financial records are organized and accessible.

-

What are the benefits of using airSlate SignNow for the 2012 form 2106?

Using airSlate SignNow for the 2012 form 2106 provides numerous benefits, including faster processing times and improved document security. Our platform simplifies eSigning, reduces paperwork, and enhances collaboration amongst team members. This results in a more efficient workflow for your tax documentation.

-

How secure is my information when completing the 2012 form 2106 with airSlate SignNow?

Safety and security are paramount at airSlate SignNow. We utilize industry-leading encryption protocols to protect your personal and financial information while completing the 2012 form 2106. Our commitment to your data security ensures your documents are safe from unauthorized access.

Get more for Form 2106

Find out other Form 2106

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now