Form N 342

What is the Form N 342

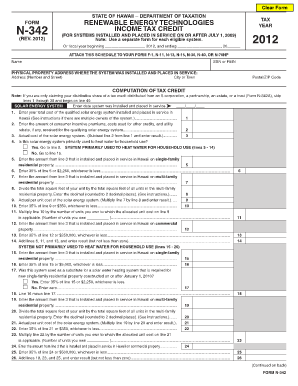

The Form N 342 is a specific document used for various administrative purposes within the United States. It is often associated with legal or tax-related matters, serving as a formal request or declaration that must be completed accurately to ensure compliance with relevant regulations. Understanding its purpose is essential for individuals and businesses alike, as improper use or completion can lead to delays or penalties.

How to use the Form N 342

Using the Form N 342 involves several key steps that ensure proper completion and submission. First, it is important to gather all necessary information and documentation required to fill out the form accurately. This includes personal identification details, financial information, or any other relevant data. Once the form is filled out, it can be submitted through various methods, including online submission, mailing, or in-person delivery, depending on the specific requirements associated with the form.

Steps to complete the Form N 342

Completing the Form N 342 involves a systematic approach to ensure accuracy and compliance. Here are the steps to follow:

- Review the form's instructions carefully to understand the requirements.

- Gather all necessary documents and information needed for completion.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check for any errors or omissions before submission.

- Choose the appropriate submission method based on the guidelines provided.

Legal use of the Form N 342

The legal use of the Form N 342 is governed by specific regulations that dictate how it should be completed and submitted. It is crucial to adhere to these legal standards to ensure that the form is recognized as valid by relevant authorities. This includes understanding the implications of digital signatures, ensuring compliance with eSignature laws, and maintaining confidentiality of sensitive information throughout the process.

Key elements of the Form N 342

Key elements of the Form N 342 include specific fields that must be completed accurately. These typically involve personal identification information, the purpose of the form, and any necessary declarations or certifications. Each section is designed to capture essential details that facilitate the processing of the form, making it vital to provide accurate and truthful information to avoid complications.

Filing Deadlines / Important Dates

Filing deadlines associated with the Form N 342 can vary based on the specific context in which it is used. It is important to be aware of these deadlines to ensure timely submission. Missing a deadline may result in penalties or delays in processing. Always check the latest guidelines or consult with a professional to confirm the relevant dates associated with your specific situation.

Form Submission Methods (Online / Mail / In-Person)

The Form N 342 can be submitted through various methods, including online, by mail, or in person. Each method has its own set of procedures and requirements. Online submission is often the quickest and most efficient option, while mailing the form may require additional time for processing. In-person submission may be necessary in certain situations, particularly when immediate confirmation of receipt is needed. Understanding the best method for your circumstances can help streamline the process.

Quick guide on how to complete form n 342

Complete Form N 342 effortlessly on any device

Online document management has gained traction with businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documentation, allowing you to locate the correct form and securely preserve it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without holdups. Manage Form N 342 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to alter and eSign Form N 342 with ease

- Locate Form N 342 and then click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal significance as a traditional handwritten signature.

- Review the details and then click the Done button to finalize your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or through an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Alter and eSign Form N 342 while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form n 342

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form n 342?

Form n 342 is a specific document required for certain legal and administrative processes. It often serves as a crucial means of communication and verification in business transactions. Utilizing tools like airSlate SignNow can streamline the completion and submission of form n 342, ensuring compliance and efficiency.

-

How does airSlate SignNow support the completion of form n 342?

airSlate SignNow offers a user-friendly platform that allows businesses to easily prepare, sign, and send form n 342. With its intuitive interface and features like templates, teams can efficiently manage the document workflow. This ensures that your form n 342 is completed accurately and in a timely manner.

-

Is there a cost associated with using airSlate SignNow for form n 342?

Yes, airSlate SignNow has various pricing plans to accommodate different business needs. The cost depends on the features required, such as document templates and user capacity. However, the value of using airSlate SignNow for processing form n 342 can greatly outweigh the costs, especially in terms of time saved and improved accuracy.

-

What are the benefits of using airSlate SignNow for form n 342?

Using airSlate SignNow for form n 342 provides several advantages, including enhanced security, ease of use, and reduced turnaround time. The platform's electronic signature capabilities ensure that the form is signed quickly and legally. Furthermore, tracking and managing your documents become easier with all actions recorded within the platform.

-

Can I integrate airSlate SignNow with other software to manage form n 342?

Absolutely! airSlate SignNow offers integration options with various software platforms, enhancing your ability to manage form n 342. Through integrations, you can link your accounting software, CRM, or other systems, streamlining the overall document handling process. This connectivity ensures your data works seamlessly across your business applications.

-

Are there templates available for form n 342 in airSlate SignNow?

Yes, airSlate SignNow provides templates for form n 342, making it easier to get started. These templates are customizable, allowing you to tailor the document to your specific needs. This feature helps reduce errors and saves time, enabling your team to focus on other critical tasks.

-

What security measures does airSlate SignNow have for form n 342?

airSlate SignNow implements robust security measures for handling form n 342, including encryption and secure data storage. The platform also complies with various industry regulations to protect sensitive information. This ensures that when you use airSlate SignNow for form n 342, your data remains safe and confidential.

Get more for Form N 342

Find out other Form N 342

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free