City of Battle Creek Annual Reconciliation Form

What is the City Of Battle Creek Annual Reconciliation Form

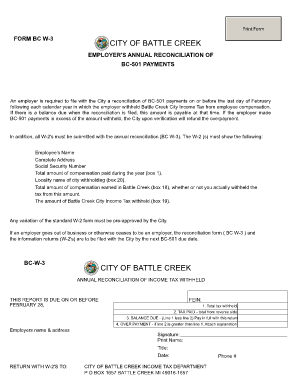

The City Of Battle Creek Annual Reconciliation Form is a crucial document used by businesses and individuals to report financial activities and ensure compliance with local regulations. This form typically summarizes income, expenses, and other financial data for the year, allowing the city to assess tax obligations accurately. It serves as a tool for reconciliation between reported figures and actual financial activities, helping to maintain transparency and accountability in financial reporting.

How to obtain the City Of Battle Creek Annual Reconciliation Form

To obtain the City Of Battle Creek Annual Reconciliation Form, individuals and businesses can visit the official city website or contact the city’s finance department directly. The form is often available for download in a digital format, making it easy to access and complete. Additionally, physical copies may be available at designated city offices for those who prefer traditional methods of obtaining documents.

Steps to complete the City Of Battle Creek Annual Reconciliation Form

Completing the City Of Battle Creek Annual Reconciliation Form involves several key steps:

- Gather all necessary financial documents, including income statements, expense receipts, and previous tax returns.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the information for accuracy, checking for any discrepancies or missing data.

- Sign the form electronically or manually, depending on the submission method.

- Submit the completed form by the specified deadline, either online, by mail, or in person.

Legal use of the City Of Battle Creek Annual Reconciliation Form

The legal use of the City Of Battle Creek Annual Reconciliation Form is essential for compliance with local tax laws. When completed correctly, this form serves as a legally binding document that can be used in audits or disputes regarding financial reporting. It is important to adhere to all relevant regulations and guidelines to ensure that the form is accepted by the city authorities.

Key elements of the City Of Battle Creek Annual Reconciliation Form

Key elements of the City Of Battle Creek Annual Reconciliation Form typically include:

- Identification information, such as the name and address of the individual or business.

- Financial data, including total income, expenses, and any applicable deductions.

- Signature section to validate the accuracy of the information provided.

- Instructions for submission and deadlines to ensure timely filing.

Form Submission Methods

The City Of Battle Creek Annual Reconciliation Form can be submitted through various methods, including:

- Online submission via the official city website, which often allows for electronic signatures.

- Mailing the completed form to the designated city office address.

- In-person submission at specified city offices for those who prefer direct interaction.

Quick guide on how to complete city of battle creek annual reconciliation form

Complete City Of Battle Creek Annual Reconciliation Form effortlessly on any gadget

Digital document management has gained traction with businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct form and securely maintain it online. airSlate SignNow provides all the tools necessary to generate, modify, and eSign your documents swiftly without any hold-ups. Handle City Of Battle Creek Annual Reconciliation Form on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to alter and eSign City Of Battle Creek Annual Reconciliation Form with ease

- Acquire City Of Battle Creek Annual Reconciliation Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in a few clicks from any device of your preference. Edit and eSign City Of Battle Creek Annual Reconciliation Form and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of battle creek annual reconciliation form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the City Of Battle Creek Annual Reconciliation Form?

The City Of Battle Creek Annual Reconciliation Form is a document used by residents and businesses to report and reconcile their financials annually. This form helps ensure compliance with local regulations and is essential for accurate record-keeping. Utilizing airSlate SignNow simplifies the process of completing and submitting this form electronically.

-

How does airSlate SignNow help with the City Of Battle Creek Annual Reconciliation Form?

airSlate SignNow empowers users to easily send, eSign, and manage the City Of Battle Creek Annual Reconciliation Form. Our platform streamlines the entire process, allowing you to complete the form securely and efficiently. Additionally, signatures can be collected remotely, making it convenient for busy professionals.

-

What are the pricing options for using airSlate SignNow for the City Of Battle Creek Annual Reconciliation Form?

airSlate SignNow offers flexible pricing plans tailored to meet different business needs, including individuals needing to fill out the City Of Battle Creek Annual Reconciliation Form. You can choose from monthly or annual subscriptions, providing an affordable solution for every budget. Visit our pricing page for detailed information on each plan.

-

Can I integrate airSlate SignNow with other applications for handling the City Of Battle Creek Annual Reconciliation Form?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your ability to manage the City Of Battle Creek Annual Reconciliation Form. Integrate with popular tools like Google Drive, Dropbox, and CRM systems to streamline your workflow. This functionality ensures that you can access all your documents in one centralized location.

-

Is airSlate SignNow secure for sending the City Of Battle Creek Annual Reconciliation Form?

Absolutely! airSlate SignNow follows industry-leading security protocols to protect your sensitive information, ensuring that the City Of Battle Creek Annual Reconciliation Form is transmitted securely. With encryption and two-factor authentication, you can trust that your data is safe during the eSigning process.

-

Are there templates available for the City Of Battle Creek Annual Reconciliation Form?

Yes, airSlate SignNow provides customizable templates for the City Of Battle Creek Annual Reconciliation Form. These templates streamline the completion process by pre-filling sections and allowing you to save time. You can easily modify them to fit your specific needs before sending.

-

How does airSlate SignNow enhance the overall efficiency of filling out the City Of Battle Creek Annual Reconciliation Form?

airSlate SignNow enhances efficiency by allowing users to complete the City Of Battle Creek Annual Reconciliation Form digitally. Our platform reduces paperwork and mailing time, enabling quicker access to your finalized documents. This ultimately helps you focus more on your core business tasks rather than administrative duties.

Get more for City Of Battle Creek Annual Reconciliation Form

Find out other City Of Battle Creek Annual Reconciliation Form

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy