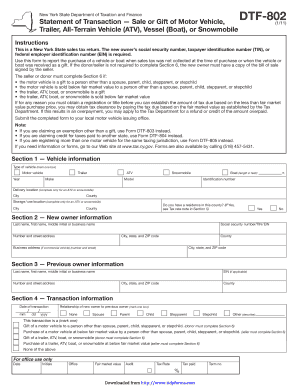

Dtf 802 Form

What is the DTF 802?

The DTF 802, also known as the New York State Department of Taxation and Finance form, is primarily used for tax purposes. This form is essential for individuals and businesses who need to report specific tax information to the state. It plays a crucial role in determining tax liabilities and ensuring compliance with state tax regulations. Understanding the purpose and requirements of the DTF 802 is vital for accurate tax reporting and avoiding potential penalties.

How to use the DTF 802

Using the DTF 802 involves several steps to ensure proper completion and submission. First, gather all necessary financial documents that pertain to your tax situation. Next, fill out the form accurately, ensuring that all required fields are completed. It is important to double-check your entries for any errors before submission. Once the form is filled out, you can submit it either electronically or via mail, depending on your preference and the specific requirements for your tax situation.

Steps to complete the DTF 802

Completing the DTF 802 requires careful attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the DTF 802 form from the New York State Department of Taxation and Finance website.

- Review the instructions provided with the form to understand the requirements.

- Fill in your personal information, including your name, address, and tax identification number.

- Provide accurate financial details as required by the form.

- Sign and date the form to certify that the information provided is true and complete.

- Submit the completed form according to the specified submission methods.

Legal use of the DTF 802

The legal use of the DTF 802 is governed by New York State tax laws. To ensure that the form is legally binding, it must be completed in accordance with the guidelines set forth by the state. This includes providing accurate information and submitting the form within the designated timeframes. Failure to comply with these regulations can result in penalties or legal consequences, making it essential to understand the legal implications of using the DTF 802.

Required Documents

When preparing to complete the DTF 802, certain documents are typically required. These may include:

- Previous tax returns for reference.

- Income statements, such as W-2s or 1099s.

- Documentation of any deductions or credits you plan to claim.

- Identification numbers, such as your Social Security number or Employer Identification Number (EIN).

Having these documents ready can streamline the process of filling out the form and help ensure accuracy.

Form Submission Methods

The DTF 802 can be submitted through various methods, allowing for flexibility based on individual preferences. The primary submission methods include:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing the completed form to the appropriate address as specified in the instructions.

- In-person submission at designated tax offices, if applicable.

Choosing the right submission method can impact processing times and should be considered based on your specific circumstances.

Quick guide on how to complete dtf 802 268642120

Complete Dtf 802 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and eSign your documents promptly without delays. Manage Dtf 802 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Dtf 802 with ease

- Find Dtf 802 and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Dtf 802 and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dtf 802 268642120

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DTF 802 tax rate?

The DTF 802 tax rate refers to a specific tax rate applicable to certain transactions. Understanding this rate is vital for businesses to ensure compliance with state tax regulations. By using the airSlate SignNow platform, you can easily manage documents and transactions that involve the DTF 802 tax rate.

-

How does airSlate SignNow help with DTF 802 tax rate documentation?

airSlate SignNow simplifies the process of preparing and signing documents that relate to the DTF 802 tax rate. With our easy-to-use platform, businesses can create, edit, and securely sign tax-related documents. This streamlines compliance and reduces the likelihood of errors associated with tax submissions.

-

Are there any fees associated with handling DTF 802 tax rate documents on airSlate SignNow?

While airSlate SignNow offers competitive pricing for its services, specific fees may depend on the volume of documents processed. Our flexible pricing plans are designed to cater to various business needs, including those dealing with DTF 802 tax rate documentation. It's best to review our pricing page for detailed information.

-

Can I integrate airSlate SignNow with my existing accounting software for DTF 802 tax rate filings?

Yes, airSlate SignNow offers integrations with popular accounting software, making it easier to manage DTF 802 tax rate filings. This integration allows you to streamline your workflow and ensure that all tax-related documents are accurate and readily accessible. Check our integrations page to learn more about compatibility.

-

What are the benefits of using airSlate SignNow for DTF 802 tax rate management?

Using airSlate SignNow for DTF 802 tax rate management offers several benefits, including improved accuracy in document handling and faster processing times. The platform's intuitive design allows for easy navigation, making tax compliance simpler for businesses. Additionally, our secure eSigning features enhance document security.

-

Is airSlate SignNow secure for managing sensitive DTF 802 tax rate documents?

Absolutely! airSlate SignNow prioritizes the security of your documents, including those related to the DTF 802 tax rate. Our platform uses advanced encryption and security protocols to protect sensitive information during transmission and storage, ensuring that your documents remain confidential.

-

How can I get started with airSlate SignNow for DTF 802 tax rate processes?

Getting started with airSlate SignNow for DTF 802 tax rate processes is easy! Simply sign up for an account on our website, and you can begin creating and managing your documents. We also offer comprehensive resources and customer support to help you optimize your experience with our platform.

Get more for Dtf 802

- Grading certificate form

- Chattel mortgage form

- Sponsorship application form muskowekwan muskowekwan

- Cea blood test form ontario fullexamscom

- Submit to the office of the dean of the student s home faculty form

- Tphc new pt intake form 140224doc tphc

- Icbc collector form

- Form 1 bpdf the human rights tribunal of ontario

Find out other Dtf 802

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT