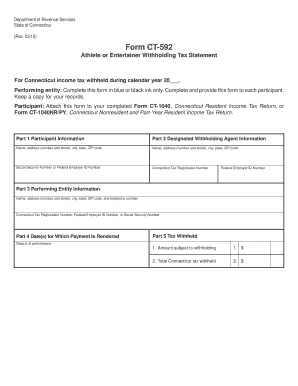

Ct 592 Form

What is the Ct 592

The Ct 592 form is a document used primarily for reporting certain tax-related information in the United States. It serves as a means for individuals and businesses to disclose specific financial details to the relevant tax authorities. Understanding the purpose of the Ct 592 form is crucial for compliance with federal and state tax regulations.

How to use the Ct 592

Using the Ct 592 form involves several steps to ensure accurate reporting. First, gather all necessary financial documents that pertain to the information you need to report. Next, carefully fill out the form, ensuring that all required fields are completed accurately. After completing the form, review it for any errors before submission. This careful process helps ensure compliance and reduces the risk of penalties.

Steps to complete the Ct 592

Completing the Ct 592 form requires attention to detail. Follow these steps:

- Obtain the latest version of the Ct 592 form from the appropriate tax authority.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide the required financial information as specified in the form.

- Double-check all entries for accuracy and completeness.

- Sign and date the form where indicated.

Legal use of the Ct 592

The Ct 592 form is legally binding when completed correctly and submitted in accordance with applicable laws. It is important to adhere to the guidelines set forth by the IRS and state tax authorities to ensure that the information reported is valid. Failure to comply with these regulations can result in penalties or legal consequences.

Key elements of the Ct 592

Key elements of the Ct 592 form include:

- Taxpayer Information: Essential details about the individual or business filing the form.

- Financial Data: Specific financial information that must be reported, which varies based on the taxpayer's situation.

- Signature: A required signature that verifies the accuracy of the information provided.

Form Submission Methods

The Ct 592 form can be submitted through various methods, including:

- Online Submission: Many tax authorities offer electronic filing options for convenience.

- Mail: You can print the completed form and send it to the designated address provided by the tax authority.

- In-Person: Some individuals may choose to submit the form in person at a local tax office.

Quick guide on how to complete ct 592

Complete Ct 592 effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly with no delays. Handle Ct 592 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Ct 592 with ease

- Locate Ct 592 and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and hit the Done button to preserve your adjustments.

- Choose your preferred method for submitting your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Ct 592 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 592

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 592 and how does it relate to airSlate SignNow?

ct 592 refers to a specific tax form used for Connecticut business taxes. While airSlate SignNow does not directly handle tax forms, it can help you eSign and manage documents related to business taxes efficiently, including ct 592.

-

How can airSlate SignNow help streamline the signing process for ct 592?

With airSlate SignNow, you can easily upload, send, and eSign your ct 592 documents within minutes. The platform's intuitive interface ensures a seamless experience, allowing multiple parties to sign the form without delays.

-

Is airSlate SignNow a cost-effective solution for managing ct 592 documents?

Yes, airSlate SignNow is a cost-effective solution for handling ct 592 documents. The pricing plans are designed to accommodate businesses of all sizes, maximizing your value while ensuring you have all the tools necessary for efficient document management.

-

What features does airSlate SignNow offer for electronic signatures on ct 592?

airSlate SignNow provides a range of features ideal for eSigning ct 592 documents, including customizable workflows, reminders for signers, and secure electronic storage. These functionalities enhance the signing experience and maintain document integrity.

-

Can I integrate airSlate SignNow with other platforms for handling ct 592 forms?

Absolutely! airSlate SignNow integrates seamlessly with various applications and platforms, making it easier to manage your ct 592 forms alongside other essential business software, including CRM and accounting tools.

-

What are the benefits of using airSlate SignNow for ct 592 eSigning?

Using airSlate SignNow for ct 592 eSigning offers numerous benefits, including increased efficiency, reduced paper usage, and higher compliance with legal requirements. This ensures that your business operates smoothly and remains organized.

-

Is airSlate SignNow secure for signing sensitive ct 592 documents?

Yes, airSlate SignNow prioritizes security with industry-standard encryption and secure access controls, making it safe for signing sensitive ct 592 documents. You can trust the platform to protect your data while maintaining compliance.

Get more for Ct 592

Find out other Ct 592

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal