AU 724, Motor Vehicle Fuels Tax Refund Claim off CT Gov Ct Form

What is the AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct

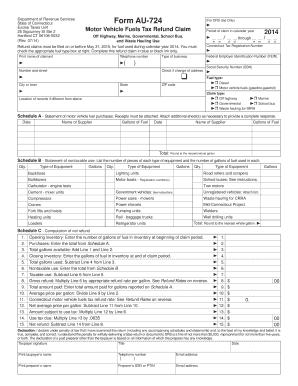

The AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct is a form used by individuals and businesses in Connecticut to claim refunds on taxes paid for motor vehicle fuels. This form is essential for those who have incurred fuel taxes while operating vehicles for specific purposes, such as agricultural or commercial use. By submitting this claim, taxpayers can recover a portion of the taxes they have paid, thereby alleviating some financial burdens associated with fuel costs.

Steps to complete the AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct

Completing the AU 724 form requires careful attention to detail. Here are the essential steps:

- Gather necessary documentation, including receipts for fuel purchases and proof of vehicle use.

- Fill out the form accurately, providing all requested information such as your name, address, and tax identification number.

- Detail the amounts of fuel purchased and the corresponding taxes paid.

- Sign and date the form to affirm the accuracy of the information provided.

- Submit the completed form either online or via mail, following the specific submission guidelines outlined by the state.

How to obtain the AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct

The AU 724 form can be obtained through the official Connecticut government website. It is available for download in a printable format, allowing users to fill it out by hand or digitally. Additionally, local tax offices may provide physical copies of the form. Ensure that you are using the most current version of the form to avoid any issues during the submission process.

Eligibility Criteria

To qualify for a refund using the AU 724 form, applicants must meet specific eligibility criteria. These include:

- Proof of fuel purchases that include the taxes paid.

- Documentation showing that the fuel was used for qualifying purposes, such as agricultural or commercial activities.

- Compliance with any additional state-specific requirements that may apply to your situation.

Legal use of the AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct

The AU 724 form is legally recognized as a valid means for claiming tax refunds on motor vehicle fuels in Connecticut. To ensure its legal standing, it is crucial to complete the form accurately and submit it within the designated time frames. Compliance with state laws regarding tax refunds is essential to avoid penalties or denial of the claim.

Form Submission Methods (Online / Mail / In-Person)

Submitting the AU 724 form can be done through various methods. Taxpayers can choose to file online through the state’s tax portal, which often provides a quicker processing time. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each submission method has its own guidelines, so it is important to follow the instructions carefully to ensure successful processing.

Quick guide on how to complete au 724 motor vehicle fuels tax refund claim off ct gov ct

Effortlessly prepare AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without hindrances. Manage AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct effortlessly

- Locate AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specially provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your updates.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from a device of your choice. Modify and eSign AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the au 724 motor vehicle fuels tax refund claim off ct gov ct

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct process?

The AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct is a process designed to help vehicle owners recover taxes on fuels that were not used for taxable purposes. By submitting this claim, individuals can receive refunds for their qualified fuel expenses, making it a worthwhile financial opportunity. Understanding how to correctly complete the claim is essential for optimal results.

-

Who is eligible to file the AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct?

Eligibility for the AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct generally includes individuals and businesses that utilize motor fuels for vehicles not subject to taxation. This typically applies to companies in specific sectors or those who can demonstrate that the fuel was consumed off-road or for otherwise tax-exempt purposes. It's important to review the requirements to ensure you qualify.

-

What documentation is needed for the AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct?

To file the AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct, you need to provide proof of fuel purchases, such as receipts and invoices. Additionally, documentation verifying that the fuel was used for non-taxable purposes must be included with your claim submission. Ensuring proper documentation can streamline the refund process.

-

How long does it take to receive a refund after submitting the AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct?

After submitting the AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct, the processing time may take several weeks to a few months depending on the volume of claims. State agencies typically review submissions carefully to validate claims. Patience is advised, but you can always follow up if you have concerns about your claim's status.

-

Are there any fees associated with filing the AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct?

Filing the AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct is generally free if you submit your claim directly to the state. However, if you choose to use third-party services or software for assistance, there may be associated service fees. Always check the details to understand any potential costs involved in the process.

-

Can I track the status of my AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct?

Yes, most state agencies provide a way to track the status of your AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct after submission. You may find online tracking tools that allow you to enter your details and view the progress of your claim. Regularly checking your status can keep you informed about your refund.

-

What are the benefits of using airSlate SignNow for my AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct documents?

Using airSlate SignNow to manage your AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct documents offers efficiency and ease of use. You can eSign necessary forms, track documents, and ensure secure storage all within one platform. This enhances your workflow and can help expedite the claim process.

Get more for AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct

- Allstate insurance application form

- Sg lourens nursing college application form sg lourens nursing college application form

- Sample of philhealth form with answer

- Form xxviii wage slip format

- Theraputty exercises pdf 288472431 form

- Pakistan embassy madrid passport form

- State of md withholding form 766

- Nuisance response plan cityofventura form

Find out other AU 724, Motor Vehicle Fuels Tax Refund Claim Off CT gov Ct

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document