Wisconsin International Fuel Tax Agreement Form

What is the Wisconsin International Fuel Tax Agreement

The Wisconsin International Fuel Tax Agreement (IFTA) is a cooperative agreement among the contiguous United States and Canadian provinces that simplifies the reporting of fuel use by motor carriers operating in multiple jurisdictions. Under IFTA, fuel taxes are collected based on the miles driven in each jurisdiction, allowing for a streamlined process for both reporting and tax payment. This agreement helps ensure that all jurisdictions receive their fair share of fuel tax revenue while reducing the administrative burden on carriers.

Steps to complete the Wisconsin International Fuel Tax Agreement

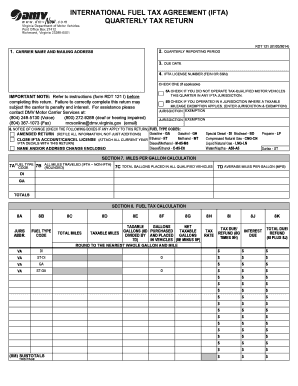

Completing the Wisconsin International Fuel Tax Agreement involves several key steps. First, you need to gather all necessary information, including vehicle details, mileage records, and fuel purchase receipts. Next, you will fill out the IFTA quarterly report form RDT 121, ensuring that all data is accurate and complete. After completing the form, review it for any discrepancies before submitting it. Finally, submit the form by the designated deadline, either online or via mail, along with any applicable tax payments.

Legal use of the Wisconsin International Fuel Tax Agreement

The legal use of the Wisconsin International Fuel Tax Agreement is governed by specific regulations that require motor carriers to comply with the reporting and payment of fuel taxes based on their operational mileage. Carriers must maintain accurate records of their fuel purchases and mileage traveled in each jurisdiction. Failure to comply with these regulations can result in penalties, including fines and audits. It is essential for carriers to understand their obligations under IFTA to ensure lawful operation and avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Wisconsin International Fuel Tax Agreement are crucial for compliance. Typically, IFTA quarterly reports, including form RDT 121, are due on the last day of the month following the end of each quarter. This means that the deadlines are April 30, July 31, October 31, and January 31 for the respective quarters. Carriers should mark these dates on their calendars to ensure timely submission and avoid penalties associated with late filings.

Required Documents

When completing the Wisconsin International Fuel Tax Agreement, several documents are required to ensure accurate reporting. Carriers need to provide detailed mileage records, fuel purchase receipts, and any relevant documentation that supports the information reported on form RDT 121. Maintaining organized records will facilitate the completion of the form and assist in any potential audits by tax authorities.

Penalties for Non-Compliance

Non-compliance with the Wisconsin International Fuel Tax Agreement can lead to significant penalties. Carriers may face fines for late submissions, inaccuracies in reporting, or failure to maintain required records. In severe cases, repeated non-compliance can result in the suspension of IFTA privileges, affecting a carrier's ability to operate across state lines. It is vital for carriers to adhere to all IFTA regulations to avoid these consequences.

Quick guide on how to complete wisconsin international fuel tax agreement

Accomplish Wisconsin International Fuel Tax Agreement effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal sustainable alternative to conventional printed and signed documents, as you can obtain the correct form and securely preserve it online. airSlate SignNow equips you with all the essentials to create, modify, and eSign your documents swiftly without hindrances. Manage Wisconsin International Fuel Tax Agreement on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to alter and eSign Wisconsin International Fuel Tax Agreement effortlessly

- Locate Wisconsin International Fuel Tax Agreement and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize relevant parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your adjustments.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Wisconsin International Fuel Tax Agreement and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wisconsin international fuel tax agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form rdt 121 and how can it be used?

The form rdt 121 is a crucial document used in various industries for streamlined signing and approval processes. With airSlate SignNow, you can easily send this form for eSigning, ensuring that your documents are securely signed and managed in one place.

-

How does airSlate SignNow support the creation of form rdt 121?

airSlate SignNow provides intuitive tools to create and customize the form rdt 121 to fit your business needs. Users can add fields, modify layouts, and integrate necessary branding elements, making it a versatile solution for any organization.

-

What pricing plans are available for using airSlate SignNow with form rdt 121?

airSlate SignNow offers various pricing plans that cater to different business sizes and needs. These plans allow you to utilize the form rdt 121 with features suited for small teams to large enterprises, ensuring affordability and flexibility.

-

Can I integrate form rdt 121 with other applications using airSlate SignNow?

Yes, airSlate SignNow allows seamless integration with a wide range of applications, making it easy to incorporate the form rdt 121 into your existing workflows. This enhances productivity by connecting with CRM systems, cloud storage, and more.

-

What are the benefits of using airSlate SignNow for the form rdt 121?

Using airSlate SignNow for the form rdt 121 offers enhanced efficiency, reduced turnaround times, and improved workflow management. The platform also provides robust security measures to protect your important documents during the signing process.

-

Is it easy to track the status of form rdt 121 with airSlate SignNow?

Absolutely! airSlate SignNow offers real-time tracking features that let you monitor the status of the form rdt 121 at any time. You'll receive notifications once it’s signed, making the document management process much simpler.

-

Can multiple users sign the form rdt 121 simultaneously?

Yes, airSlate SignNow supports simultaneous signing, allowing multiple users to sign the form rdt 121 at their convenience. This feature enhances collaboration and speeds up the overall process, which is vital for time-sensitive agreements.

Get more for Wisconsin International Fuel Tax Agreement

- Sales and use tax on aircraft florida department of revenue 533500554 form

- Council on state taxation cost form

- California form 3533 b search edit fill sign fax ampamp save pdf

- Instructions for form 592 v california

- 2020 form 592 b resident and nonresident withholding 2020 form 592 b resident and nonresident withholding

- 2019 california form 3502nonprofit corporation request for pre dissolution tax abatement 2019 california form 3502nonprofit

- W 2 duplicate request form nycgov

- Instructions for filing terminal supplier fuel tax return form

Find out other Wisconsin International Fuel Tax Agreement

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online