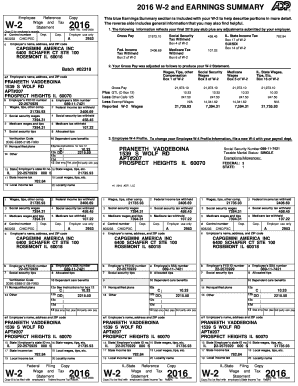

The Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted by Your Employer

What is the Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer

The Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer is a crucial document that outlines an employee's earnings and deductions for a specific pay period. This form typically includes details such as gross pay, net pay, tax withholdings, and any adjustments made by the employer. Understanding this document is essential for employees to verify their compensation and ensure that all deductions are accurate.

How to Use the Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer

To effectively use the Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer, employees should review each section carefully. Begin by checking the gross pay to confirm that it aligns with the agreed-upon salary or hourly wage. Next, examine the deductions for taxes, retirement contributions, and other withholdings. This review helps ensure that the final net pay is accurate and that all adjustments have been properly accounted for.

Steps to Complete the Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer

Completing the Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer involves several steps:

- Gather all necessary information, including hours worked, salary details, and any adjustments.

- Calculate the gross pay based on hourly rates or salary agreements.

- Deduct applicable taxes and other withholdings to determine net pay.

- Include any adjustments submitted by the employer, such as bonuses or corrections.

- Review the completed pay stub for accuracy before finalizing.

Key Elements of the Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer

Key elements of the Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer include:

- Employee Information: Name, address, and employee identification number.

- Pay Period: The specific dates for which the pay is calculated.

- Gross Pay: Total earnings before deductions.

- Deductions: Taxes, insurance, and retirement contributions.

- Net Pay: Final amount received after all deductions.

- Adjustments: Any changes made by the employer affecting pay.

Legal Use of the Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer

The Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer serves as a legal document that provides proof of income. It is often required for various purposes, such as applying for loans, renting property, or filing taxes. Ensuring that this document is accurate and properly formatted is vital for its acceptance in legal and financial transactions.

Who Issues the Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer

The Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer is typically issued by the employer or payroll department. Employers are responsible for generating this document at the end of each pay period and providing it to employees. It is important for employers to ensure that all information is accurate and compliant with federal and state regulations.

Quick guide on how to complete the following information reflects your final pay stub plus any adjustments submitted by your employer

Complete The Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily locate the appropriate form and securely save it online. airSlate SignNow supplies you with all the resources necessary to create, modify, and digitally sign your documents promptly without delays. Manage The Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The easiest way to alter and digitally sign The Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer with ease

- Obtain The Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer and click on Get Form to begin.

- Utilize the tools provided to finish your document.

- Mark relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Select your preferred method of sending your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiring document searches, or errors that require new copies to be printed. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and digitally sign The Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer and ensure exceptional communication throughout every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the following information reflects your final pay stub plus any adjustments submitted by your employer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does the phrase 'The Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer' mean?

This phrase means that the document includes the final details of your payroll, along with any modifications made by your employer. Understanding this information is crucial for personal finance management, as it helps you confirm your earnings and deductions. It's important to keep track of any adjustments to ensure your records are accurate.

-

How does airSlate SignNow handle document security for sensitive information like pay stubs?

AirSlate SignNow prioritizes document security by employing advanced encryption methods and secure cloud storage. This ensures that 'The Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer' is protected from unauthorized access. You can trust that your sensitive information remains confidential throughout the entire eSigning process.

-

Are there any integrations available with airSlate SignNow for payroll systems?

Yes, airSlate SignNow offers integrations with various payroll systems to streamline the process. By connecting your payroll software, you can easily manage documents like 'The Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer' without manual entry. This increases efficiency and ensures accuracy in your payroll records.

-

What features make airSlate SignNow a cost-effective solution for businesses?

AirSlate SignNow combines robust eSigning capabilities with a user-friendly interface, making it an affordable choice for businesses. With features like customizable templates and real-time collaboration, you can efficiently manage documents related to 'The Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer.' This helps reduce operational costs and improve productivity.

-

Can I customize my final pay stubs using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your documents, including final pay stubs. You can easily add necessary adjustments and ensure 'The Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer' accurately represents your payroll in a professional format.

-

What are the benefits of using airSlate SignNow for employee documentation?

Using airSlate SignNow simplifies the eSigning process for employee documentation, making it quick and efficient. This ensures that essential documents like 'The Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer' are signed and processed without delays. Furthermore, the platform enhances transparency and compliance in managing employee records.

-

How can I track changes made to my pay stub within airSlate SignNow?

AirSlate SignNow provides features that allow you to track changes and revisions made to your pay stub documents. You can easily review the history of 'The Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer' and identify any updates. This audit trail helps maintain accountability and ensures that all modifications are documented.

Get more for The Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer

- April 2020 s 012 st 12 wisconsin sales and use tax return state county and stadium sales and use tax st 12 form

- 2019 pa schedule ue allowable employee business expenses pa 40 ue formspublications

- Schedule a on the back of this form and use filing status c

- Whats new for louisiana 2019 individual income tax form

- Fillable online franchisee application form the

- 05 income from form 1 line 10 or form 1 nrpy line 12

- The status of a refund is available at form

- Lansing individual income tax forms and instructions

Find out other The Following Information Reflects Your Final Pay Stub Plus Any Adjustments Submitted By Your Employer

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament